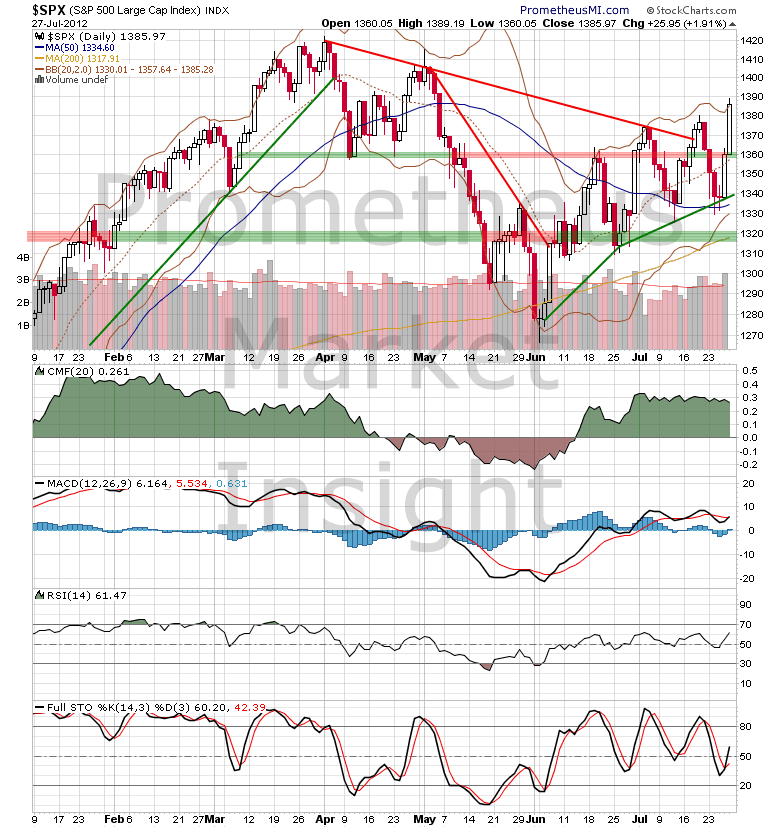

The S&P 500 index closed sharply higher for a second straight session on Friday, spurred by the recurring hope that Europe is on the verge of “solving” its sovereign debt crisis. This hope is, of course, misguided, because it is impossible to solve a solvency problem with additional liquidity. However, hope springs eternal and the rumblings from Europe induced panic buying in the US stock market, continuing the pattern of violent price swings that has characterized market behavior during the oversold reaction from early June. The close at a new short-term high has reconfirmed the uptrend and shifted the lower boundary of the advance to the 1,340 level. Additionally, the short-term breakout has negated the rising wedge breakdown that occurred last week.

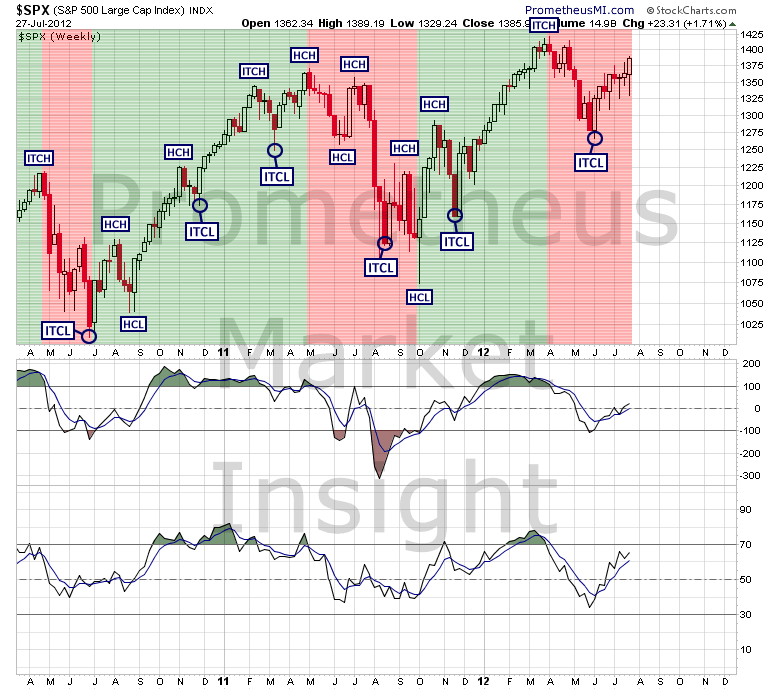

However, the intermediate-term and long-term outlooks are still bearish as the development of a cyclical top remains likely. The initial breakdown of a cyclical bull market is usually followed by a violent, speculative advance of this character and the uptrend from June will almost certainly be followed by an equally violent decline.

Although the imminent development of a recession in the US remains likely, it is unlikely that the Federal Reserve will engage in any form of QE3 until the coincident data trends experience much more deterioration. The Fed has a long history of being well behind the curve and their current growth projections suggest that they are a long way from implementing additional liquidity operations, especially given the historic magnitude of the operations that have already been undertaken during the last four years. In spite of the optimism that continues to be exhibited by the mainstream view, stock market risk remains at a historic extreme, warranting equally extreme caution.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Formation Of Long-Term Top In Stocks Remains Likely

Published 07/30/2012, 12:40 AM

Formation Of Long-Term Top In Stocks Remains Likely

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.