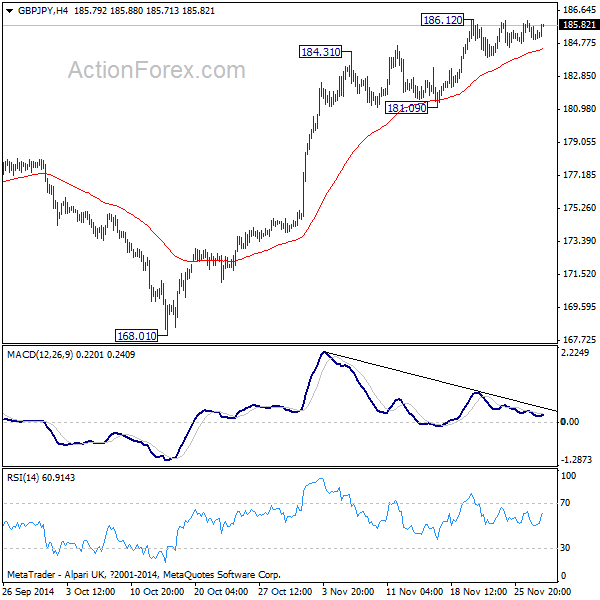

GBP/JPY Daily Outlook

Daily Pivots: (S1) 184.84; (P) 185.37; (R1) 185.75;

GBP/JPY continues to stay in tight range below 186.12 and intraday bias remains neutral. With 181.09 support intact, further rally is still expected in the cross. Above 186.12 will extend recent up trend to 190 psychological level. However, break of 181.09 support will indicate short term topping, with bearish divergence condition in 4 hours MACD and bring deeper pull back.

In the bigger picture, the up trend from 116.83 is still in progress for 61.8% retracement of 251.09 to 116.83 at 199.80, which is close to 200 psychological level. On the downside, break of 168.01 support is needed to confirm medium term topping. Otherwise, outlook will stay bullish in case of pull back.

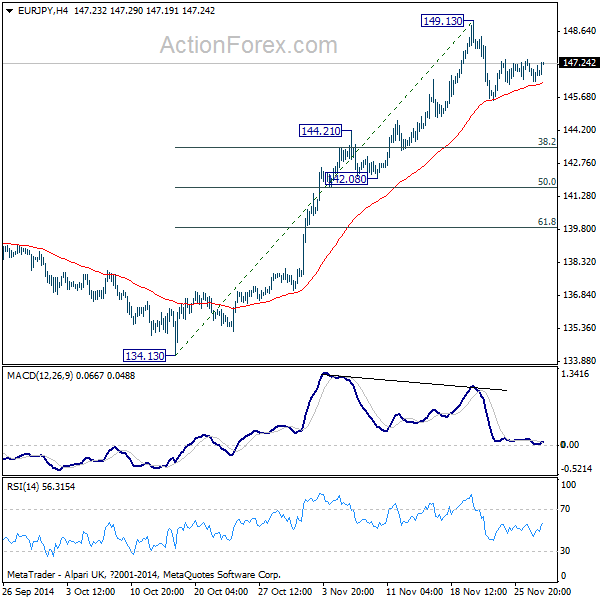

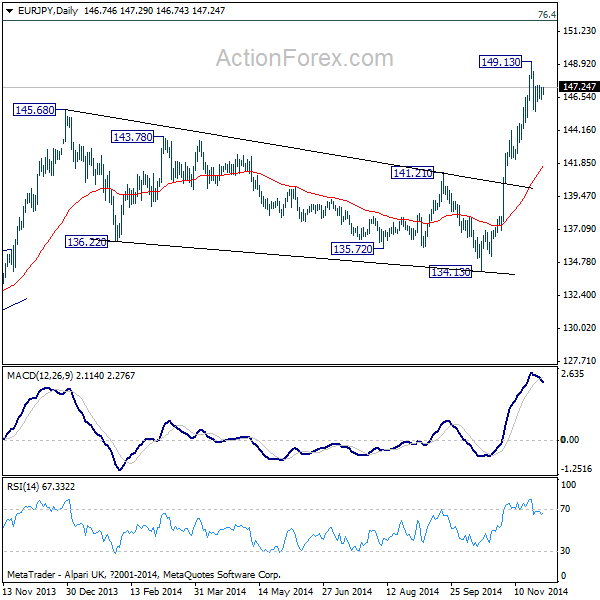

EUR/JPY Daily Outlook

Daily Pivots: (S1) 146.37; (P) 146.80; (R1) 147.19;

No change in EUR/JPY's outlook. The correction from 149.13 could head lower to 144.21 resistance turned support. But we'd expect strong support from 142.08/144.21 support zone and bring rebound. Some consolidations should be seen in near term first but another rally is expected after that. Break of 149.13 will target next fibonacci level at 152.59.

In the bigger picture, the up trend from 94.11 long term bottom is still in progress and has just resumed. Further rise should be seen to 76.4% retracement of 169.96 to 94.11 at 152.59 next. Break of 152.59 will target a test on 169.96 (2008 high). On the downside, break of 134.13 is needed to confirm medium term reversal. Otherwise, outlook will stay bullish.