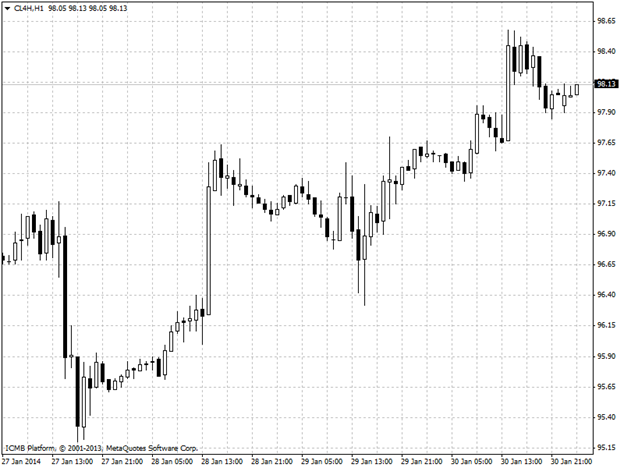

CL

West Texas Intermediate crude traded near the highest price this year, heading for a third weekly gain, as increased spending by U.S. consumers boosted the economy of the world’s biggest oil user. Futures were little changed after climbing 0.9% yesterday to the highest price in a month. U.S. gross domestic product grew at a 3.2% annualized pace in the fourth quarter. WTI for March delivery was at $98.17 a barrel, down by 6 cents. The contract increased 87 cents to $98.23 yesterday, the highest settlement since December 31. The volume of all futures traded was about 52% below the 100-day average. Prices are down 0.3% in January.

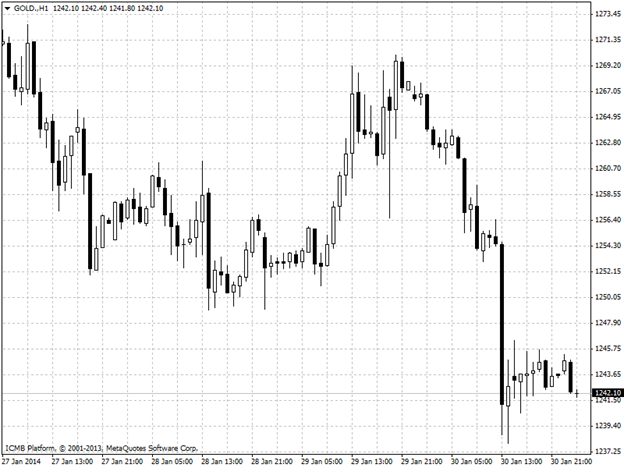

GOLD

Gold headed for the first weekly loss since December as signs of faster U.S. economic growth increased bets that the Federal Reserve will keep cutting stimulus and a decline in emerging markets eased. Bullion for immediate delivery traded at $1,243.36 per from $1,243.92 yesterday when it fell to $1,238.17, the lowest in a week. Prices are set to drop 2.1% this week, the first weekly loss since the period ended December 20, trimming this month’s 3.1% advance. The Fed said Jan. 29 that it will trim monthly bond purchases by $10 billion to $65 billion. Data yesterday showed U.S. gross domestic product grew at a 3.2% annualized pace in the fourth quarter. Gold for April delivery traded at $1,243.10 per ounce for a 1.7% decline this week.