Daily Insight

Trader's Corner:

- EUR/USD: Key Reversal on heavy volume suggests interim reversal

- USD/JPY: Real money investors pile into Yen; USDJPY due another dip lower?

- GOLD: At 6-month high but suspecting a pullback

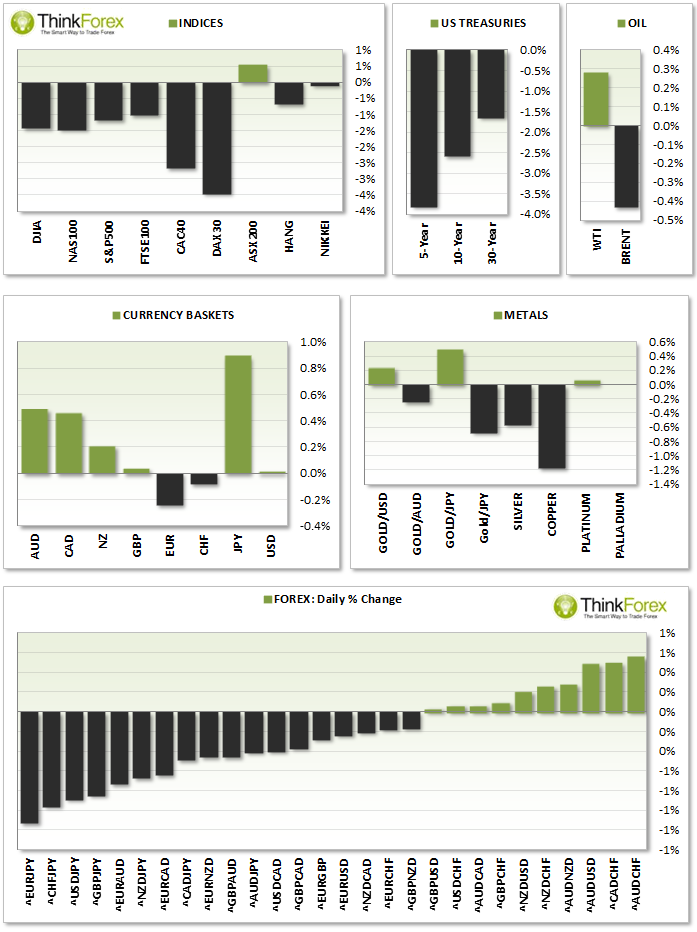

MARKET SNAPSHOT:

NYLON ROUNDUP (New York - London)

Golman Sachs lower targets on AUD/USD to 0.80 expecting further rate cuts from RBA

- USD: Core/Retail sales, unemployment and import prices all beat expectations to see USD Index recoup losses seen earlier in the session.

- EUR: The Euro tested a new 2.5 yr high of 1.3966 to reverse lower and close down for the day. Volume was heavy to suggest potential key reversal.

- GBP: Cable saw an intraday high of 1.67 and hit yesterday's initial target to then reverse and close back at the open price of 1.661

- JPY: Increased volume on Yen Currency Basket highlights flow of money into this safe haven.

- INDICES: European Equities felt the pinch with DAX at 3-month lows CAC and FTSE at 5-week lows. US Equities, whilst down, are holding above last week's lows.

- COMMODITIES: Gold traded to a 6-month high to close at $1370.17; WTI holds above 97.60 support; Brent is now trading at 5-week lows; Copper trading back near yesterday's multi-month lows

ASIA ROUNDUP

Narrow ranges during Asia following a volatile session from the US.

- AUD: Trading at yesterday's lows against the Yen to further highlight risk-off sentiment;

- NZD: Key Reversal on NZD/JPY;

- INDICES: Hang Seng opened down 0.7%; Nikkei 225 continues sell-off for 5th consecutive session; AUS200 trading back at last week's lows;

- COMMODITIES: Gold continued to break to new highs following comments from China's premier of debt defaults.

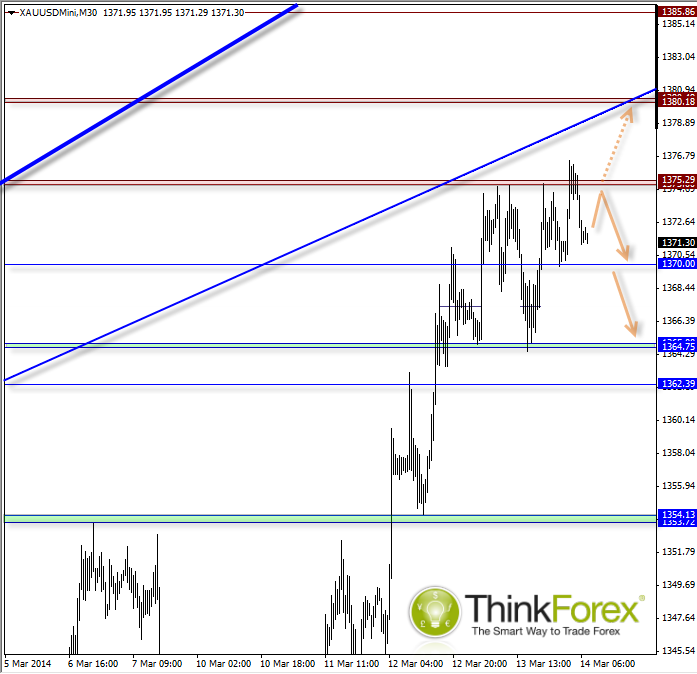

CHART OF THE DAY:

GOLD: Intraday Levels

With the tension in Ukraine and further weak data from China I am calling no major tops in Gold just yet. However there is argument for a retracement (as outlined in today's post) but either way there are clear levels of support and resistance to use as targets for your intraday trading going into the weekend.