Freeport-McMoRan Inc. (NYSE:FCX) reported net income (attributable to common stock) of 18 cents per share for second-quarter 2017, as against the year-ago loss of 38 cents.

Arkema SA (ARKAY): Free Stock Analysis Report

Chemours Company (The) (CC): Free Stock Analysis Report

Freeport-McMoran, Inc. (FCX): Free Stock Analysis Report

HITACHI CHEMICL (HCHMY): Free Stock Analysis Report

Original post

Zacks Investment Research

Barring one-time items, adjusted earnings were 17 cents a share in the second quarter, missing the Zacks Consensus Estimate of 20 cents.

Revenues went up around 11.3% year over year to $3,711 million in the reported quarter, surpassing the Zacks Consensus Estimate of $3,678 million.

Consolidated sales from mines totaled 942 million pounds of copper, 432,000 ounces of gold and 25 million pounds of molybdenum for the reported quarter. Copper sales volumes were lower than the company’s expectations reflecting the impact of worker absenteeism on mining and milling rates in Indonesia. Gold sales were higher year over year on higher ore grades from Indonesia.

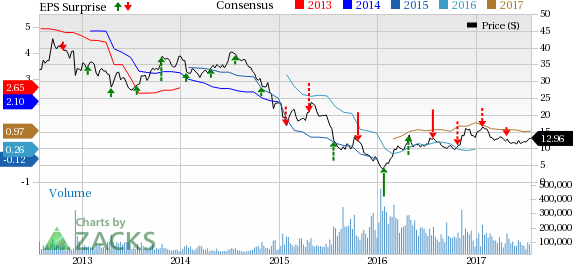

Freeport-McMoran, Inc. Price, Consensus and EPS Surprise

Operational Update

Consolidated average unit net cash costs declined to $1.20 per pound of copper from $1.33 in the year-ago quarter. This is mainly attributable to higher by-product credits, partly offset by reduced copper sales volumes

Average realized price per ounce for gold rose to $1,243 in the quarter from $1,292 a year ago, while average realized price per pound for molybdenum was $9.58 per pound.

Mining Update

North America Copper Mines: Copper sales decreased 12.1% year over year to 408 million pounds mainly due to lower ore grades. Production fell 18.1% year over year to 384 million pounds in the reported quarter.

Freeport expects copper sales from North America to be 1.5 billion pounds in 2017, compared with the year-ago figure of 1.8 billion pounds.

South America Mining: Copper sales of 287 million pounds declined 12.2% from the year-ago quarter owing to reduced mining rates, ore grades and recoveries.

South America mining is anticipated to report sales of around 1.2 billion pounds of copper in 2017, compared with sales of 1.3 billion pounds in 2016.

Indonesia Mining: Copper sales of 247 million pounds improved 26% from 196 million pounds the year-ago quarter. The results reflect the sale of concentrate in inventory and increased ore grades, partly offset by reduced mill rates.

Gold sales surged 182.8% to 427,000 ounces and production rose 120.2% year over year to 348,000 ounces in the reported quarter.

Sales from Indonesia mining are anticipated to be about 1 billion pounds of copper and 1.6 million ounces of gold for 2017.

Molybdenum Mines: Molybdenum production was 8 million pounds in the second quarter compared with 7 million pounds in the year-ago quarter.

Financial Position

Freeport had operating cash flows of roughly $1 billion in the quarter, which includes $144 million in working capital and changes in other tax payments.

Freeport had total debt of $15,354 million as of Jun 30, 2017, down from $19,220 million as of Jun 30, 2016.

Guidance

Freeport anticipates sales volumes for the year 2017 to be roughly 3.7 billion pounds of copper, 1.6 million ounces of gold and 93 million pounds of molybdenum, including 940 million pounds of copper, 375,000 ounces of gold and 22 million pounds of molybdenum in third-quarter 2017.

The company assumes average prices of $1,250 per ounce of gold, $2.65 per pound of copper and $7.50 per pound of molybdenum for the remainder of 2017.

Consolidated unit net cash costs (net of by-product credits) for copper mines are expected to average $1.19 per pound of copper for 2017.

Price Performance

Freeport’s shares have moved up 2.2% in the last one year, underperforming the industry’s 14.2% gain.

Zacks Rank & Key Picks

Freeport currently carries a Zacks Rank #4 (Sell).

Some better-ranked companies in the basic materials space include The Chemours Company (NYSE:CC) , Arkema S.A. (OTC:ARKAY) and Hitachi Chemical HCHMY. All three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Chemours has an expected long-term earnings growth of 15.5%.

Arkema has an expected long-term earnings growth of 12.4%.

Hitachi Chemical has an expected long-term earnings growth of 5%.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Arkema SA (ARKAY): Free Stock Analysis Report

Chemours Company (The) (CC): Free Stock Analysis Report

Freeport-McMoran, Inc. (FCX): Free Stock Analysis Report

HITACHI CHEMICL (HCHMY): Free Stock Analysis Report

Original post

Zacks Investment Research