I recently read an article that attempted to dive into the nuances of trading the United States Oil ETF (NYSE:USO) versus the United States Gasoline ETF (NYSE:UGA). I suddenly realized that through all the nuanced comparisons, the forest was being lost for the trees.

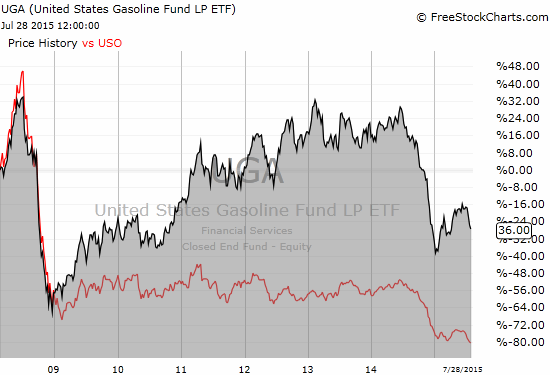

Here's the bottom line: Since at least 2009, UGA has greatly outperformed USO. In fact, the dominance is so great that for longer-term holders UGA is the clear winner.

UGA clearly dominates USO in long-term performance

A pairs trade shorting USO versus going long UGA is an even better long-term strategy and would have delivered positive long-term gains despite the recent plunge in the oil patch. Most of these gains come thanks to the accelerated out-performance of UGA over USO in 2015.

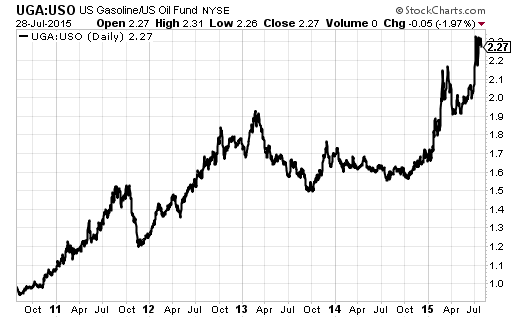

The ratio of UGA versus USO demonstrates the out-performance in even greater clarity.

These charts make me rethink how I approach the oil trade (for example, see “The Commodities Crash Accelerates: Scenarios for Trading Oil“). My only hesitation from jumping on a trade that assumes UGA out-performance over USO is that the UGA/USO ratio has accelerated so much in 2015 that a pullback seems to be very likely just from a technical standpoint. Moreover, USO seems very likely to bounce soon and initiating a short would be much better to do at higher prices from current levels.

Note that I have executed the USO rangebound trade as described in the earlier piece.

Be careful out there!

Full disclosure: long USO call options, short USO call and put options