Tis obvious: clearly everything, at least StateSide, once again is Great. Our economic raceway is replete with the efficiency of today's six-cylinder Formula One engines apparently running as if on eight cylinders fully firing: why, the unemployment rate alone is back down into the 5% range, which by traditional subjective interpretation, means that the USA is now fully-employed. We've returned to energy-richness as well: why, North Dakota alone may plausibly be en route to putting all nations adjacent to the Persian Gulf "out of business". And how about our Dollar, eh, the now venerable Dieu of Dough: why, the bodacious Buck alone has become the iconic investment of choice 'round the world. 'Tis obvious: clearly everything, ex-StateSide, once again is Awful.

But before one calls the local garbage collection agency for delivery of that scavenger box into which to discard one's Gold, Silver, Copper, Oil, Swiss Francs, Euros, Stocks and Bonds, prudence ought be accorded the potential duration of such aforementioned economic excellence, given: a nation of coast-to-coast part-time jobs, environment roadblocks that can limit energy production let alone the geo-political ramifications of one day no longer importing Oil from various emirates et alia, and a Dollar getting its due only on the backs of other flailing fiat facsimiles. Whether it takes a year's time for it all to unravel, or merely that of a week, I certainly would hold onto my Gold. (Stock market indices are, of course, another story: in overhearing a FinMedia TV reporter ask an analyst if they'd buy on this dip, my own mumbled shot-from-the-hip response was to certainly at least consider so doing should such dip reach -50% -- but then as you already know, a few of us old fuddy-duddies still value stocks the old fashioned way: by earnings).

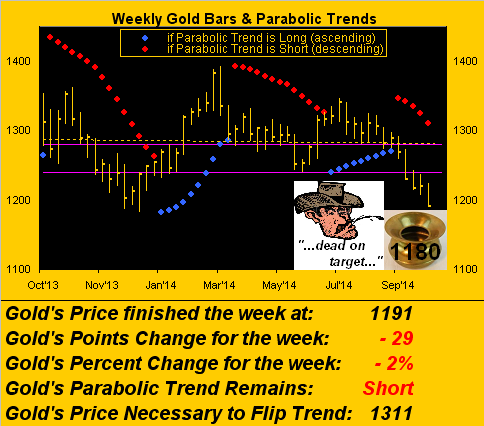

For the present, Gold's Short trend as described below by the declining parabolic red dots continues to persevere in this year-over-year view of the weekly bars. In settling out yesterday (Friday) at 1191, Gold made a new low for the year after all, (the prior low having been 1203 back on 02 January), with 2013's low of 1180 but a spittoon's distance away:

But if you're looking for a silver lining in the above graphic, note just over the purple lines that define what has become the 1240-1280 resistance zone, the thin dashed line which is essentially flat across the breadth of the entire chart. That is the linear regression trendline of all the weekly closes; and in observing the deviative distances of price above and below that dashed line, one might opine, 'tis time to end this annoying decline, (and send those deviant Shorts a-packin').

Speaking of silver linings, indeed lacking thereof, is Sister Silver. To be beaten down from having been Cinderella as once adorned in her precious metal pinstripes and sent back to the factory to toil away in her industrial metal jacket is one thing. But now 'tis worse, for she's since been fired, left to sit today in her tattered togs out in some back alley, as cold as snow and at a four-year low. Silver traded down to 16.640 yesterday, her lowest level since 26 March 2010. Here's her parabolic weekly bars structure from a year ago-to-date:

Fear not, Sister Silver: I want you, just as do many others.

"I love you too Sister Silver!"

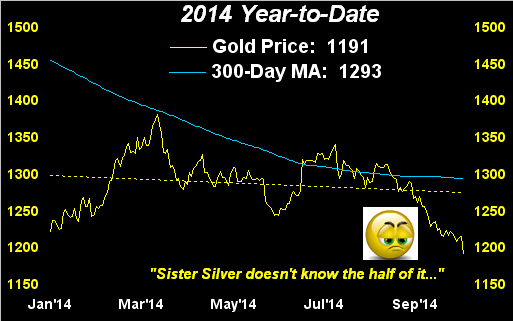

See there, the gallant chivalry of our very own Squire, (no doubt angling for a Princedom upon Sister Silver's return to resplendence, respect and radiance). But for leadership thereto, we look to Gold and assess its year-to-date price track vis-à-vis the 300-day moving average. And clearly, the one true monetary asset of Planet Earth since time immemorial is hardly the happy camper these days:

Oh, quit pouting for pity's sake. Our modest calculation for your own "book value" today is already around $2,100/oz. 'Tis just that you're ridiculously under-owned at the moment. What you need is a new publicity agent, (me, I guess), not to mention a currency shock or two and you'll become embraced by households from Bangalore to Beverly Hills. Indeed speaking of household names, Lorenzo Bini-Smaghi, (ex-Governing Council member of the European Community Bank), is on record that the central bank's survival is now dependent on the €uro further weakening, or as he succinctly said it, that the ECB "accept that QE is the only answer left". And who is it that, at the end of the day, we've provably claimed plays no currency favourites? 'Tis you, King Gold. So buck up!

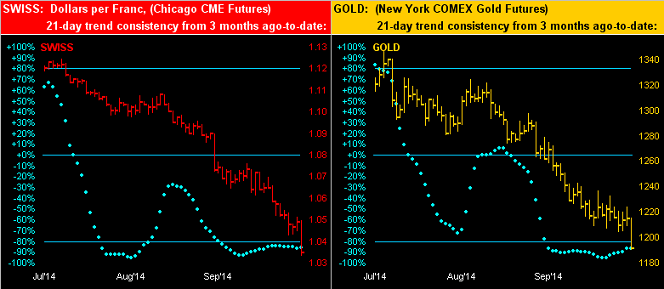

'Course, the headlines these days are rife with the Dollar's having become the "currency of choice", reaching its highest level in almost two years against the €uro. 'Tis said that the EuroZone's malaise of stagnation may be around for some time to come as its economy is losing momentum heading into Q4. Meanwhile on the other side of the world, China's key PMI manufacturing measure is barely above the 50 level that separates growth from contraction. Their People's Bank is fresh into its ¥500 million injection of QE. Our Federal Reserve Bank is all but done with QE, at least until its next such spree. For the Dollar's being the "currency of choice", such tease is not to see the forest for the trees. Having to fork over $1.04 for a lousy Swiss Franc today when they used to be 25¢ is not what I'd call "Dollar strength". But the present state of inclination is certainly negative for "everything else". To wit, here for the last three months we've the Swiss Franc and Gold, their -80% "Baby Blues" levels indicative of the respective 21-day linear regression trends being absolutely down:

(Note to those of you sitting on the Gold bid at zero ["0"]: the above price decline at a pace of 50 points per month ought see you filled in just about two year's time to the day).

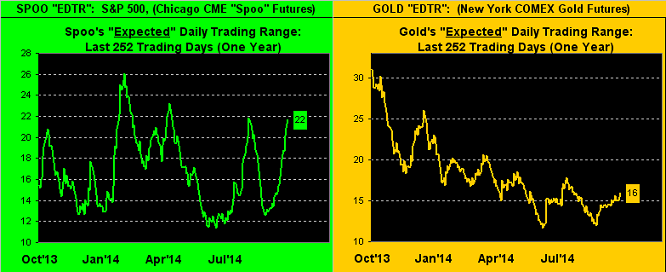

Indeed, right on time given seasonality, volatility for most of the BEGOS markets as enumerated in our second paragraph is ramping up, the only exception actually being in the precious metals. Here we next compare the robust movement in the S&P to the rather lackluster ranginess of Gold. Below are those markets "expected daily trading ranges" (EDTR) from a year ago-to-date. Note how the S&P's range is typically up to where 'twas a year ago, but how comparatively subdued the Gold trade is; lot's of "caution" there with respect to Gold, for the Specs can only Short it so far...

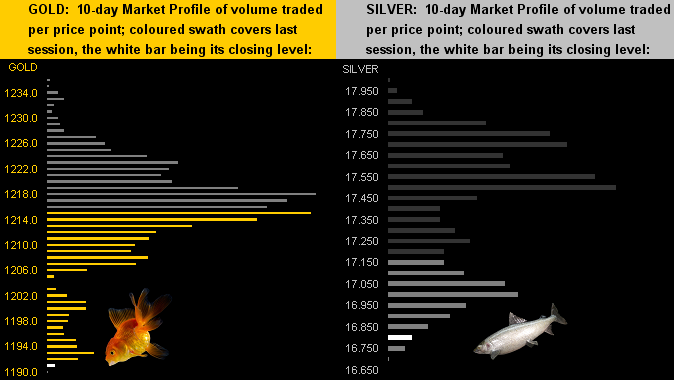

Nonetheless, Gold's also being down near-term is no more starkly represented than by its 10-day Market Profile along with that for Silver. The white bar near the foot of each profile is yesterday's bottom fishing settle:

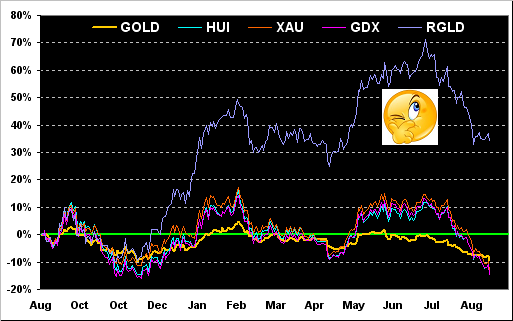

Finally, as we've crossed into the month of October, here we've the usual year-over-year view of Gold itself alongside the Gold Bugs Index (HUI), Philly Exchange Precious Metals Index (XAU), the exchange-traded fund for the miners (Market Vectors Gold Miners (ARCA:GDX)), and hardly alongside, the royalty company Royal Gold (NASDAQ:RGLD), whose unabashed out-performance is in response to attractively structured long-term financing arrangements:

As we've quipped in the past, to trade RGLD gives Gold itself the illusion of being a savings account, (which broadly 'tis -- but 'tis its futures leverage that counts, luv).

In closing out this week's missive as characterized by lows and woes, we turn to a LaForge and a Lewis.

With respect to "lows", there's John LaForge, (priceless name for a precious metals strategist), who sees Gold $660/oz. on the radar in making a comparison 1) from the price spike during 1980 up into the $800/oz. area before declining by some 65%, to 2) Gold's run during 2011 up into the $1,900/oz. area and thus a projected decline of like percentage. We politely disagree with such a similar decline, our not viewing the events as fundamentally comparable, (given the gazillions more global faux dough today).

With respect to "woes", the managing director of the upscale UK retailer known as John Lewis says France is "finished" as nation into which one ought invest, further describing Paris' Gare du Nord (from where one commutes back to London) as "the squalor pit of Europe". Andy Street has since apologized from what was quite the anti-France tirade -- and as much as you know that we (i.e. the royal oui) adore France -- he wasn't completely off the mark. Still, let us give la République its due: as of mid-year, per the World Gold Council, France ranks fifth in the world in total holdings of Gold tonnage, outranking the combined holdings of China and India. "Allons enfants de la Patrie" indeed! Now if we can get the price of Gold to also allons, we'll have the whole package!