2012 has finally started to look a lot like the final months of last year with the European single currency coming under pressure again as the market ponders the probability that a breakup of the currency union may be a possibility. EUR/USD retraced all of the gains made in the previous session while GBP/EUR hit 14 month highs and closed at the highest level since September 2010. European news wasn’t all that shocking yesterday however, the herd mentality of the people who are expecting the euro to collapse is a force to be reckoned with, and we expect that a fair lump of the move yesterday was still positioning for the new year.

Yesterday’s German bond auction once again disappointed the market as demand was subdued. The bid-to-cover ratio was only 1.3 with the yield averaging 1.93%; once again we emphasise that this is not as a result of people becoming scared and no longer thinking that German debt is a safe haven and more that people are unwilling to hold debt that has ties to the Eurozone and is paying negative yields in real terms (once you account for inflation). Even so, the euro lost heavily after the auction and continued to slip through the afternoon session.

Fears over the European banking system were not helped by news that the Italian bank Unicredit saw its shares fall by 14% yesterday. This was as a result of a “rights issue” and should not be viewed as any change in the stability of the bank itself. The offer to buy new shares in the bank were at a significant discount to the market and that will have contributed to the fall. One thing it does show is that the banking system may have difficulty in raising money from 3rd parties in the coming year; Unicredit will not be the only one who needs to tap shareholders.

Staying with Europe we have a French bond auction today which will likely garner a few headlines. The auction is for the longer term side of the curve, with the nearest being 2021. Yields are obviously nowhere near the level that Spain or Italy are paying on debt but they are also a fair premium to Germany and we know which boat the French would rather be sailing in. Results will be due just after 10.00 GMT.

Part of the reason for the resurgent pound has been two PMI releases that have been stronger than expected, and today gives us the chance to go for a third. The reading for the important services sector is due at 09.30 and an expansionary figure of 51.5 is expected. Recent earnings releases from high street companies have shown that demand was not spectacular into Christmas and we are worried that any pop higher may be as a result of price discounting and would therefore be difficult to maintain into Q1. It would also make the potential fall-off in the first 3 months of 2012 that much more sharp and increase the risk that Q1 GDP is negative.

Elsewhere we have Italian unemployment at 09.00 which is unlikely to show the same strength that the German measure did in posting a post-reunification low of 6.8%. Staying on the jobs front we have US ADP unemployment at 13.15 as the market gears up for Friday’s first non-farm payrolls announcement of the year and finally a look at the US services sector comes in the ISM number at 15.00.

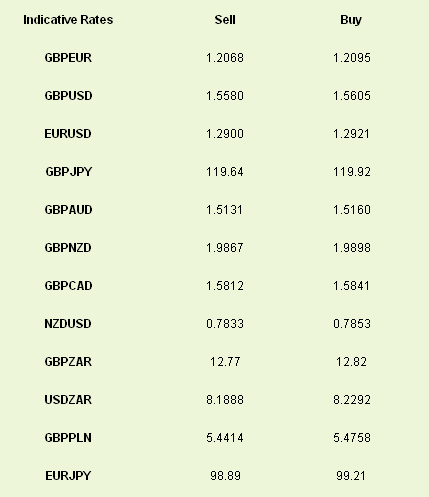

Latest exchange rates at time of writing

Yesterday’s German bond auction once again disappointed the market as demand was subdued. The bid-to-cover ratio was only 1.3 with the yield averaging 1.93%; once again we emphasise that this is not as a result of people becoming scared and no longer thinking that German debt is a safe haven and more that people are unwilling to hold debt that has ties to the Eurozone and is paying negative yields in real terms (once you account for inflation). Even so, the euro lost heavily after the auction and continued to slip through the afternoon session.

Fears over the European banking system were not helped by news that the Italian bank Unicredit saw its shares fall by 14% yesterday. This was as a result of a “rights issue” and should not be viewed as any change in the stability of the bank itself. The offer to buy new shares in the bank were at a significant discount to the market and that will have contributed to the fall. One thing it does show is that the banking system may have difficulty in raising money from 3rd parties in the coming year; Unicredit will not be the only one who needs to tap shareholders.

Staying with Europe we have a French bond auction today which will likely garner a few headlines. The auction is for the longer term side of the curve, with the nearest being 2021. Yields are obviously nowhere near the level that Spain or Italy are paying on debt but they are also a fair premium to Germany and we know which boat the French would rather be sailing in. Results will be due just after 10.00 GMT.

Part of the reason for the resurgent pound has been two PMI releases that have been stronger than expected, and today gives us the chance to go for a third. The reading for the important services sector is due at 09.30 and an expansionary figure of 51.5 is expected. Recent earnings releases from high street companies have shown that demand was not spectacular into Christmas and we are worried that any pop higher may be as a result of price discounting and would therefore be difficult to maintain into Q1. It would also make the potential fall-off in the first 3 months of 2012 that much more sharp and increase the risk that Q1 GDP is negative.

Elsewhere we have Italian unemployment at 09.00 which is unlikely to show the same strength that the German measure did in posting a post-reunification low of 6.8%. Staying on the jobs front we have US ADP unemployment at 13.15 as the market gears up for Friday’s first non-farm payrolls announcement of the year and finally a look at the US services sector comes in the ISM number at 15.00.

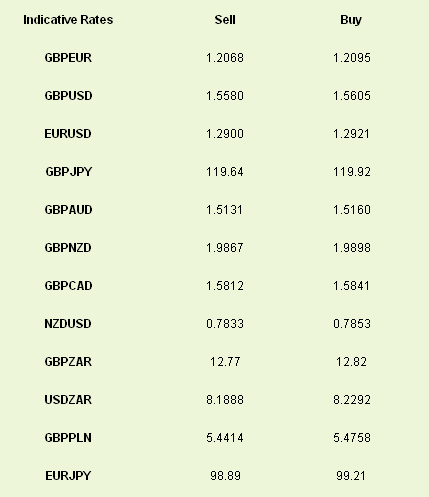

Latest exchange rates at time of writing