Fortive Technologies’ (NYSE:FTV) second-quarter 2017 earnings per share of 71 cents beat the Zacks Consensus Estimate by 2 cents. Earnings were up 10.9% year over year.

During the quarter, Fortive agreed to acquire Industrial Scientific Corporation, a leading provider of portable gas detection equipment and a safety-as-a-service pioneer. The deal is expected to close before the end of 2017.

The acquisition will enhance the company’s digital strategy and thereby create a stronger platform for connected solutions. These solutions can be used for applications in maintenance and safety.

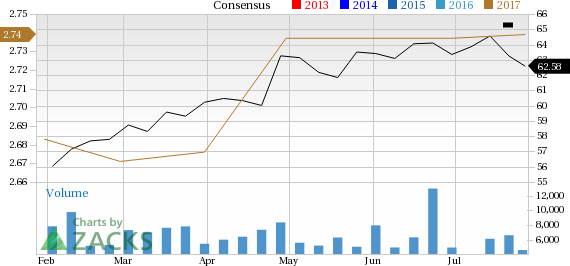

Following the strong second-quarter results, share price increased 0.64% to $62.58. Also, Fortive's shares have returned 55.8% year to date, outperforming the industry’s gain of 43.5%.

Revenues

Revenues of $1.63 billion increased 4.7% year over year. The increase was driven by strength across all its end markets. Also, the top line was slightly above the Zacks Consensus Estimate of $1.62 billion.

Moreover, acquisitions contributed to the revenue growth in the second quarter.

Operating Results

Gross margin for the quarter was 49.4%, flat year over year.

Operating expenses (research & development and selling, general & administrative expenses) in the quarter were $456.8 million, reflecting an increase of 2.4% compared to the year-ago quarter. As a percentage of sales, both selling, general & administrative and research & development expenses decreased from the year-ago quarter. Therefore, adjusted operating margin of 21.4% was up 70 bps year over year.

Net Income

Fortive’s pro forma net income came in at $249.9 million, or 71 cents, compared with $220.8 million or 64 cents in the previous quarter. Our pro forma estimates exclude acquisition-related costs, restructuring charges, amortization of intangibles and other one-time items, as well as tax adjustments.

Including these above-mentioned items, GAAP net income was $240.1 million (68 cents per share) compared with $238.9 million (69 cents) in the year-ago quarter.

Operating & Free Cash Flow

During the quarter, cash flow from operating activities was $246.0 million, capital expenditures amounted to $29.0 million and free cash flow was $246.0 million.

Guidance

For third-quarter 2017, management expects non-GAAP adjusted diluted net earnings per share to be in the range of 69–73 cents. The Zacks Consensus Estimate for the upcoming quarter is pegged at 71 cents.

For 2017, management expects non-GAAP adjusted diluted net earnings in the range of $2.72–$2.80. For the full year, the Zacks Consensus estimate is pegged at $2.74.

Stocks to Consider

Currently, Fortive has a Zacks Rank #2 (Buy). Some better-ranked stocks in the same space are KLA-Tencor (NASDAQ:KLAC) and Lam Research Corporation (NASDAQ:LRCX) , carrying a Zacks Rank #1 (Strong Buy), and Applied Materials (NASDAQ:AMAT) , carrying a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

KLA-Tencor delivered a positive earnings surprise of 11.55%, on average, in the last four quarters.

Lam Research delivered a positive earnings surprise of 4.44%, on average, in the trailing four quarters.

Applied Materials delivered a positive earnings surprise of 3.35%, on average, in the trailing four quarters.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaries,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

KLA-Tencor Corporation (KLAC): Free Stock Analysis Report

Lam Research Corporation (LRCX): Free Stock Analysis Report

Applied Materials, Inc. (AMAT): Free Stock Analysis Report

Fortive Corporation (FTV): Free Stock Analysis Report

Original post

Zacks Investment Research