Investing.com’s stocks of the week

Investors seem to have a bottomless appetite for investment grade (IG) corporate paper. Issuers are coming to market to borrow money at ridiculously low rates. Even for the longer maturities the spreads are 1-2% above the corresponding Treasury yield. Here are some examples:

- Tyco (NYSE:TYC): 10-year notes at Treasurys + 190bp

- Markel (NYSE:MKL): 10-year notes at Treasurys + 225bp (this firm is BBB)

- John Deere (NYSE:DE): 10-year notes at Treasurys + 122bp

- Caterpillar (NYSE:CAT): 10-year notes at Treasurys +110bp

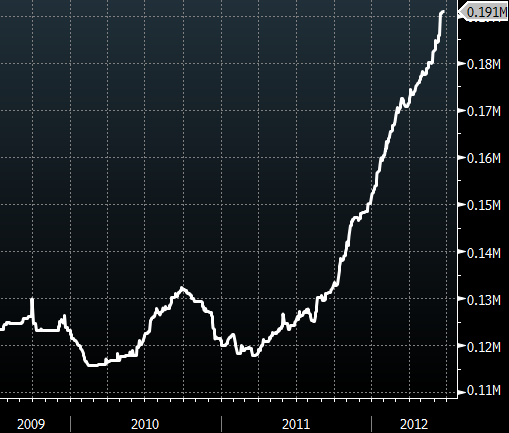

Below is a chart of shares outstanding for LQD, the iShares IBOXX investment grade corporate bond ETF. This thing is now $22.3 billion in assets (growing rapidly as new money pours in), and Larry Fink is opening the Champagne - again. LQD paid out 1.7% in dividends YTD (3.4% annualized) and investors can't get enough of it.

People are betting that rates/spreads will go down even further and they will get capital appreciation on top of the crummy interest income. This looks like another crowded trade that is not going to end well.