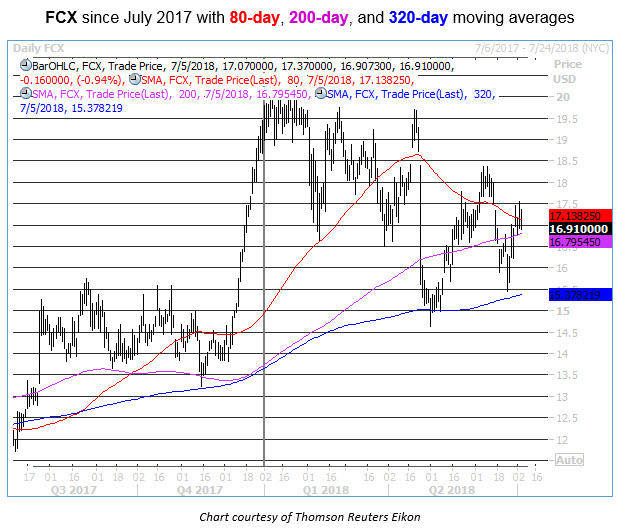

Mining giant Freeport-McMoRan (NYSE:FCX) has been trending lower since late January, with the stock now down 10.8% year-to-date to hover at $16.91. The shares have notched a series of lower highs along the way, and as a result, FCX has breached former support at its 80-day moving average. Based on historical returns from Schaeffer's Senior Quantitative Analyst Rocky White, the commodity stock's latest rally up to this trendline could be a viable sell signal for short-term bears.

Looking back over the past three years, there has been only one prior instance of FCX rising to within one standard deviation of its 80-day moving average after a lengthy stretch of time spent below it (defined as 60% of the time over the preceding two months, and at least eight of the previous 10 trading days). Following that prior occurrence, the stock was down 4.72% a month later.

FCX is pulling back from its 80-day in today's trading, which has the stock testing its footing around its 200-day moving average. This benchmark trendline cushioned the equity's mid-November 2017 lows, but proved itself an unreliable layer of support during a couple of second-quarter tests. Instead, the 320-day moving average stepped up to contain FCX's early May drop.

Despite the equity's technical troubles, calls have dominated the FCX options action lately. Over the past 10 days, traders on the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) have bought to open 24,729 calls on FCX, compared to just 3,912 puts. The resulting 10-day call/put volume ratio of 6.32 registers in the 87th annual percentile, revealing a stronger-than-usual skew toward bullish bets over bearish.

With FCX not due to report earnings until after July options expiration, front-month bets on the stock are going cheap. Schaeffer's Volatility Index (SVI) checks in at 40%, which registers in the 27th percentile of its annual range. In other words, short-term FCX options have been cheaper from a volatility standpoint only 27% of the time in the last 52 weeks. As such, traders expecting another move lower following FCX's latest 80-day rejection may want to consider standard monthly July puts.