Words mean little on Fridays in the Wall Street Daily Nation. Instead, we let pretty pictures do the talking for us.

Each week, I select a handful of graphics to put important economic and investing news into perspective.

So I’ll (mostly) shut up now…

Hey, Washington -- Get to Work!

Funk band, Kool and the Gang needs to stay put until Inauguration Day. Because there’s no time for celebrating in our nation’s capitol just yet.

Why? Because our elected (mis)representatives need to get to work on eliminating the next big uncertainty facing the nation – the “Fiscal Cliff.”

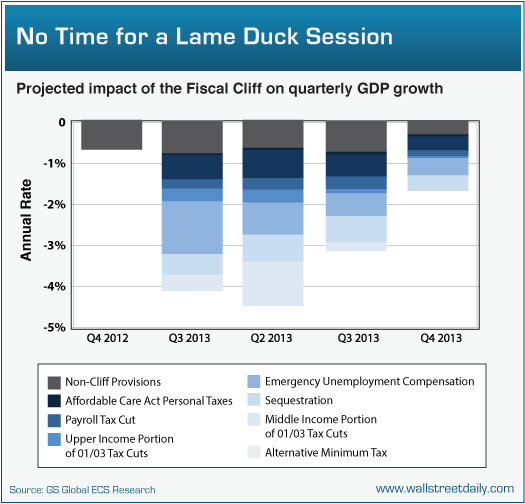

According to the fine analysts at Goldman Sachs (GS), the looming spending cuts and tax rate expirations could slash GDP growth by a full four percentage points. Yikes!

Like I said, there’s no time for celebrating -- or brinkmanship -- in Washington. We’re on a crash course with a recession. And kicking the can down the road for old time’s sake is not going to postpone it, either.

Try it… and the economy dies.

So get to work on the one thing you’ve avoided for four years, Washington -- a bi-partisan comprise.

Step Away From the Cliff, Or Else…

Investors aren’t the only ones increasingly troubled by Washington’s inaction. Businesses are, too.

Case in point: Business investment, one of the major drivers of economic growth, just ground to a halt.

The Census Bureau reported that shipments of U.S.-made capital investment goods declined for the first time since late 2009 -- at a 4.9% annual rate.

As MarketWatch reports, “Economists are in broad agreement that businesses aren’t investing in the equipment they would need to increase productivity or to expand their output, but they can’t agree on the causes of the downshift.”

Really? Are economists that thickheaded?

Anybody home? Huh? Think, McFly. Think!

This is a case where the simplest explanation applies: The problem is uncertainty surrounding the Fiscal Cliff.

Businesses admitted as much in various surveys. Take Morgan Stanley’s (MS) proprietary Business Conditions Index, for instance.

“In October, 51% (versus 49% last month) of analysts responded that companies have downgraded business conditions as a result of cliff-related issues,” says Morgan Stanley economist, Dane Vrabac.

Forget Voting, Stalk Your Congressman

I know, I’m typically the optimist. But that doesn’t mean I’m an idiot. It’s time for Washington to make a deal -- stat! The economy’s riding on it.

Plus, it’ll be good practice for the next issues awaiting their immediate resolution. Like the debt ceiling and the federal budget.

Another debt downgrade is all that hangs in the balance. No biggie. Our elected representatives got this. Right, guys?

Yeah, I’m not so confident, either.

If you did your part by getting out the vote, keep it up by stalking your local congressman via phone, email, text and smoke signals. They need to get the message quickly -- and often.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Friday Charts: From One Uncertainty To The Next

Published 11/09/2012, 11:00 AM

Updated 05/14/2017, 06:45 AM

Friday Charts: From One Uncertainty To The Next

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.