Have you been eager to see how Franklin Resources Inc. (NYSE:BEN) performed in fiscal Q4 in comparison with the market expectations? Let’s quickly scan through the key facts from this CA-based popular asset management firm’s earnings release this morning:

An Earnings Beat

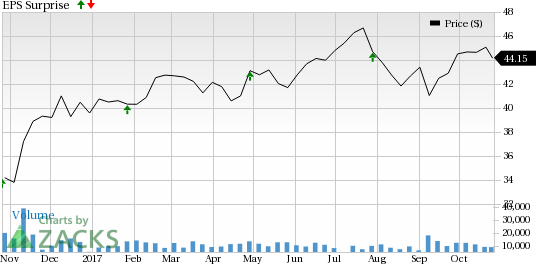

Franklin Resources came out with earnings per share of 76 cents, beating the Zacks Consensus Estimate of 72 cents. Slightly higher revenues and strong assets under management were primarily responsible for the beat.

How Was the Estimate Revision Trend?

You should note that the earnings estimate revisions for Franklin Resources depicted neutral stance prior to the earnings release. The Zacks Consensus Estimate remained stable over the last seven days.

Further, Franklin Resources has a decent earnings surprise history. Before posting earnings beat in fiscal Q4, the company delivered positive surprises in three of the prior four quarters. Overall, the company surpassed the Zacks Consensus Estimate by an average of 10.6% in the trailing four quarters.

Revenue Came In Lower Than Expected

Franklin Resources posted revenues of $1.62 billion, which missed the Zacks Consensus Estimate of $1.64 billion. However, it compared favorably with the year-ago number of $1.61 billion.

Key Stats to Note:

- Operating expenses were up 3% year over year

- Revenues were up slightly year over year

- Assets Under Management were up 3% year over year

What Zacks Rank Says

The estimate revisions that we discussed earlier have driven a Zacks Rank #2 (Buy) for Franklin Resources. However, since the latest earnings performance is yet to be reflected in the estimate revisions, the rank is subject to change. While things apparently look favorable, it all depends on what sense the just-released report makes to the analysts.

(You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.)

Check back later for our full write up on this Franklin Resources earnings report!

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Franklin Resources, Inc. (BEN): Free Stock Analysis Report

Original post