Hey everybody, Dave Bartosiak here with Trending Stocks at Zacks.com giving you the four dumbest things about the Equifax (NYSE:EFX) hack.

In case you haven’t heard, hackers breached the data of credit agency Equifax and made off with a few social security numbers and sensitive information. A few…million. Well, 143 million to be exact. So basically nearly half of the US population. That’s right folks, the place that tricks off on you for missing one credit card payment two years ago when you had the stomach flu and sets you up for a 20% loan on your Miata as punishment for your irresponsible behavior, allowed 143 million customer’s data to be hacked. Dumb. Oh, it gets better.

Dumb fact number two, the hack wasn’t a one-time event. Hackers exploited a security flaw which was 9 years old, slowly accessing the data over several months. We have attained footage of the hackers cracking the code.

The vulnerability was in a popular open-source software package known as Apache (NYSE:APA) Struts. What’s even crazier is that at least 65% of Fortune 100 companies still use web applications built with the Struts framework. Information comprised includes names, Social Security numbers, birth dates, addresses and driver’s license numbers. About 209,000 consumer’s credit card numbers were stolen as well. Boy am I glad Equifax gets to tell potential lenders about how responsible I am with…life.

Dumb fact number three, is that three Equifax execs, including the CFO, sold shares in early August. 6,500 shares by the CFO, 4,000 by the president of their US Information Solutions unit, and 1,719 shares by another president. Doesn’t sound like much money, but when you price them at $146, it’s a pretty good chunk of change. The company knew about the hack on July 29th. But, before you give these guys a black eye, they each have a history of selling shares and in the grand scheme of insider compensation, this is a drop in the bucket. All three of these guys still own over 40,000 shares.

Dumb fact four, in an attempt to stop the bleeding, Equifax created a website that would allow consumers to check if they were affected by the breach. In the fine print you have to agree to in order to check if you are affected, they snuck in a line saying you would waive your rights to sue Equifax or be part of any class action lawsuit.

I suggest everybody out there take a detailed look at your credit report using anyone but Equifax. When you do, dispute any inaccuracies. The bureau has 30 days to respond to your dispute. If they don’t respond within 30 days, the item is dropped from your report. With the flood of disputes Equifax is likely to get now, you may finally be able to resolve some lingering issues like that collection account from your days as an Enzyte customer.

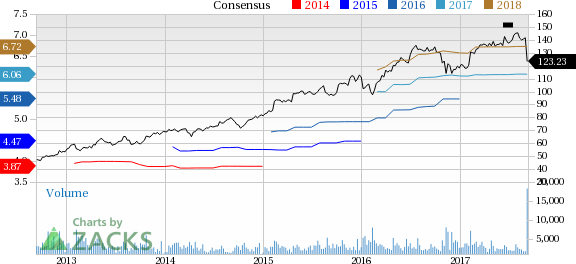

Obviously the market didn’t like the breach, sending Equifax shares tumbling since the move. After trading over $142 last week, shares have tumbled down to $113. We’ve still got it as a Zacks Rank #3 (Hold) right now as most analysts haven’t jumped out and dropped earnings estimates yet. Those which have commented on the breach believe the stock is oversold. I’d wait until the Congressional hearings to initiate a position for those looking to buy the dip.

Every time you share this video, you help somebody with a 580 credit score buy a house with 3 ½ percent down. Subscribe to the YouTube channel, Twitter @bartosiastics, and come back here for all the Trending Stocks with Zacks.com, I’m Dave Bartosiak.

Equifax, Inc. (EFX): Free Stock Analysis Report

Original post

Zacks Investment Research