I heard commentary after the Fed’s proclamation on monetary policy on March 21st that the Fed is “one vote away” from 4 rate hikes this year. Yet, something strange happened along the way to over-speculation on the number of rate hikes in 2018: the traders putting their money on the line on the 30-Day Fed Funds Futures think 4 rate hikes in 2018 is only slightly more likely than 3 weeks ago.

According to the CME FedWatch, the current probability for a total of 4 rate hikes this year is 35.3% (one is in the bag with March’s rate hike). Three weeks ago, this probability was 27.8%.

The 30-Day Federal Funds Futures are confident about two more rate hikes by December at 77.5% odds. The odds for 3 MORE rate hikes by December plunges to 35.3%.

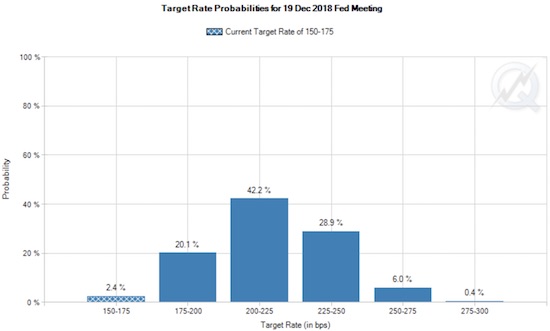

As a reminder, the above chart should be read from left to right. Each bar represents the probability that the Fed at its December meeting will set its target rate to the given level. So starting with the far left bar, the probability is only a paltry 2.4% that in December the Fed will leave rates at the new 150 to 175 bps range. The probability for rates to be set at the 200-225 bps range is 42.2% (unchanged from 3 weeks ago). However, given the market thinks there is a non-zero chance for rates to be set even higher, it is more appropriate to frame the answers as the probability for rates to be AT LEAST 200-225 bps is 42.2% + 28.9% + 6.0% + 0.4% = 77.5%; sum up the odds starting from the target range and everything higher. Similarly, the likelihood for the Fed to set rates at least 225 to 250 bps in December is 35.3%.

I took a pause to watch the press conference for the Federal Reserve’s announcement on monetary policy. I wanted to see new Fed chair Jerome (Jay) Powell perform in real-time. That press conference must have been the most dry and the most boring Fed meeting I have seen in a very long-time, maybe ever, maybe across all central bank meetings I have ever watched. If Powell was trying hard to avoid sudden movements that could spook a hyper-tuned market, he thoroughly succeeded. The whole affair was as straight-laced, monotone, and non-emotional as a central bank press conference can get. I am pretty sure Powell never even attempted a smile. The basic headline from the Fed: another 25 bps rate hike; the economic outlook improved with no impact to inflation and a slightly higher rate profile 1-2 years out.

Meantime, the net impact of the Fed sent the dollar lower by the close of U.S. trading. If the market believed in the speculation about 4 total rate hikes for this year, new information from the Fed to that effect would have likely sent the U.S. dollar index higher. Instead, the dollar lost 0.7% on the day.

The U.S. dollar remains tightly capped by its declining 50-day moving average (DMA).

Financials did not perform as I expected in the wake of a rate hike. Early gains were wiped out by the close. The Financial Select Sector SPDR ETF (NYSE:XLF) ended the day flat and quickly gave up all its intraday post-Fed gain.

The Financial Select Sector SPDR ETF (XLF) failed to gain post-Fed traction. The 50DMA is serving as an approximate pivot.

I expect financials to eventually get the engines started and move higher so I added to my call options in Goldman Sachs Group Inc (NYSE:GS).

Be careful out there!

Full disclosure: long GS call options