It’s Friday in the Wall Street Daily nation.

That means I’m ditching our regular routine of commentary-based articles and, instead, using charts to present some important investment and economic insights.

This week, I’m sharing the most important Fiscal Cliff-related graphic I’ve seen in weeks.

I’m not going to spend too much time on it, though, unlike other media outlets. After all, once a compromise is ultimately reached, we’ll need to get back to investing, right?

The problem is, if we wait until after a deal, we’ll have already missed some profit opportunities. So that’s why I’m going to share two overlooked opportunities brewing right under our noses…

Cash Call, Anyone?

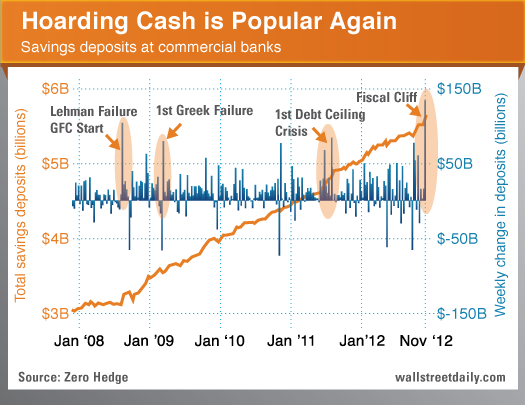

Yesterday, I told you that the Fiscal Cliff is having a lopsided impact on investor behavior. And today, I have even more definitive proof that it’s scaring investors stockless.

Last week, investors plowed $131.9 billion into savings deposits at commercial banks.

That’s the largest weekly inflow ever, topping the cash hoarding craze that hit before Lehman Brothers collapsed, the first Greek debt failure and the first debt ceiling crisis.

However, notice how each record inflow is followed very shortly by a massive outflow? That money is going right back into investments.

The trick is to invest before that tidal wave of capital hits the market. With that in mind, here are two opportunities to consider…

Real Estate (Really!)

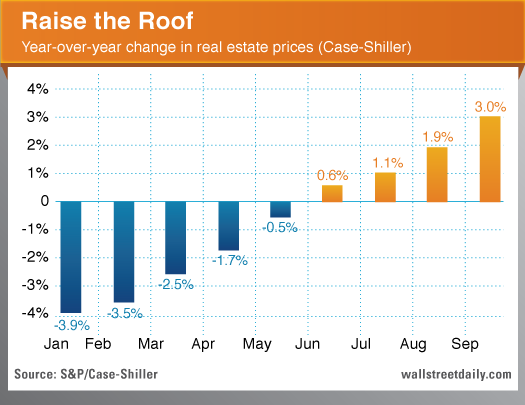

Longtime readers know that I called a bottom in the residential real estate market when virtually nobody believed in it.

Fast-forward to today and now everyone agrees that a rebound is, indeed, underway. They’re just not sure how long it will last.

Sorry, I don’t have an exact timeframe either. But I can tell you this: I’m more convinced than ever about my July prediction that real estate is going to propel the economy in 2013.

I have a stack of research on my desk – going back nine months – to prove it, too. Here’s the most telling bit of data. Home price increases are gaining momentum.

You can doubt me again if you want. But that’s not going to stop me from uncovering additional investments that will capitalize on the real estate rebound.

Turning Japanese

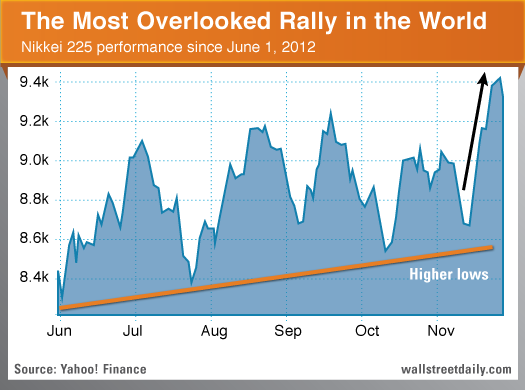

Not long ago, I wrote, Japanese stocks are some of the cheapest stocks on the planet and, therefore, a compelling ‘Buy.’

Readers scoffed at the notion. However, it appears that more and more investors are warming up to the idea.

Over the last six months, the Nikkei 225 Index has set a series of higher lows, before going parabolic over the last two weeks. All told, Japanese stocks are up a solid 10.3% since June 1, matching the performance of the S&P 500 over the same period.

Meanwhile, China -- the other cheap Asian market that many investors keep swearing is overdue for a rebound -- continues to plummet. Since June 1, the Shanghai Composite Index is off another 16.9%.

If you’re looking for a super cheap momentum trade, believe it not, you should go with Japan, not China.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Friday Charts: A Mountain Of Cash And Two Shocking Rebounds

Published 11/30/2012, 05:53 AM

Updated 05/14/2017, 06:45 AM

Friday Charts: A Mountain Of Cash And Two Shocking Rebounds

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.