Bitcoin is plunging yet again. Following a small recovery from $7027 to $7791 in the first week of the month, BTC/USD just breached the support of $7200 and still seems to be in a downward spiral from its December 2017 high of $19 666. But let’s ignore the bubble-or-not-a-bubble talk for a moment and concentrate on the short-term for a minute. Bitcoin lost over $300 per coin in just an hour today. According to newsbtc.com, the flash crash was caused by the US Commodity Futures Trading Commission, which accused a number of larger exchanges such as Kraken, Coinbase and Bitstamp of price manipulation.

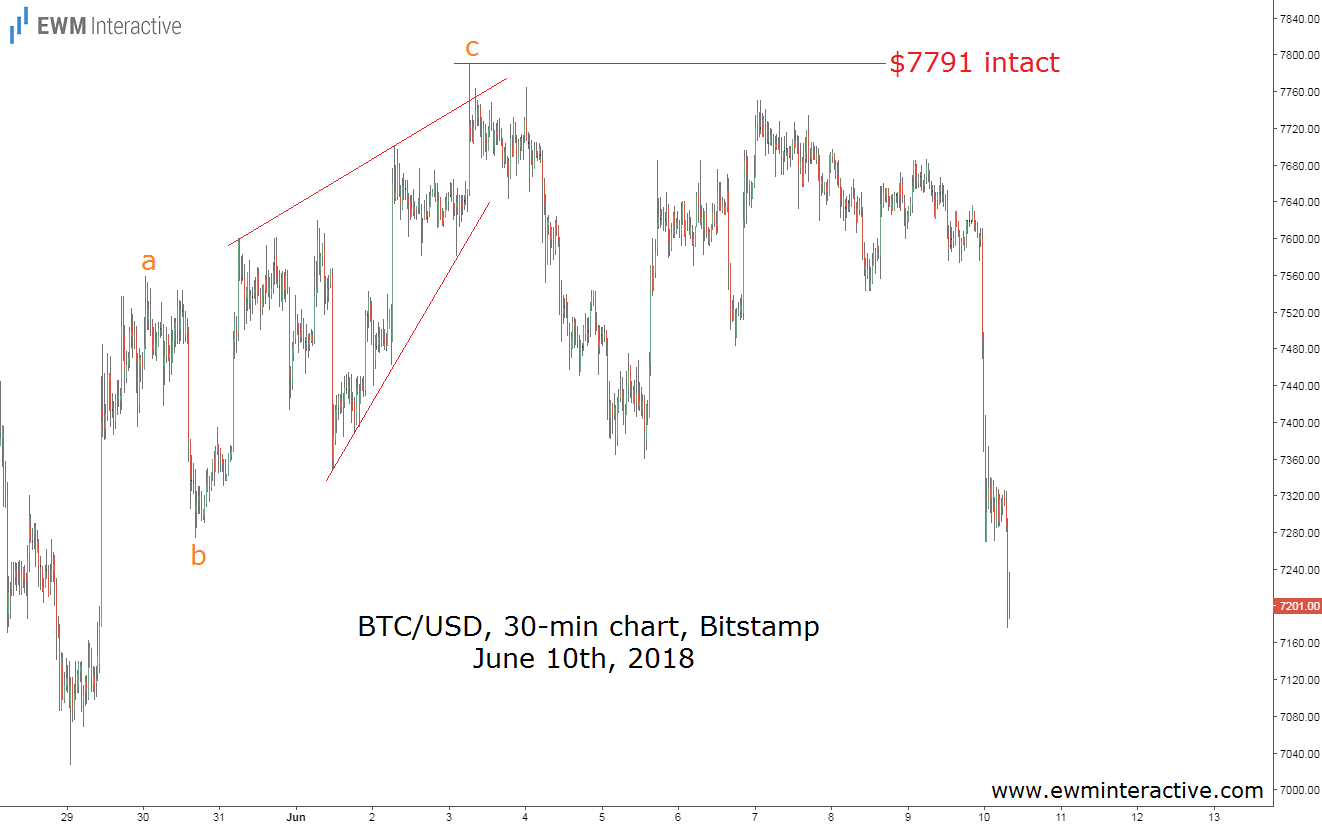

Well, if the CFTC caused the plunge today, how come the Elliott Wave Principle managed to put us four days ahead of it? The chart below was sent to our subscribers as a mid-week update on Wednesday, June 6th.

Four days ago, the 30-minute chart of Bitcoin revealed that the recovery from $7027 to $7791 was corrective in nature. It looked like a textbook simple a-b-c zigzag with an ending diagonal in the position of wave “c”. The theory states that once a correction is over the larger trend resumes. Here, this retracement was preceded by a sharp selloff from $9949, so it made sense to expect a similar outcome. In addition, the chart also provided us with a specific stop-loss level at $7791. As long as BTC/USD traded below it, the bears were still in charge. The updated chart below shows how the situation has been developing since Wednesday.

The bulls did try to invalidate the bearish count, but $7750 on Thursday, June 7th, was the best they managed to achieve. As it often does, the market was already anticipating bad news and all it needed was a catalyst in order to send the price of Bitcoin into a tailspin. In other words, the CFTC manipulation investigation did not cause the selloff. It is only an excuse for it, since the stage was already set for a decline. And the Elliott Wave principle managed to prepare traders for it several days in advance.

What will Bitcoin bring next week? That is the subject of discussion in our next premium analysis due out later TODAY!