On this week’s episode of Forward Guidance, Manward Press Founder Andy Snyder joins us to discuss income investing in a low-interest-rate world.

You may remember Andy as the former Editor-in-Chief of The Oxford Club and the author of the popular Lecture Notes column in Investment U. But about two months ago, Andy left a rewarding job at the Club to pursue his passion project full time.

As Andy explains, Manward Press is a lifestyle and financial publishing company dedicated to helping men (and many women) achieve success and fulfillment. It’s focused on a research-backed “Triad” of personal goals: Liberty, Know-How and Connections.

Financial guidance is an important aspect of Manward Press, as Andy considers income security to be crucial to personal liberty.

That’s why Andy has been a vocal critic of what he calls the “Zero Economy,” or the Federal Reserve’s policy of maintaining artificially low interest rates. He wrote about this topic frequently in Investment U.

Andy sees the Fed’s low-interest lending and quantitative easing policies as unsustainable in the long term. He points out that it now has $4.5 trillion in bonds and asset-backed securities on its balance sheet - and that every attempt to unwind that balance sheet has sent the market into a panic (as with the 2013 “taper tantrum”).

He also notes that the persistent low-interest environment is depriving retirees of their living income - and may be contributing to a bubble in junk bonds and dividend stocks.

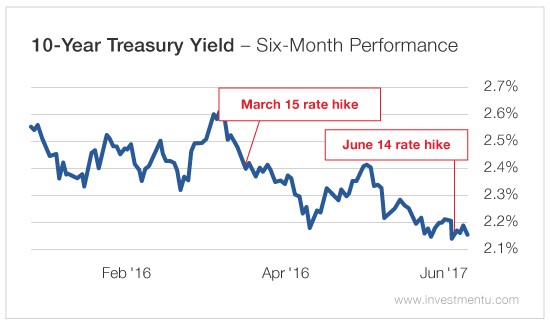

Even after the Fed’s rate hikes this year, the benchmark 10-year Treasury yield is still falling over time, shown in the graph below.

In Andy’s view, this is a result of lukewarm economic growth - and of the Fed procrastinating on unwinding its balance sheet. Despite the Fed’s attempt to increase benchmark rates, Andy doesn’t think investors are confident about the current interest rate situation.

That’s why he’s been recommending a unique approach to income investing to Manward Trader readers. Unlike traditional income investing, Andy’s method doesn’t involve fixed-income securities. Instead, he uses growth stocks with relatively predictable returns to generate a steady stream of profits