Forex News and Events:

The FX traders remain quiet before the US payrolls due at 12:30 GMT in New York. Released on Wednesday, the ADP report showed that the US economy added 220’000 new private jobs in April. Although the April 26th jobless claims spiked above the yearly average (336.85), the downtrend in jobless applications show significant improvement and the continuing claims stand at six year lows. According to these numbers, there is improvement in US jobs data and the April NFPs should reflect the improving trend, now that the difficult winter is behind us. The consensus is 215’000 new nonfarm jobs in April, versus 192’000 a month ago. Any positive surprise should lead to further recovery in USD (hit by dovish FOMC this week).

Swiss manufacturing expands

Swiss April Manufacturing PMI came in at a solid 55.2 vs. 54.4 expected. The gains were good in all sub-indexes suggesting that last month’s pullback was most likely an anomaly. Back-log of orders was particularly encouraging climbing to 59.8 vs. 52.2 prior read. Overall, the reports suggest the Swiss economic growth will continue to expand. And we even dare to say, generate signs of inflation. With questions over the sustainability of the Fed current tapering path, indecision in the ECB and tensions in the Ukraine mounting, CHF should continue to outperform verse USD and EUR.

Japan inflation a year after the introduction of QE

It has been more than a year since the Bank of Japan introduced the “quantitative and qualitative monetary easing approach” (April 4th, 2013) to reach the 2% inflation target by “doubling monetary base in 2 years”. In March 2013, the nationwide y-o-y CPI was -0.5%. A year later, the CPI y-o-y advanced to 1.6% (March 2014 release) witnessing BoJ’s success to generate inflation. In this respect, the Japanese policy makers’ median forecast for 2016 CPI raised to 2.1% at April 30th outlook report, clearly demonstrating the shared belief that the BoJ should hit the 2% target as planned - by mid-2015. Given the optimism, we didn’t hear any suggestion about an additional round of monetary stimulus, which clearly kept JPY-crosses in tight ranges this week.

Released in Tokyo, March data showed that jobless rate remained stable at 3.6% in Japan, while the overall household spending surged to 7.2% from -2.5% a month ago. These numbers are in line with significant March hike in retail sales (to 11%) and are suspected to be in anticipation of April’s sales tax increase. Japanese PM Abe said that the consumption has not slowed as much as feared, yet we prefer to wait for April figures to confirm such statement. Given the significant preventive move in March figures (retail sales, spending, etc), a counter-reaction should be well expected from April data. The main risk is clearly a slowdown in inflation dynamics, if materialized should push BoJ to take additional steps to further expand its monetary policy. As of today, the most likely timing for a policy action is seen as July, once the impacts of sales tax will become quantifiable through inflation readings. At this stage, USD/JPY is stuck within 100.76/103.75 range and should break on either side to trigger worthy short-term trend.

Today's Key Issues (time in GMT):

2014-05-02T12:30:00 USD Apr Change in Nonfarm Payrolls, exp 215K, last 192K2014-05-02T12:30:00 USD Apr Two-Month Payroll Net Revision

2014-05-02T12:30:00 USD Apr Change in Private Payrolls, exp 215K, last 192K

2014-05-02T12:30:00 USD Apr Change in Manufact. Payrolls, exp 8K, last -1K

2014-05-02T12:30:00 USD Apr Unemployment Rate, exp 6.60%, last 6.70%

2014-05-02T12:30:00 USD Apr Average Hourly Earnings MoM, exp 0.20%, last 0.00%

2014-05-02T12:30:00 USD Apr Average Hourly Earnings YoY, exp 2.10%, last 2.10%

2014-05-02T12:30:00 USD Apr Average Weekly Hours All Employees, exp 34.5, last 34.5

2014-05-02T12:30:00 USD Apr Change in Household Employment, last 476

2014-05-02T12:30:00 USD Apr Underemployment Rate, last 12.70%

2014-05-02T12:30:00 USD Apr Labor Force Participation Rate, last 63.20%

2014-05-02T13:45:00 USD Apr ISM New York, exp 54, last 52

2014-05-02T14:00:00 USD Mar Factory Orders, exp 1.50%, last 1.60%

2014-05-02T16:00:00 EUR IT Apr New Car Registrations YoY, last 4.96%

The Risk Today:

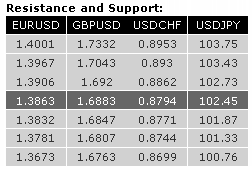

EUR/USD continues to consolidate after its rise from 1.3673 to 1.3906. The technical structure remains supportive as long as the support at 1.3780 holds. However, we see a limited upside potential given the strong resistance at 1.3967. A first key resistance lies at 1.3906. Hourly supports can be found at 1.3854 (intraday low) and 1.3832 (50% retracement of the recent rise). In the longer term, EUR/USD is still in a succession of higher highs and higher lows. However, the recent marginal new highs (suggesting a potential long-term rising wedge) indicate an exhausted rise. A key resistance stands at 1.3967 (13/03/2014 high).

GBP/USD has broken the key resistance at 1.6823, opening the way for a test of the major resistance at 1.7043. Hourly supports can be found at 1.6847 (29/04/2014 high) and 1.6807 (30/04/2014 low). In the longer term, prices continue to move in a rising channel. As a result, a bullish bias remains favoured as long as the support at 1.6661 (15/04/2014 low) holds. However, we are reluctant to suggest an upside potential higher than the major resistance at 1.7043 (05/08/2009 high), especially given the general overbought conditions.

USD/JPY continues to move in a potential ascending triangle. Monitor the resistance at 102.73 (22/04/2014 high). A support area stands between 102.03 (30/04/2014 low, see also the rising trendline) and 101.96. Another support lies at 101.87, whereas another resistance can be found at 103.43 (07/04/2014 high). A long-term bullish bias is favoured as long as the key support area given by the 200 day moving average (around 100.94) and 101.33 (11/04/2014 low, see also the rising trendline from the 93.79 low (13/06/2013)) holds. A major resistance stands at 110.66 (15/08/2008 high).

USD/CHF remains weak despite the proximity of the support at 0.8771 (see also the rising trendline). Another support can be found at 0.8744. A key resistance lies at 0.8862. From a longer term perspective, the structure present since 0.9972 (24/07/2012) is seen as a large corrective phase. However, a decisive break of the key resistance at 0.8930/0.8953 is needed to validate a bullish reversal pattern.