FormFactor Inc. (NASDAQ:FORM) reported better-than-expected second-quarter 2017 results.

Adjusted earnings of 35 cents beat the Zacks Consensus Estimate by 11 cents while revenues of $144 million beat the same by $10 million.

Shares increased 5.5% since the earnings release. Year to date, shares have gained almost 21%, underperforming the industry’s gain of 25.2%.

Earnings were driven by contribution from the acquisition of Cascade Microtech and growth in all business segments. The acquisition enhanced FormFactor’s product and market diversification, enabling the company to further strengthen its foothold in the semiconductor space.

During the quarter, the company witnessed 14% sequential growth in probe card segment. The company delivered strong shipments of 300 millimeter platforms. Moreover, the mobile sector gained strength in the quarter, primarily due to foundry, logic and DRAM probe cards.

Let’s check out the numbers.

Revenues

Revenues were up 11.8% sequentially and 73.3% year over year and came well above the company’s guidance of $130–$138 million.

The improvement was driven by continued strength in the FormFactor core probe card business as well as growing probe card and engineering systems businesses from Cascade Microtech.

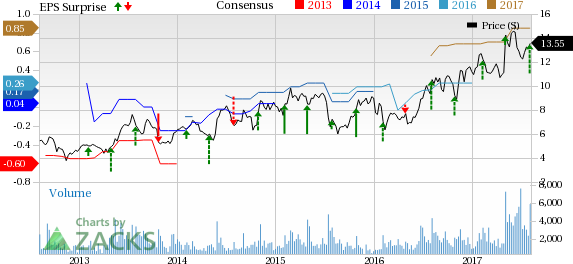

FormFactor, Inc. Price, Consensus and EPS Surprise

Revenues by Geography

The U.S. contributed 35.1% of second-quarter revenues (up 26.9% sequentially and 59.8% year over year); Taiwan accounted for 20.7% (up 52% sequentially and 131% year over year); South Korea brought in 15.8% (up 21.4% sequentially and 29% year over year); Japan accounted for 7.4% (down 30.3% sequentially but up 135.6% year on year); Europe contributed 6.5% (up 6.8% sequentially but down 22.3% year over year) and the rest of the world contributed 0.4% (down 14.3% sequentially).

Revenues by Market Segments

Foundry & Logic revenues (62% of the total first-quarter revenue) were $88.7 million, reflecting an increase of 19.4% from the prior quarter and 53.2% from the year-ago quarter. The strength was driven by strong advanced packaging demand and continued strength in data center, mobile, and automotive applications.

Reported revenues for DRAM products were $31.5 million, reflecting an increase of 8.6% sequentially and 30.2% year over year and driven by continuous strong demand.

Flash revenues were $1.4 million, reflecting a decline of 56.3% from the previous quarter but an increase of 10% from the year-ago period.

Systems revenues were $22.4 million, up slightly sequentially driven by increased 300 mm platform shipments.

Margins

Non-GAAP gross profit was $61.8 million, up from $47.6 million in the previous quarter and $27.5 million in the year-ago quarter. Gross margin of 42.9% was up 598 basis points (bps) sequentially and 975 bps year over year. The increase was attributed to higher revenues and a favorable product mix.

Adjusted operating expenses were $30 million, reflecting an increase of 9.3% sequentially and 58.6% year over year. Operating margin of 21.8% was up 645 bps sequentially and 3 bps year over year.

Pro forma net income was $29.2 million in the second quarter compared with $8 million in the year-ago quarter.

Balance Sheet

FormFactor exited the quarter with cash (comprising cash and cash equivalent, and marketable securities) of $130 million compared with $121.9 million reported in the prior quarter.

Cash from operations was $24.5 million in the second quarter compared with $17.8 million in the prior quarter. Free cash flow was $21.2 million in the second quarter.

Guidance

Management expects third-quarter 2017 revenues in the range of $136 million–$144 million. The Zacks Consensus Estimate is pegged at $133.4 million.

On a GAAP basis, the company projects gross margin of 38–41% and fully diluted income per share of 12–18 cents. On a non-GAAP basis, gross margin is expected in the range of 43–46% and earnings per share are projected in the range of 29-35 cents. The Zacks Consensus estimate is pegged at 24 cents.

Zacks Rank and Stocks to Consider

FormFactor currently has a Zacks Rank #3 (Hold). Better-ranked stocks in the broader sector include Alibaba (NYSE:BABA) , Lam Research Corporation (NASDAQ:LRCX) and Luxoft Holding (NYSE:LXFT) , each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term expected earnings per share growth rate for Alibaba, Lam Research and Luxoft is projected to be 29%, 17.2% and 20%, respectively.

5 Trades Could Profit “Big-League” from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure.

See these buy recommendations now >>

Alibaba Group Holding Limited (BABA): Free Stock Analysis Report

Luxoft Holding, Inc. (LXFT): Free Stock Analysis Report

FormFactor, Inc. (FORM): Free Stock Analysis Report

Lam Research Corporation (LRCX): Free Stock Analysis Report

Original post