Gold traded below a four-month high in New York as investors weighed the crisis in Ukraine and the outlook for the U.S. economy before employment data due tomorrow. Palladium was near the highest price since April.

Russian President Vladimir Putin said this week that while he sees no immediate need to use force in southeastern Ukraine, he’s reserving the right for military action to protect ethnic Russians in the region from extremists. Western nations including the U.S. are threatening Russia with sanctions over its military intervention in Crimea while pursuing diplomacy in an effort to defuse the crisis.

Gold rallied 11 percent this year as concern that the U.S. recovery may be faltering and recent turmoil in Ukraine boosted demand for a haven. Bullion rebounded from the biggest annual drop since 1981 even as the Federal Reserve scaled back stimulus. Most U.S. regions grew last month even as harsh winter weather impeded hiring, the Fed’s Beige Book survey showed yesterday. The Labor Department will release jobs data tomorrow.

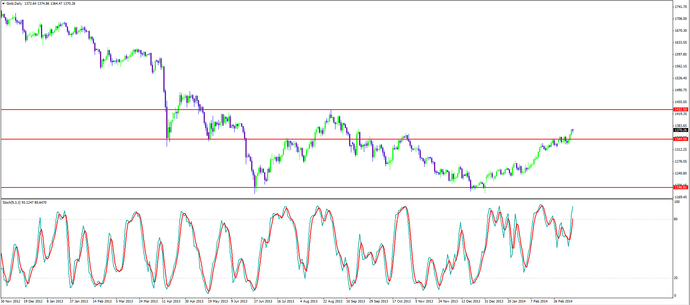

Technically gold has broken a major resistance of 1350 level and looking to go further to the upside up to the 1430 resistance zone. A retest back to the 1350 level would call for a good opportunity for traders to go long and GOLD and capitalize on the opportunity.