Although Fresenius Medical Care KGAA ST (DE:FMEG) (NYSE:FMS) is a German company, it has a 38% share of the U.S. dialysis market. The company cares for over 345 000 patients via its nearly 4200 dialysis centers worldwide. In terms of financial performance, it generates roughly €17.5 billion (US$19.05 billion) a year with annual net profit gravitating around a billion euro (US$1.08 billion).

Unfortunately, kidney dialysis is something patients must keep doing for the rest of their lives to survive. In this respect, Fresenius Medical Care is literally saving lives every day. It also means it is a pretty stable and predictable business. This is the type of defensive company whose operations do not suffer much when the economy falls into a recession.

That doesn’t mean its stock cannot go down, however. In fact, that is just what has been happening for the past four years. The share price reached an all-time high of €93.82 on Feb. 1, 2018.

Last month, it briefly dipped below €51 before recovering to €60 as of this writing. Alas, the current price means that investors who bought in 2015 are still under water. Four years is a long time when you’re holding a losing position. Inflation is now adding insult to injury, not to mention the opportunity cost of the missed chances to invest the money elsewhere.

Fresenius Holds An Elliott Wave Promise

The good news is that just as trends don’t last forever, corrections eventually end as well. In fact, we think the uptrend in Fresenius Medical Care stock might finally be ready to resume. Take a look.

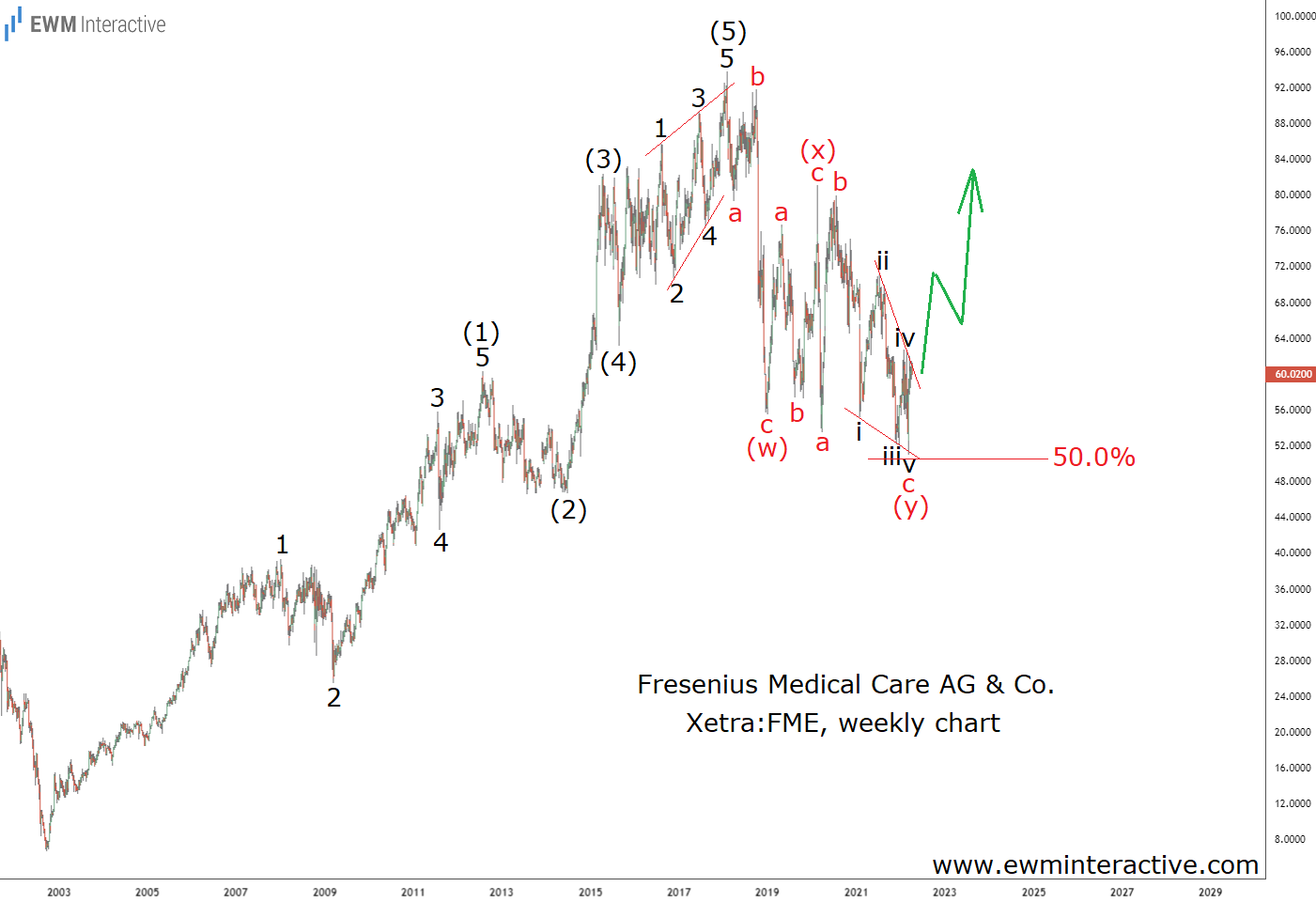

The weekly chart above reveals that prior to its recent four-year decline, FME enjoyed a 15-year bull market. The stock fell as low as €6.66 in September, 2002, before rising 14-fold by February, 2018. Furthermore, the structure of that uptrend can easily be seen as a five-wave impulse. The pattern is labeled (1)-(2)-(3)-(4)-(5), where the five sub-waves of wave (1) are also visible and wave (5) is an ending diagonal.

So, the post-2018 drop is nothing more than the natural correction that follows every impulse. It resembles a (w)-(x)-(y) double zigzag, whose wave ‘c’ of (y) is also an ending diagonal. If this count is correct, the Elliott Wave cycle in Fresenius Medical Care stock, which took almost 20 years to develop, is finally complete. According to the theory, once a correction is over, the preceding trend resumes. This means we can expect more gains from FME going forward.

In the long term, Fresenius Medical Care stock should reach and exceed the €100 mark. Add the company’s decent 2.25% dividend yield to the equation and investors might be looking at a ~100% total return over the next 5-year period for a 15% CAGR. Not bad for an already established business with little growth runway ahead of it.