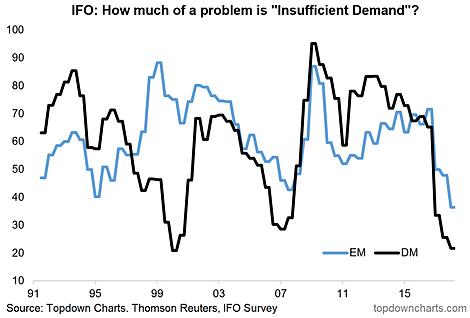

A short time ago people were writing thought pieces on the "demand deficient" environment, and other buzzwords like "secular stagnation," but as time has passed, structural challenges seem more like cyclical trivia. Just take a look at today's chart and you'll see the stark shift in the global economy that has taken place.

The Chart comes from a recent edition of the Weekly Macro Themes report where I talked about the state of the economic cycle, policymaker hubris, transitory deflation, and volatility suppression.

The chart shows the IFO World Economic Survey responses to how much of a problem is 'insufficient demand.'

To be clear, if the survey reading were to be at 100 that would mean all survey respondents cited lack of demand as a problem. So in other words, right now, lack of demand is close to a non-issue. Said differently, things look pretty darn good in the global economy right now.

And it's both emerging markets and developed economies which are seeing a clear shift away from the demand deficient environment.

The glass half full view, of course, is that this is a good sign, and earnings will only improve from here and risk sentiment will be biased to the bullish side. Also, inflation will probably improve too, and wages will likely tick up.

The glass half empty view is probably that the last time we got to these levels was at the peak of the dot com boom and just prior to the financial crisis. That's because basically it's a sign that the global economy is well progressed through the economic cycle.

If demand deficiency is not a problem, then it stands to reason that growth must be decent and inflation is a logical follow on. This means higher bond yields and tighter monetary policy. Which is basically my base case for the outlook from here. At some point, though, higher yields and tighter policy will end the business cycle - as they have done so with regularity across the decades. Until then, the music is still playing.