Mining company Freeport-McMoran Copper & Gold (NYSE:FCX) is enjoying the tailwind from a strong year for gold and silver prices. And although copper prices are down, Copper has been turning up lately.

This has helped Freeport’s stock price recover in 2019 and has FCX testing a key breakout level.

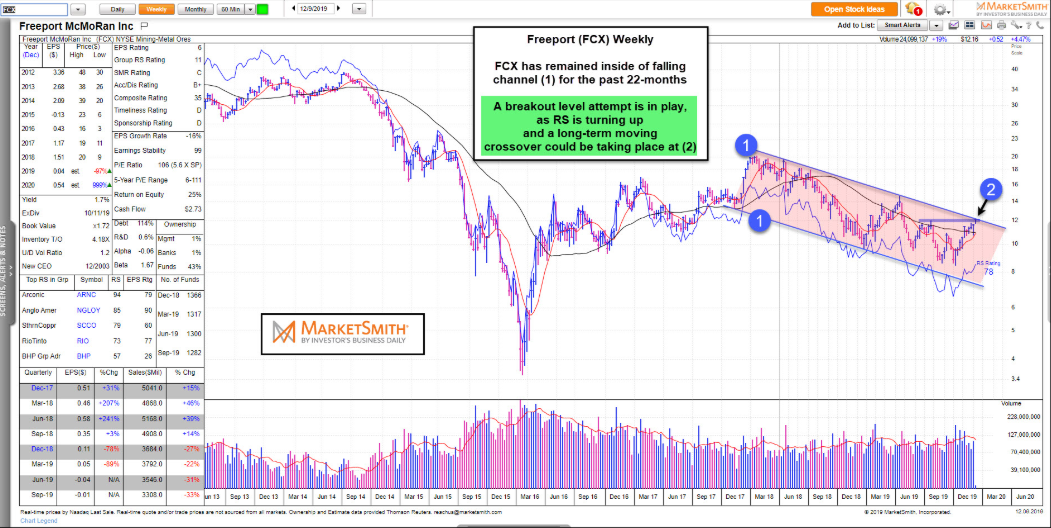

The chart above is a weekly look at Freeport McMoRan. The shaded channel outlined by each (1) highlights the longer-term downtrend that FCX has been stuck in.

But this could change on a dime, especially if FCX can breakout above (2). This area represents its recent highs as well as its falling downtrend line.

A breakout here with strong volume would be very bullish.

It is worth noting that its Relative Strength (RS) is turning up and a moving average crossover appears to be in the works as well. Stay tuned!

The chart data and stats came from Marketsmith.com