The French economy faces a number of problems, but inflation is not one of them. Indeed, its marked fall is a source of support for growth.

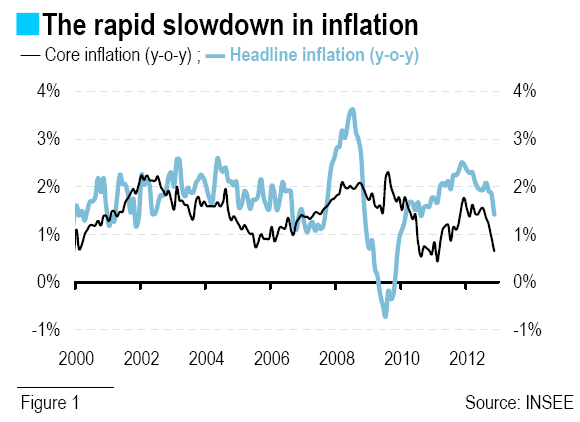

Inflation has been falling for a year now, and in November, its deceleration gathered speed. Consumer prices fell 0.2% (not seasonally adjusted), a much greater fall than expected. Year-onyear inflation was half a point lower, slipping from 1.9% to 1.4%, its lowest level since mid-2010. It is worth remembering that just a year ago it was 2.5%. The seasonally-adjusted CPI was also down, by 0.1%, which is a relatively rare occurrence.

This good inflation number -- and that is what this is -- benefited from a very favourable basis of comparison and was accentuated by a fall in energy prices (-1.2% over the month), particularly vehicle fuels (-2.3%, having already fallen by 1.4% in October), but this was not the only explanation. Services prices were also down (0.2% over the month), due largely to major cuts in telecommunications prices (3.3% in the month, 15.1% over a year) and air travel (-5.6% in the month).

Over the past year, services prices have increased by just 1.1%. Food and tobacco prices have not moved and the increase in the price of manufactured goods was very stately (0.2% on the month, 0.5% year-on-year). We are witnessing a genuine phase of disinflation.

More importantly, core inflation also provided a positive surprise: zero for the month, the year-on-year figure dropped a further 0.2 percentage point, from 0.9% to 0.7%. This is very low and one might even be tempted to think that it is too low. Such weak core inflation is a bad sign as it reflects the lack of growth. The current rate is not too far off the low of 0.4% recorded in early 2011, which bore the full brunt of the 2008-2009 recession. It is also a rate similar to that reached by US inflation at the end of 2010, which at the time raised fears of deflation.

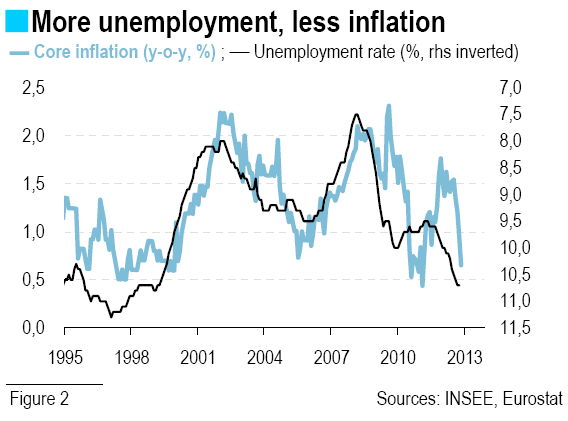

The lack of economic activity and tough competition, both pushing down margins in an attempt to protect market share, combined with rising unemployment, all contribute to strong downward pressures on inflation. Nor is there any imported inflation on the radar. We therefore expect inflation to remain low in 2013, with a headline figure of around 1.5% and core inflation close to 1%.

The first consequence of this inflation moderation is to push down all the indexed variables. The minimum wage, the various social incomes and benefits will enjoy a limited automatic boost (which is by the way positive for public finances). It also raises the tricky question of the reduction in the livret A yield, currently at 2.25%.1 Such a modest pace of inflation is above all good news for growth. First, it is synonymous with price stability, which contributes to proper functioning of the economy.

Secondly, given the current economic context in France, it is good news for consumers’ purchasing power, hence their confidence and their expenditures. Thirdly, low inflation contributes to low interest rates. Lastly, it offers a route towards rebuilding competitiveness, as French inflation is lower than that in the euro zone as a whole (HCPI figures of 1.6% and 2.2% respectively).

By Hélène BAUDCHON

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Fortnight In France: Low Inflation

Published 12/16/2012, 04:41 AM

Updated 03/09/2019, 08:30 AM

Fortnight In France: Low Inflation

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.