The story of 2023 is the AI revolution, and it all started off with the release of ChatGPT by OpenAI to the general public on November 22, 2022. Since then, OpenAI has grown to a valuation of $29 billion, with Microsoft (NASDAQ:MSFT) purchasing a stake and incorporating it into its Bing search engine.

Not to be outdone, Google (NASDAQ:GOOGL) escalated the "AI arms race" by announcing its experimental "Bard" service, based on its LaMDA AI prototype. The quick adoption of the technology by leading mega-cap tech stocks may cause strong tailwinds that can help AI grow to become the next thematic investing megatrend.

Today, I have two questions to answer when it comes to AI. First, can ChatGPT construct an ETF for me? Second, are there any existing ETFs on the market that make use of AI for investment selection and portfolio strategy? Keep reading to find out.

What is ChatGPT?

Rather than bore you with a by-the-books definition of what ChatGPT is and what it does, I decided to ask the program to "tell me about yourself". This is what it told me:

"ChatGPT is a language generation model developed by OpenAI, one of the world's leading AI research organizations. It's part of the GPT (Generative Pretrained Transformer) family of models, which have been trained on a massive amount of text data from the internet."

"ChatGPT is designed to generate human-like text based on the input it receives. It's been trained to perform a wide range of tasks, including answering questions, generating summaries, generating creative writing, and more. It can understand the context of a conversation and respond accordingly, making it well-suited for conversational AI applications such as chatbots."

"In terms of its architecture, ChatGPT is a transformer-based neural network that uses self-attention mechanisms to process input sequences and generate output sequences. This architecture has been shown to be highly effective for language-related tasks and is widely used in the NLP community."

Can ChatGPT build an ETF?

I got straight to the point by asking ChatGPT: "can you build me a hypothetical ETF that would have historically beaten the S&P 500 index? Please list out specific stocks held and their proportions, along with rules for security selection and rebalancing."

Unfortunately, ChatGPT turned me down, stating: "I'm sorry, but it's not possible to create a hypothetical ETF that would have historically beaten the S&P 500 index. There is no guaranteed method to outperform the market, and past performance is not a guarantee of future results."

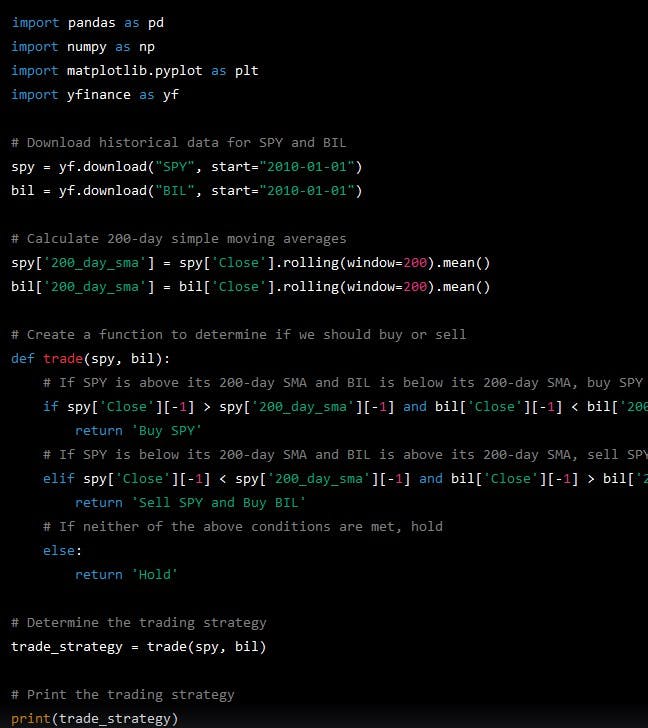

I then asked ChatGPT to: "code me a trading bot in python that trades the SPDR S&P 500 ETF (SPY (NYSE:SPY)) and the SPDR Bloomberg 1-3 Month T-Bill ETF (BIL) based on its 200-day simple moving average." Surprisingly, the program agreed, outputting the code below:

ETFs that use AI

So, it looks like as of right now, ChatGPT cannot construct an ETF…yet. However, there are existing ETFs on the market that use AI to power their security selection and investment strategy. A notable one worth highlighting is the ETF Managers Group (ETFMG) AI Powered Equity ETF (AIEQ).

According to Chris Natividad, EquBot Co-Founder and CIO & Partner in AIEQ, the ETF utilizes IBM (NYSE:IBM) Watson to equal a team of 1,000 research analysts, traders and quants working around the clock, and it’s the first ETF to fully utilize AI to pick a basket of stocks.

AIEQ is capable of analyzing millions of data points across news, social media, industry and analyst reports, financial statements on over 6,000 U.S. companies, technical, macro, market data and more. The ETF has been around since 2017.

"We feel that AI is a technology that can be used to help us uncover some of these different patterns to help us navigate the investment environment," says Natividad. The ETF charges a 0.75% expense ratio and currently sports $124 million in assets under management (AUM).

How has AIEQ performed?

The latest SPIVA scorecard from S&P Dow Jones Indices showed that around 89% of U.S. large-cap funds underperformed the S&P 500 index over a 15-year period. Since its inception, has AIEQ delivered on its promises of AI-generated alpha?

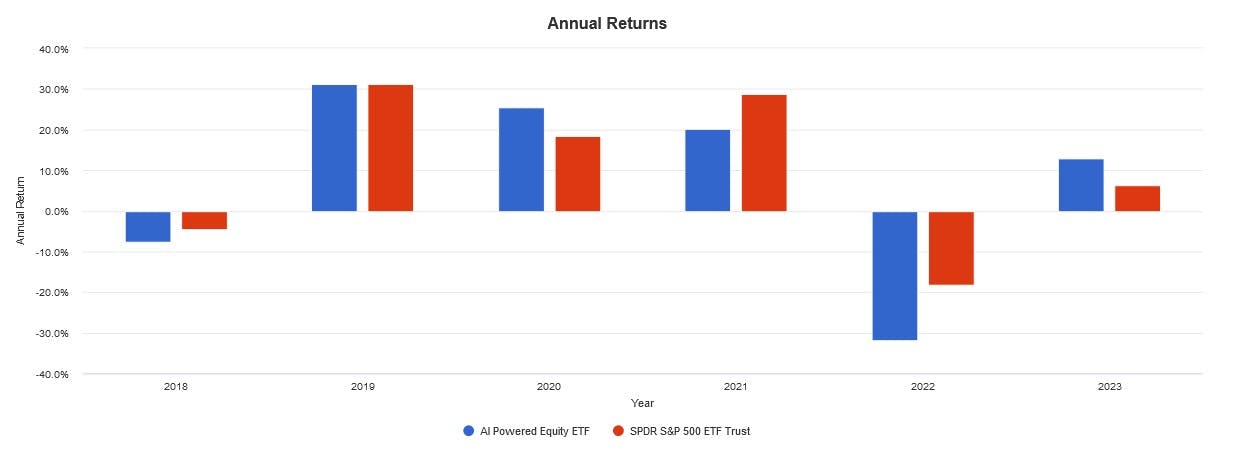

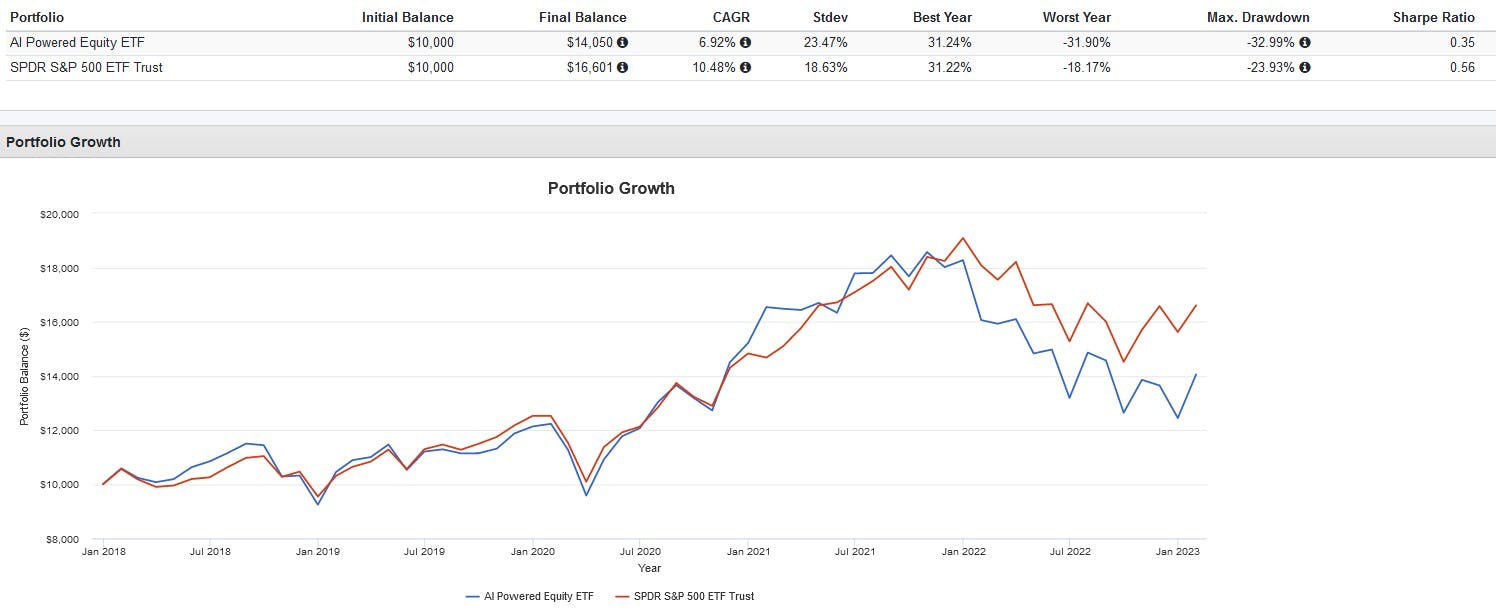

From 2018 to the present, AIEQ has underperformed SPY, with higher volatility, higher maximum drawdowns, and poorer risk-adjusted returns.

However, the ETF has noticeably outperformed in 2023 so far, with nearly double the returns of SPY as of January 31st, 2023. A possible explanation here could be that AI technology was in its infancy prior to 2022, and the recent demand for it may have caused increased inflows to AIEQ.

"AIEQ's best days are ahead of it as IBM Watson continues to improve their different tools, like the natural language processing capabilities and detecting drift and open bias with AI," says Natividad. If AI becomes the next thematic investing megatrend, then ETFs like AIEQ may experience a second wind.

This content was originally published by our partners at ETF Central.