London Forex Report: Markets underwent a choppy session yesterday as oil surrendered initial gains and collapsed lower on news that Saudi Arabia and Russia will freeze oil production at January levels but won’t reduce output. The deal is also reliant on other producers agreeing to the same terms, a situation which is very much in doubt as Iran still refuses to meet with Saudi and Russian officials. Over the New York session equity markets managed to recover lost ground however European and American markets still closed in the red as risk-sentiment remains subdued in the wake of continued oil price declines. Key data for today’s European session will be UK employment and earnings data with traders keen to see if the recent downward momentum in wage-growth continues. Later in the day we have the release of the January FOMC meeting minutes

EUR/USD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: Despite further oil price declines EUR was led lower yesterday weighed upon by a recovery in Equity markets and a stronger USD. EUR/USD begins European session looking fimer as equities sustain returned weakness over the Asian session. Traders await the Jan FOMC minutes release later today

Technical: While 1.1220/40 rejects intra-day upside reactions expect a test of pivotal support at 1.1050/30 as the next downside objective. A breach of 1.1260 opens 1.1350 offers.

Interbank Flows: Bids 1.1150 stops below. Offers 1.1250 stops above

Retail Sentiment: Bearish

Trading Take-away: Short

GBP/USD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: A set of weaker than expected January inflation data yesterday saw GBP sharply sold as the effects of continued Oil price declines are visible once again. Attention now turns to employment and earnings data with key focus on average weekly earnings, expected 1.9% from 2% prior.

Technical: While 1.4510/30 caps the upside expect a retest of bids towards 1.4350/30. A breach of 1.4550 opens a retest of February highs a 1.4660’s

Interbank Flows: Bids 1.4350 stops below. Offers 1.45 stops above.

Retail Sentiment: Neutral

Trading Take-away: Neutral

USD/JPY

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: The Japanese yen strengthened over a broadly risk-off day yesterday as safe-haven demand and speculators continued to support JPY despite the likleihood of further BOJ intervention. Continued equity weakness supports JPY as London opens again today.

Technical: While 113.20 supports downside rotations expect a grind higher to retest the broken neckline resistance at 115.80/116 where fresh selling interest should emerge

Interbank Flows: Bids 113.20 offers below. Offers 116 stops above

Retail Sentiment: Bullish

Trading Take-away: Short

EUR/JPY

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: EUR/JPY was sharply lower yesterday as EUR weakness and JPY strength combined to weigh on price. Expectations are bulding for further easing by both the ECB and BOJ.

Technical: While 129 caps upside reactions expect a retest of year to date lows 125.77 a breach of this support opens a move down to 124 as the next downside objective. A close over 129.74 would ease immediate downside pressure and open a rotation higher yo test 132.30

Interbank Flows: Bids 126 stops below. Offers 128.50 stops above.

Retail Sentiment: Bullish

Trading Take-away: Short

AUD/USD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: AUD/USD fell to a new weekly low as risk-aversion and USD strength swept across the markets in the wake of further downside in oil. Continued risk-off flows have AUD under pressure again into the London open.

Technical: While AUD continues to trade above the pivotal .7100 expect a retest of offers above .7200 en-route to .7310. Another failure at .7100 would suggest further weakness to retest year to date lows at .6820’s

Interbank Flows: Bids .6950 stops below. Offers .7250 stops above

Retail Sentiment: Bearish

Trading Take-away: Neutral

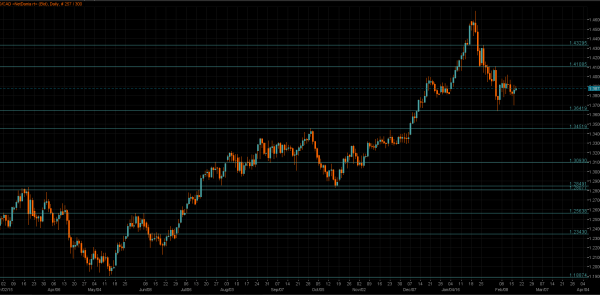

USD/CAD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bullish

Fundamental: Oil broke down beneath the key $29.40 support level yesterday, weighing upon the Canadian dollar, with further selling today supporting USD/CAD into the London open.

Technical: While USD/CAD trades sub 1.3830 downside pressure remains the driver with bears fully focused on a retest of 1.3630 bids ahead of 1.3530. A close over 1.3850 suggests a retest of 1.40 offers in broader range trade.

Interbank Flows: Bids 1.3650 stops below. Offers 1.40 stops above

Retail Sentiment: Bullish

Trading Take-away: Short