Trends don’t last so long any more. The action last week was risk aversion and the recovery of the “safe haven” currencies, but that all turned around yesterday and the dollar generally recovered. The big winner as risk appetite came back was the AUD, which was the biggest loser last week. Behind the rise was a fairly steady recovery in the Tokyo stock market Monday and this morning; the index is currently up around 2% from Monday’s opening levels. Higher Tokyo stocks mean higher USD/JPY means risk on.

The Tokyo stock market has become much more volatile recently, which is affecting all markets around the world. I think the Japanese authorities will have no choice but to come to grips with their problems there and deal with them. They are in this too deep to back out. Having committed to large-scale quantitative easing, higher inflation and fiscal stimulus, they have to make it work, otherwise their increased debt and higher interest rates will bankrupt the government. So I expect they will do whatever is necessary (the mantra of central banks nowadays, perhaps?) and that should support stocks and push USD/JPY higher over the next several months. The alternative is too grim to think about.

This morning we have French consumer confidence, which is expected to rise by 1 point in May to 85, but that would just be random motion in the same range it’s been in for some time. In the US, the Case/Shiller house price index for March is expected to be up 10.2% yoy, an acceleration from +9.3% in February. Later in the day the Richmond and Dallas Feds manufacturing indices are scheduled to be released. Both are expected to show some improvement, although the Empire State and Phili Fed indices earlier this month disappointed the market so we may be in for a disappointment here too.

That could push EUR/USD a little higher. On the other hand, the Conference Board’s index of US consumer confidence for May is forecast to have risen to and the U of Michigan consumer confidence index rose more than expected, boosting the dollar, so this could counter some of the possible impact.

The Market

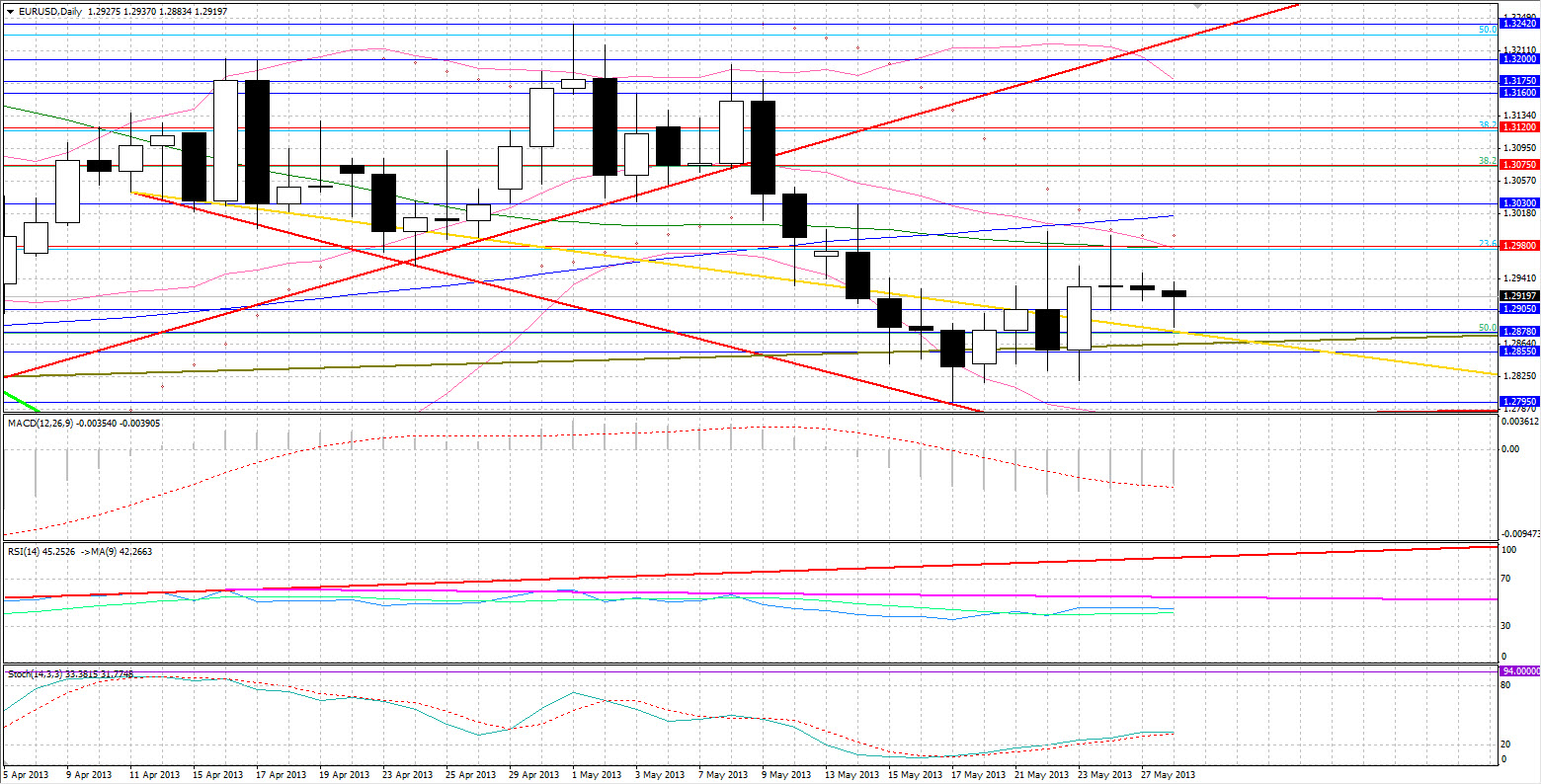

EUR/USD

EUR/USD" title="EUR/USD" width="1560" height="794">

EUR/USD" title="EUR/USD" width="1560" height="794">

• EUR/USD had a very quiet day yesterday, ending marginally lower. It declined further overnight with the 1.2880 support being tested and holding. This is an area of interest where there are previous lows, falling trendline support and a 50% retracement level. The 1.2780 November rising trendline support remains the next support. Resistance levels remain the 1.2980 followed by the stronger 1.3075.

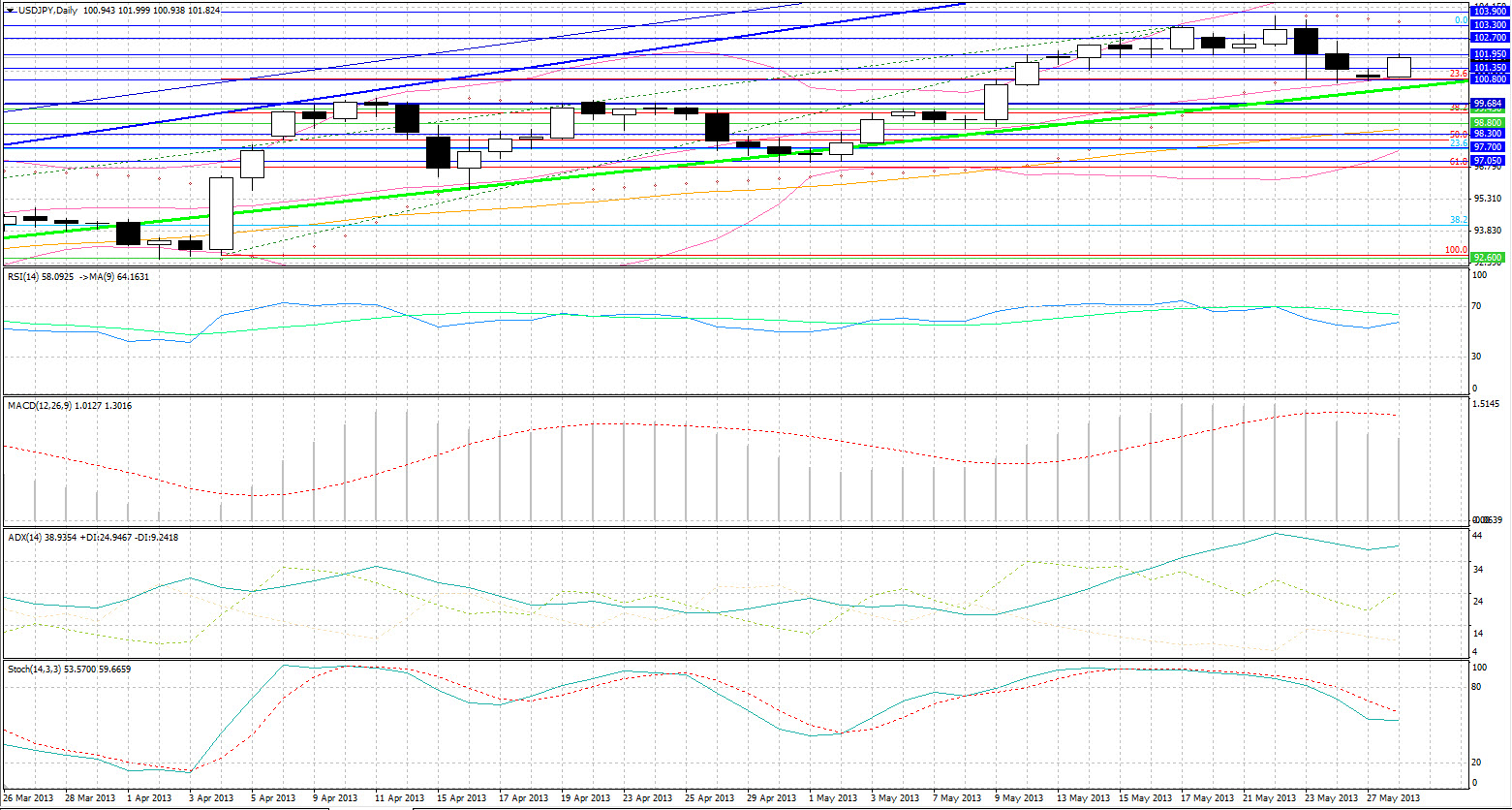

USD/JPY  USD/JPY" title="USD/JPY" width="1561" height="836">

USD/JPY" title="USD/JPY" width="1561" height="836">

• USD/JPY spent the whole day yesterday testing the 100.80 support, but was unable to break it. We saw a bounce this morning with the pair moving higher and testing the 102.00 resistance. The next resistance is the 102.70 level followed by103.30 . Should we see another down move today, 100.80 support is the first level to be tested with a breakout leading towards 99.90, a previous support.

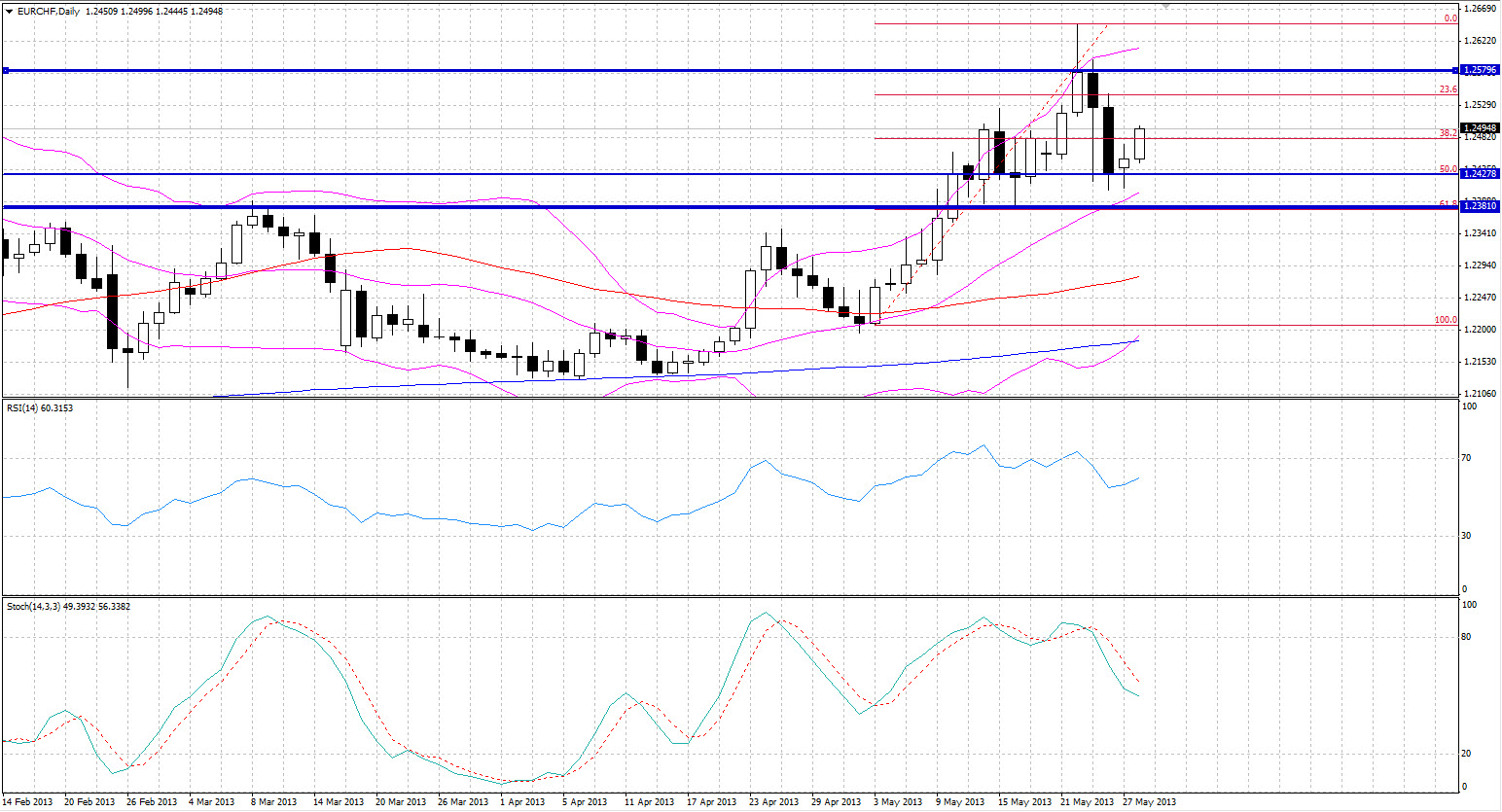

EUR/CHF  EUR/CHF" title="EUR/CHF" width="1544" height="835">

EUR/CHF" title="EUR/CHF" width="1544" height="835">

• EUR/CHF moved higher yesterday and continued to do so overnight after bouncing higher from the 1.2430 support level. This level is its 50% retracement level from a two week up move and also a previous low. The pair maintains in an uptrend and this morning is breaking 1.2480, its 38.2% retracement level. It appears to be on its way towards 1.2580. Support is the 1.2430 level followed by 1.2380.

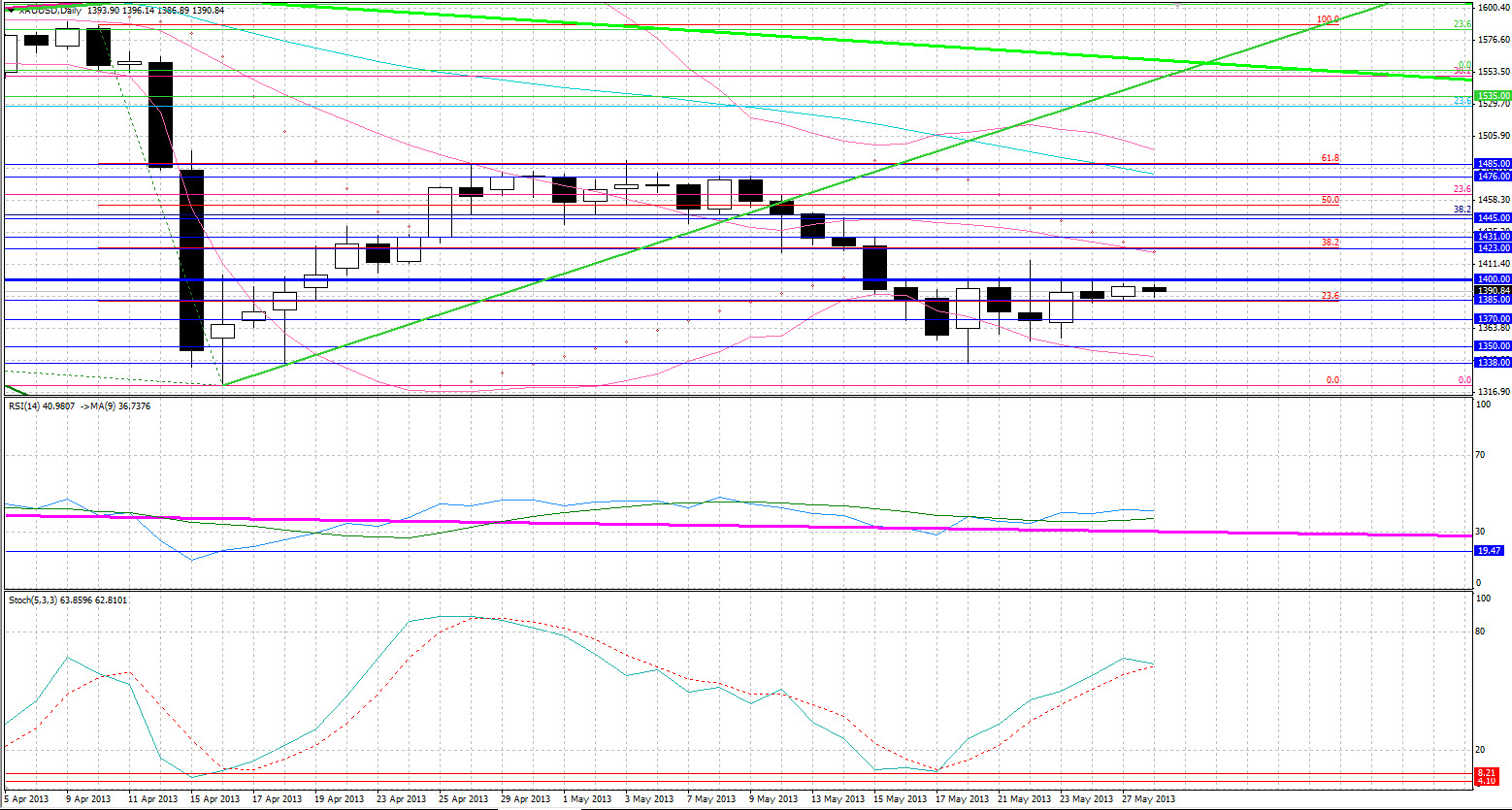

Gold

• Gold continued its consolidation for another day, trading in the tight range of $1383-1400. Resistance levels remain the $1400 area. A breakout of that would probably see gold test the$1430 level and $1445 in succession. Current support is the $1383 level .Further support remains at $1350 -$1340 area followed by $1320.

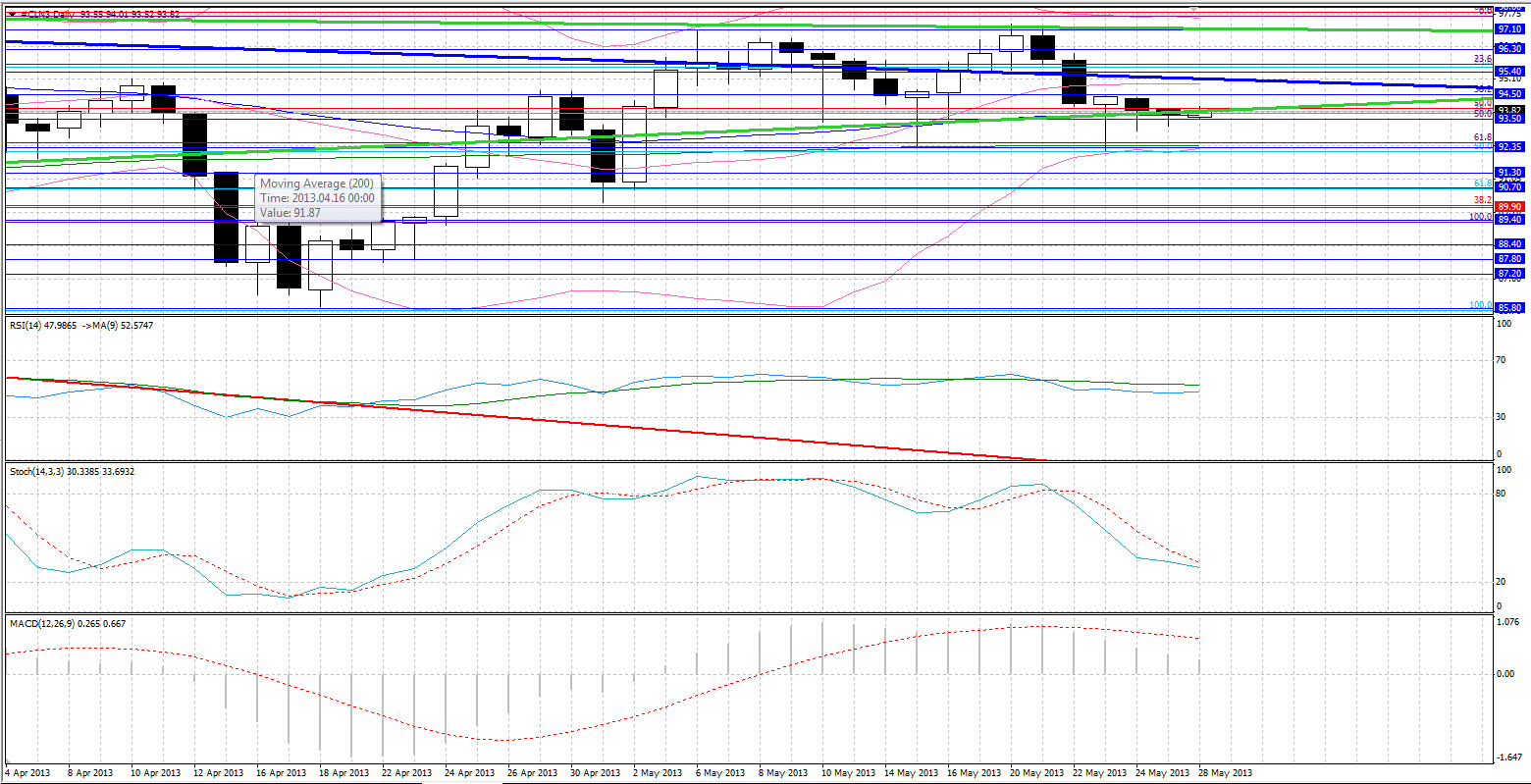

Oil

• WTI moved around the same levels as Friday with no significant changes. For another session the $93.50 support level held strong and we saw a small overnight rise in the price of oil. The key levels for oil remain unchanged with supports coming at $93.50 and $92.20 in succession while resistance is at $94.50 level followed by $95.00.

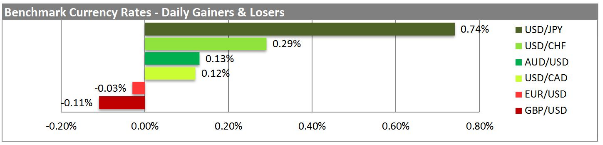

BENCHMARK CURRENCY RATES - DAILY GAINERS AND LOSERS

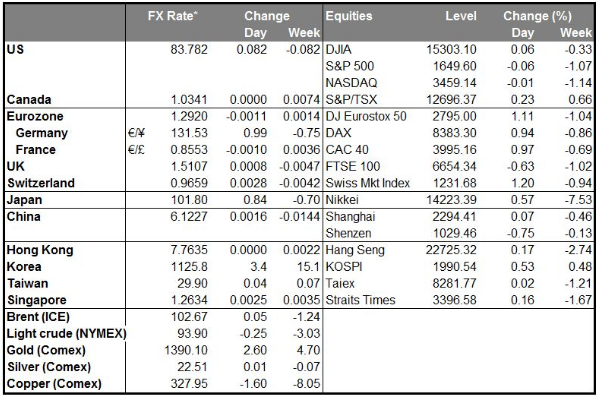

MARKETS SUMMARY

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Forex Trends: The Last Shall Be First

Published 05/28/2013, 05:57 AM

Updated 07/09/2023, 06:31 AM

Forex Trends: The Last Shall Be First

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.