Between France’s increasing yields and the UK’s colossal debt-to-GDP ratio, Europe is facing difficulties financing itself. Meanwhile, SNB head bows out with a last rate cut and China unveils its massive stimulus plan.

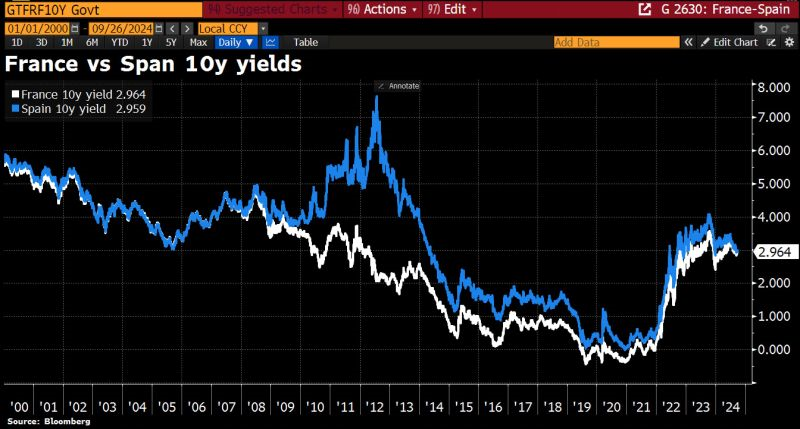

The announcement of the new French government led by Prime Minister Michel Barnier has failed to instill confidence in financial markets. For the first time since 2007, France's 10-year bond yields have exceeded those of Spain.

Source : HolgerZ, Bloomberg

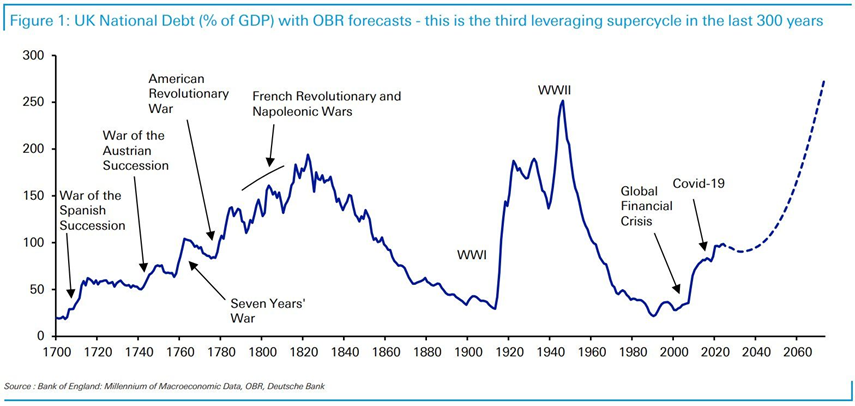

Catastrophic Projections for UK Debt

For the first time since 1961, the UK's public debt has reached 100% of GDP. As illustrated in a chart from Deutsche Bank, this marks the third super cycle of indebtedness since 1700. The Office for Budget Responsibility (OBR) forecasts that debt (as a % of GDP) could rise to 274% by 2073-74.

The previous two cycles were primarily driven by wars, while this one results simply from an increase in public spending that exceeds the government's capacity or willingness to raise the necessary taxes.

Source: HolgerZ, DB

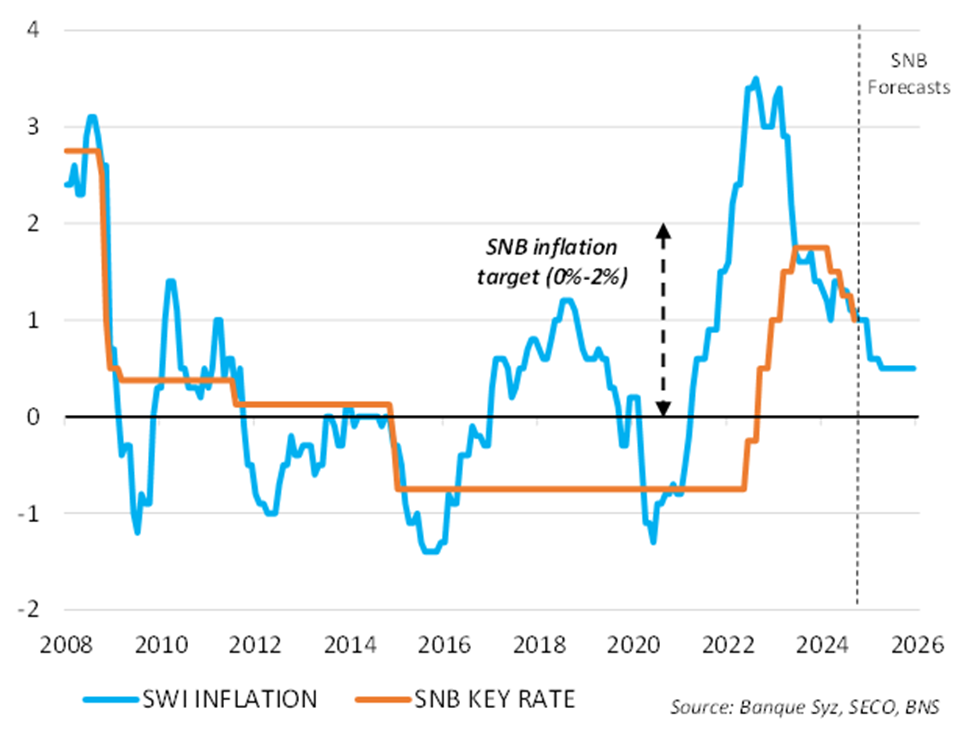

One Last Rate Cut for Tony Jordan

Mr. Jordan waves goodbye with a last-rate cut. The SNB cut its key rate by 25bp to 1.00%. Since the June meeting of the SNB, two developments have led the central bank to opt for an additional monetary policy easing:

- Inflation has continued to slowdown throughout the summer and has proved to be below the SNB estimates.

- In parallel, the Swiss franc has strengthened against both the US dollar and the euro, back around the levels of end-2023 and close to record highs.

This combination of softer current inflationary pressures and additional disinflationary pressures from the strong CHF warranted to cut the key rate further. With this reduction, the SNB simply brings back its monetary policy at the neutral level, with a real rate close to 0%.

Indeed, the SNB’s move is an adjustment of its policy to the slowing inflation rate (from 1.4% to 1.1%), that maintains the monetary stance as it was in June. It cannot be seen as a proper “monetary policy easing” as it would have been the case had the SNB cut its rate by 50bp. The resilience of economic growth in Switzerland so far, along with some lingering upward pressures on prices in the service sector, may have prevented the SNB to opt for a clear easing signal at this stage.

The outlook for SNB rates will remain highly dependent on developments on inflation and the Swiss franc sides. The SNB revised its inflation projections lower compared to June: it now expects inflation to settle around 1% till the end of 2024, before slowing down further in 2025 with an average expected rate of 0.6% (and 0.7% for 2026). This highlights the fact that inflationary pressures have been dampened in the Confederation.

In this context, the SNB must ensure that monetary policy remains at least neutral, and possibly slightly accommodative if economic growth dynamics remain moderate. Based on inflation forecasts, another 25bp rate cut may be needed to keep the real rate near 0%.

The weakness of economic growth in neighboring European economies, the global rate cut cycle at play across most developed economies, political uncertainties in Europe and global geopolitical risks could all add upward pressures on the Swiss franc in the coming month.

In that respect, the SNB reiterated its readiness to intervene in the forex market if needed. Should the CHF strengthen further by the end of the year, more rate cuts could follow in December and into 2025. After having finally exited negative interest rates, the SNB probably wants to avoid falling back into such a situation.

Source: Banque Syz, SECO, BNS

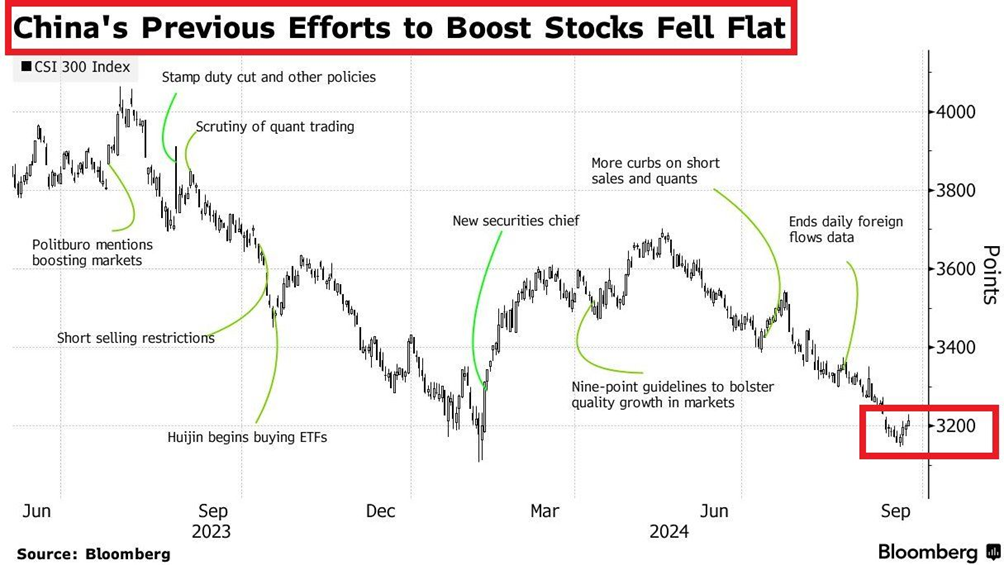

Chinese Stimulus to Work?

Chinese authorities have recently unveiled a broad stimulus package to stabilize the struggling property market and support the country's economy. A key component of the plan is the People's Bank of China (PBOC) cutting mortgage rates for individual borrowers and lowering the reserve requirement ratio (RRR) for banks by 0.50 percentage points.

Additionally, the minimum down payment for second-home purchases has been reduced from 25% to 15%. Further cuts to the RRR, potentially between 0.25 to 0.5 percentage points, are being considered for later this year, though these adjustments will not apply to smaller banks. Lastly, the government has proposed a $113 billion market stabilization fund, representing less than 1% of China's total stock market capitalization, to bolster the financial sector.

These measures triggered an immediate 4.3% surge in the CSI 300 index. But will these efforts be enough to face one of the biggest real estate bubbles bursts?

Source: Bloomberg

The following chart illustrates the potential for Chinese stocks to have a more significant and lasting impact than most investors anticipate: Short interest in Chinese equities has reached all-time highs. As these stocks begin to appreciate in value, short sellers will be forced to cover their positions, driving further momentum in the market’s recovery.

Source : MacroCharts

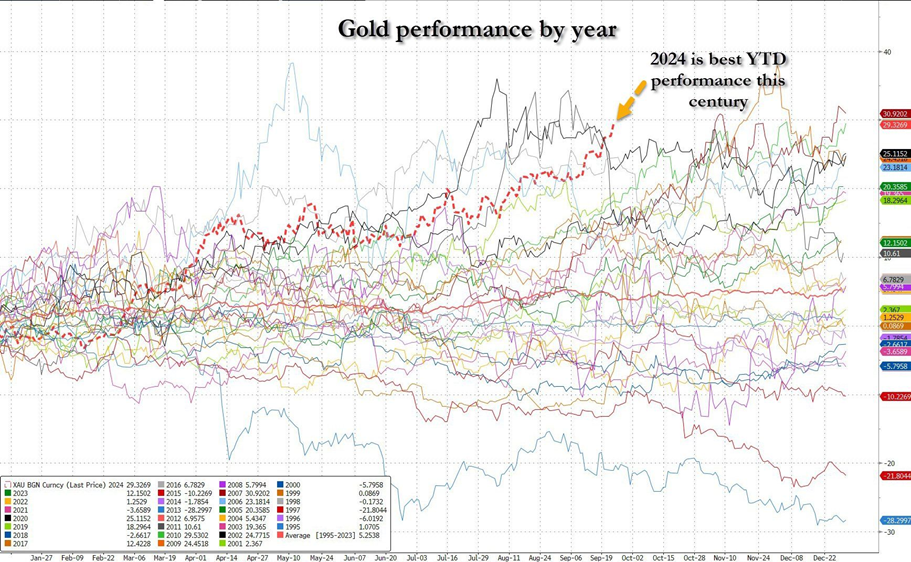

Meanwhile, Gold Continues to Shine

This last week, Gold has achieved yet another record, with a remarkable 30% increase in value since the beginning of the year. This marks gold's best annual performance of the century. Looking ahead, trends such as de-dollarization and escalating geopolitical tensions are likely to keep demand for gold strong.

Additionally, the growing fiscal pressures in the United States, such as increasing public debt and interest payments, reinforce gold’s role as a reliable hedge against inflation. Concerns from the International Monetary Fund about the sustainability of U.S. fiscal policies also boost gold's appeal as a safe haven investment.

Source: ZeroHedge, Bloomberg