Forex News and Events:

The FX markets adjust positions through a quiet Monday session. Technicals should remain in focus throughout the day given the light economic calendar. In Switzerland, the unemployment rate improved slightly to 2.9% in June, helping the franc to extend weakness against EUR and USD; the inflation and retail sales are due tomorrow. Given the better US yields and the broad based negative shift in EUR, the franc crosses are at the edge of short-term bullish reversal. We zoom in Switzerland today.

EUR/CHF: is the storm over?

EUR/CHF sunk to three-month lows last week, hit 1.21335 on July 1st. The cross took a breather after ECB/NFP squeeze, closed the week above 1.21500 and currently tests the 21-dma (1.21672) on the upside. The MACD (12, 26) will step in the green zone for a daily close above 1.21600, thus dissipating the downside pressures toward the critical 1.21044 (year low). Given the negative correlation with EUR/USD (40-day correlation stands below -20%) and our expectations for lower EUR/USD, we favor a deeper upside correction in EUR/CHF. A breakout above the key resistance at May-July downtrend channel top (1.21800) is required to talk about a short-term bullish reversal.

Better US yields sustain USD/CHF

USD/CHF attempts to clear resistance at 200-dma (0.8949) as US yields are in better shape post-NFPs. The pair hit 0.8959 as Europe walked in this morning, boosted by the slight decline in Swiss unemployment rate from 3.0% to 2.9%. The seasonally adjusted unemployment remains stable at 3.2% in June data. The MACD is ready to step in the bullish zone for a daily close above (0.8985), also matching the short-term downtrend top building since June 5th. Light option barriers should not influence the positive path should the focus remain on technicals.

Economists anticipate soft Swiss CPI

The Swiss June inflation data is due tomorrow and the expectations are flat. The CPI m/m is seen at 0.1% versus 0.3% printed in May, the CPI y/y should stabilize at 0.2%. Although the economists remain skeptical on price dynamics in Switzerland, historical data shows sustained improvement since June 2012 (-1.1%). From end-2013, Swiss market has been subject to flat-to-positive acceleration in its domestic prices. With its 3-month Libor target at historical low levels (0.00-0.25%) and its commitment to defend the EUR/CHF cap at 1.20, the SNB has little left to do. On its June 19th meeting, the SNB decided to keep its policy unchanged, given that the broad-based EUR weakness is statistically not a threat for the EUR/CHF floor. We observed some tension in interest rate futures market over the past week (as EUR/CHF retreated to 3-month lows), yet the actual levels do not signal any shift in SNB outlook.

In his interview with SonntagsZeitung, Fritz Zurbruegg, member of SNB Governing Council, said that the “inflation will remain low for longer than assumed” adding that in the current zero-rate environment, the inflation should rise only toward 1.5% until early 2017. “Despite all the money in the system, we don’t see any inflation risks for the foreseeable future” said Zurbruegg.

Today's Key Issues (time in GMT):

2014-07-07T12:30:00 CAD May Building Permits MoM, exp 3.00%, last 1.10%2014-07-07T14:00:00 CAD Jun Ivey Purchasing Managers Index SA, exp 52.5, last 48.2

2014-07-07T14:30:00 CAD 2Q Business Outlook Future Sales, exp 30, last 27

2014-07-07T14:30:00 CAD 2Q BoC Senior Loan Officer Survey, last -10.9

The Risk Today:

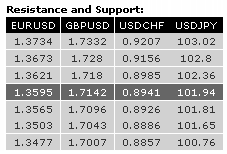

EUR/USD has broken its short-term rising channel after having stopped near the 38.2% retracement of its previous decline. A fall towards the support at 1.3503 is likely. An hourly support can be found at 1.3565 (20/06/2014 low). Hourly resistances now stand at 1.3621 (intraday high) and 1.3664 (03/07/2014 high). In the longer term, the break of the long-term rising wedge (see also the support at 1.3673) indicates a clear deterioration of the technical structure. A long-term downside risk at 1.3379 (implied by the double-top formation) is favoured as long as prices remain below the resistance at 1.3775. Key supports can be found at 1.3477 (03/02/2014 low) and 1.3296 (07/11/2013 low).

GBP/USD has broken the major resistance at 1.7043 (05/08/2009 high). A short-term bullish bias is favoured as long as the hourly support at 1.7096 (01/07/2014 low, see also the short-term rising trendline) holds. Another support lies at 1.7007 (27/06/2014 low). In the longer term, the break of the major resistance at 1.7043 (05/08/2009 high) calls for further strength. Resistances can be found at 1.7332 (see the 50% retracement of the 2008 decline) and 1.7447 (11/09/2008 low). A support lies at 1.6923 (18/06/2014 low).

USD/JPY has broken to the upside out of its declining channel (see also the 200 day moving average). Prices are now consolidating near the resistance at 102.36 (18/06/2014 high). Another resistance lies at 102.80 (04/06/2014 high). Hourly supports can be found at 101.97 (04/07/2014 low) and 101.65 (intraday high). A long-term bullish bias is favoured as long as the key support 99.57 (19/11/2013 low) holds. A break to the upside out of the current consolidation phase between 100.76 (04/02/2014 low) and 103.02 is needed to resume the underlying bullish trend. A major resistance stands at 110.66 (15/08/2008 high).

USD/CHF continues to improve and is now testing the resistance implied by the declining channel. Another resistance lies at 0.8975. Hourly supports can be found at 0.8926 (intraday low) and 0.8886 (intraday low). From a longer term perspective, the bullish breakout of the key resistance at 0.8953 suggests the end of the large corrective phase that started in July 2012. The long-term upside potential implied by the double-bottom formation is 0.9207. A key resistance stands at 0.9156 (21/01/2014 high).