Investing.com’s stocks of the week

The market’s worst kept secret was outed on Friday night as France lost its AAA rating following a downgrade from the ratings agency Standard & Poors. Personally we think that the current situation is now a lot clearer given the absence of the uncertainty that stalked French assets for the past few months. There hasn’t been much reaction in French bonds or in the CDS, default insurance, markets so we can safely say this was expected.

The ripples from the announcement, while muted in the financial world, will be felt more predominantly in the European corridors of power. If we hark back to December we have to remember that S&P stated that a downgrade of AAA rated country would probably lead to some form of downgrade for the European Financial Stability Facility. The fund’s outlook is already rated as “negative”, as in ratings action can be expected and a downgrade would not be a surprise. What it will do is elevate the funding costs of the fund as investors look for a higher yield on its debt.

Naturally in the hours before the announcement rumours were flying around causing a fair bit of volatility in the euro. The single currency lost all the gains that it had made on Thursday versus the USD and GBP and is back to the 1.26s and the 1.21s respectively. The prospects of a bounce back for the euro cannot be disregarded either; it seems that everyone is so bearish on the euro that a reversal that stuffs them would almost be de rigeur. We would not chase GBP/EUR too much higher in the short term and we expect that 1.2160 will remain the short term high.

In fact, France’s downgrade (alongside Austria’s, Spain’s and Italy’s) was not the biggest news of Friday’s session. Talks between Greece and private investors over the size of the haircut that they will have to take on their investments in Greek debt broke down on Friday. Greece has a bond repayment due in March and without this agreement in place before then a “disorderly default” is all but assured. The Greeks will default on their agreements, it’s now a case of how and how badly unfortunately.

Thankfully the market calendar is pretty quiet today and we suspect that most people will be picking through the bones of the Standard and Poors announcement today in the absence of any real news. It is Martin Luther King day in the United States so markets across the pond are closed today.

Good luck

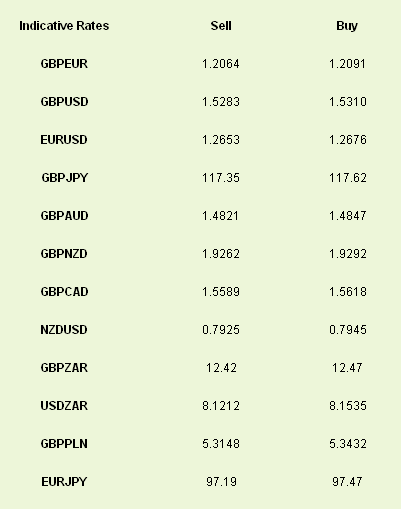

Latest exchange rates at time of writing

The ripples from the announcement, while muted in the financial world, will be felt more predominantly in the European corridors of power. If we hark back to December we have to remember that S&P stated that a downgrade of AAA rated country would probably lead to some form of downgrade for the European Financial Stability Facility. The fund’s outlook is already rated as “negative”, as in ratings action can be expected and a downgrade would not be a surprise. What it will do is elevate the funding costs of the fund as investors look for a higher yield on its debt.

Naturally in the hours before the announcement rumours were flying around causing a fair bit of volatility in the euro. The single currency lost all the gains that it had made on Thursday versus the USD and GBP and is back to the 1.26s and the 1.21s respectively. The prospects of a bounce back for the euro cannot be disregarded either; it seems that everyone is so bearish on the euro that a reversal that stuffs them would almost be de rigeur. We would not chase GBP/EUR too much higher in the short term and we expect that 1.2160 will remain the short term high.

In fact, France’s downgrade (alongside Austria’s, Spain’s and Italy’s) was not the biggest news of Friday’s session. Talks between Greece and private investors over the size of the haircut that they will have to take on their investments in Greek debt broke down on Friday. Greece has a bond repayment due in March and without this agreement in place before then a “disorderly default” is all but assured. The Greeks will default on their agreements, it’s now a case of how and how badly unfortunately.

Thankfully the market calendar is pretty quiet today and we suspect that most people will be picking through the bones of the Standard and Poors announcement today in the absence of any real news. It is Martin Luther King day in the United States so markets across the pond are closed today.

Good luck

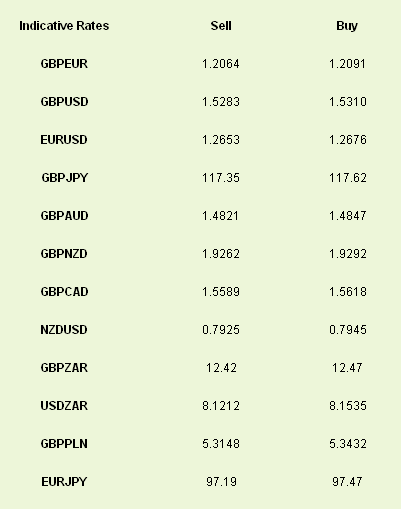

Latest exchange rates at time of writing