Although today’s data showed that Swiss retail sales dropped 3.9% in Jun and the SVME PMI declined in Jul more than analysts’ forecasts, USD/CHF extended losses earlier today. How low could the exchange rate go in the coming days?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: none

- GBP/USD: short (a stop-loss at 1.3579; initial downside target at 1.2519)

- USD/JPY: none

- USD/CAD: none

- USD/CHF: short (a stop loss at 0.9590; next downside target at 0.9590)

- AUD/USD: none

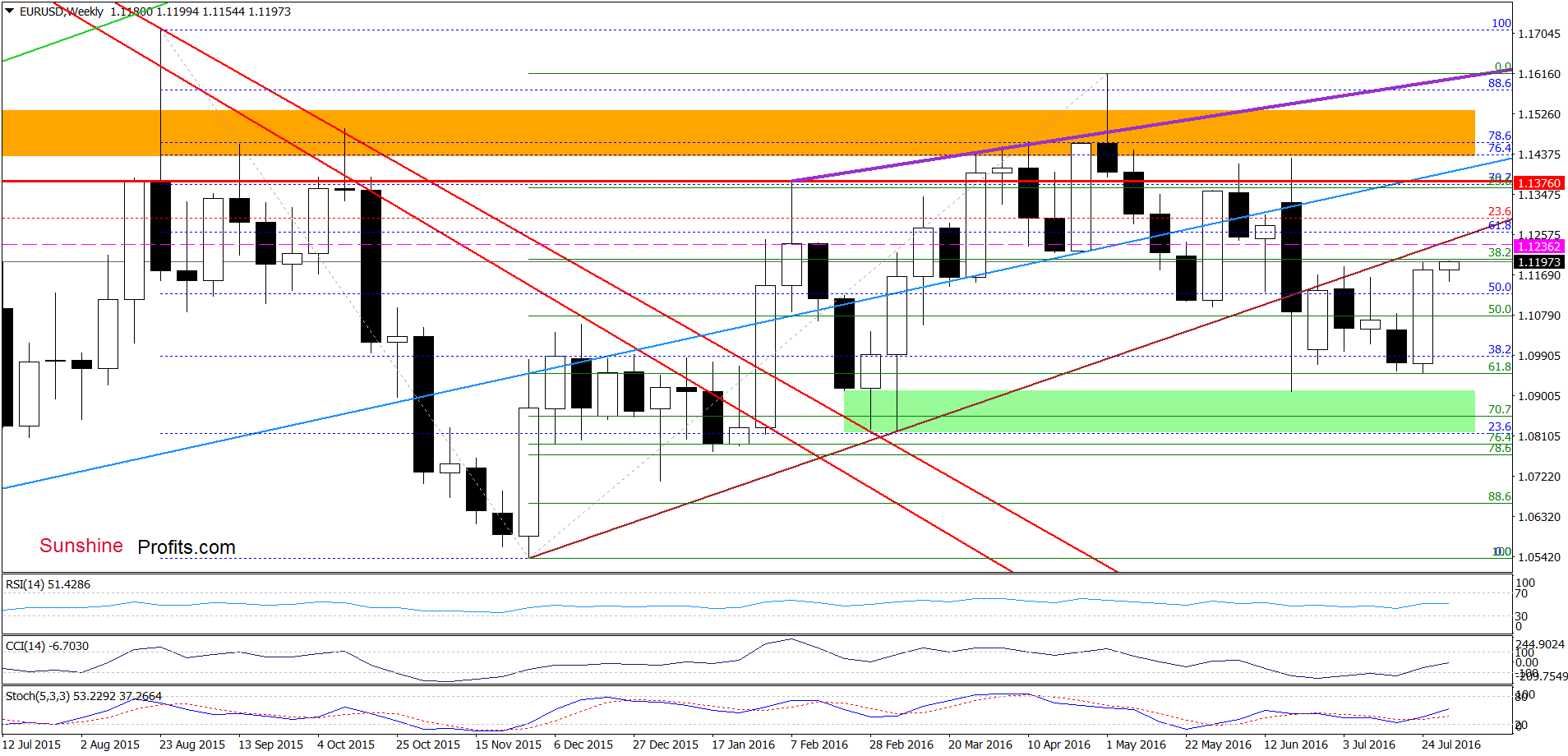

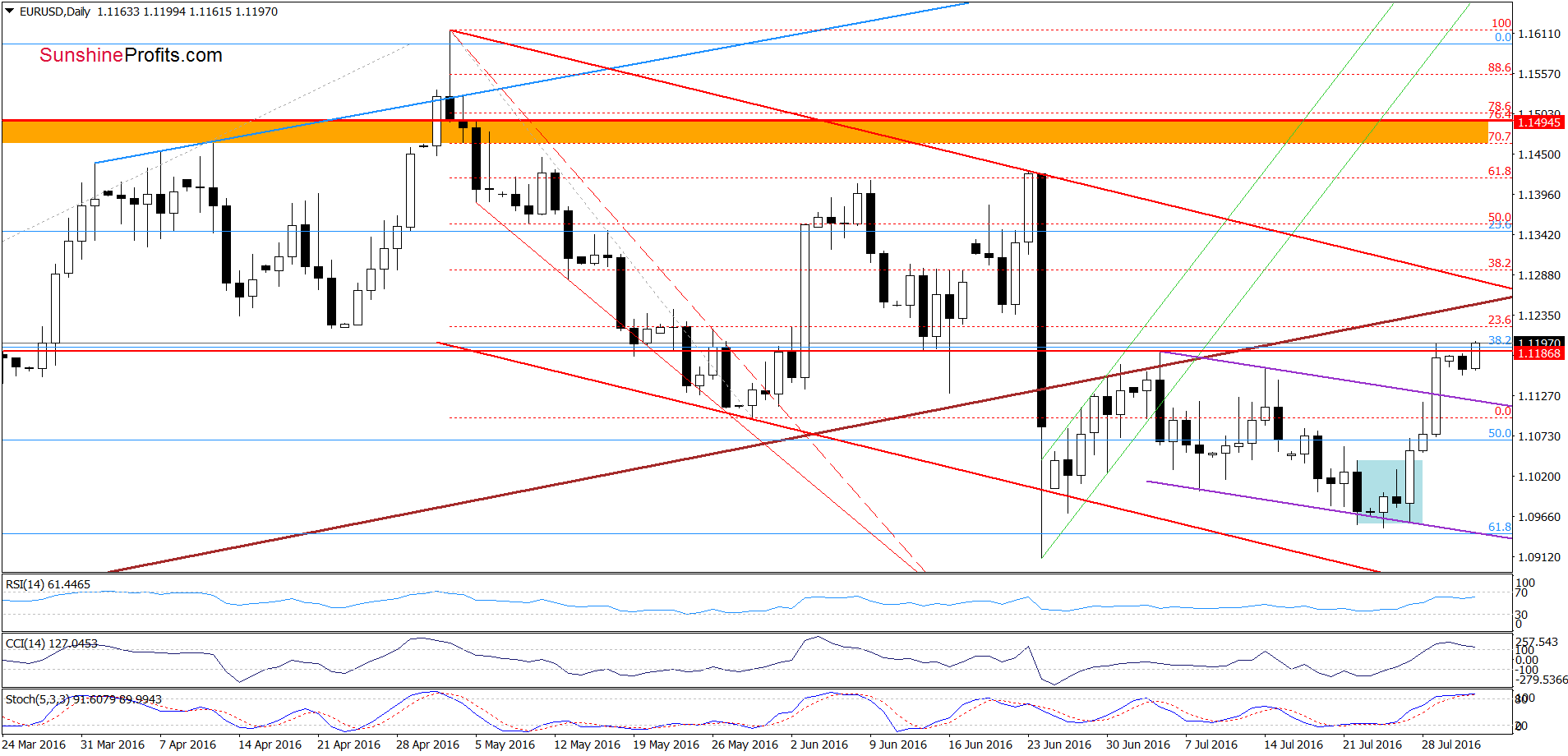

EUR/USD

Looking at the above charts, we see that EUR/USD increased above the Friday’s high, which means that what we wrote yesterday is up-to-date:

(…) there are no sell signals on the daily chart (while buy signals generated by the weekly indicators remain in place), which suggests that we may see another attempt to move higher and a test of our Friday’s target - the previously-broken medium-term brown line.

Very short-term outlook: bullish

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

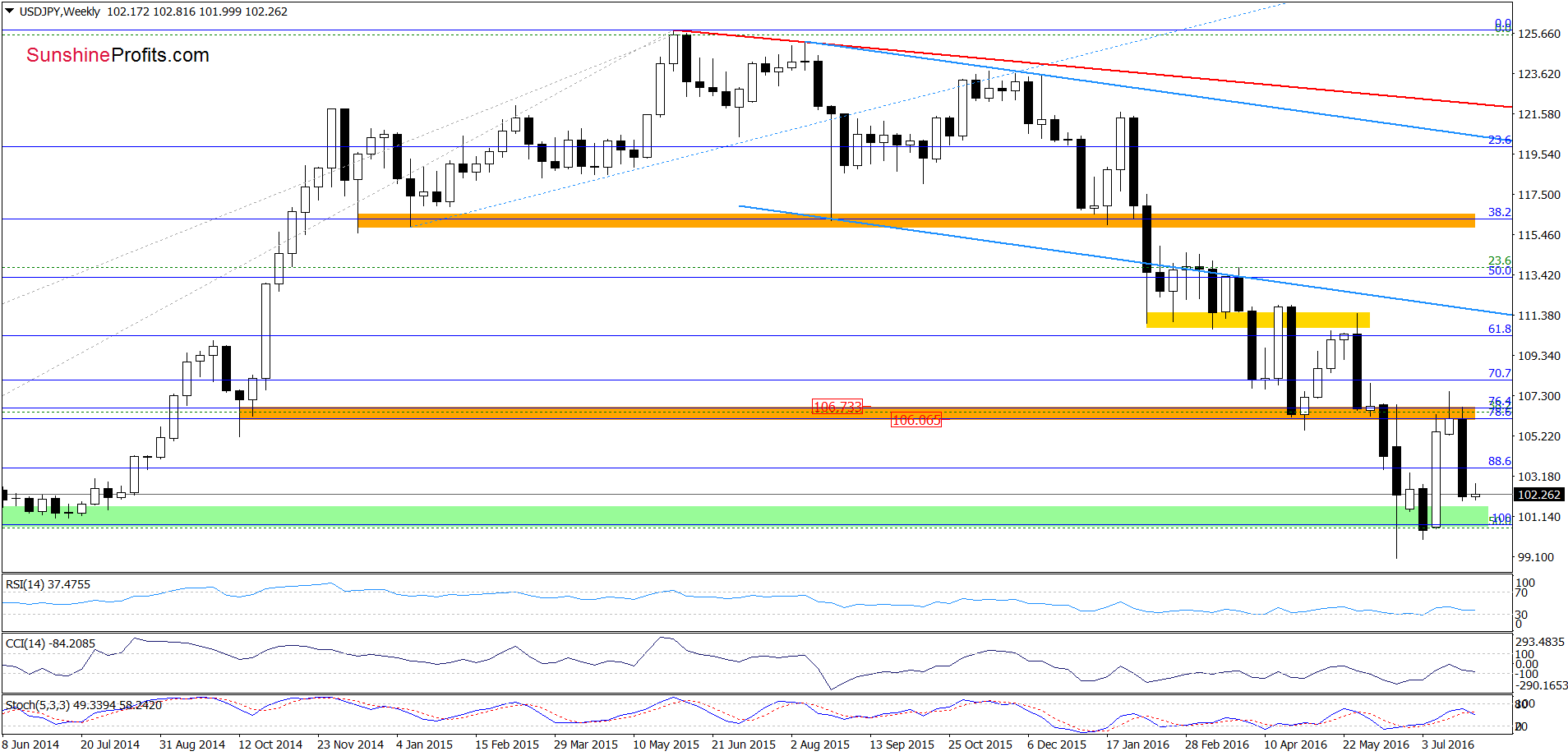

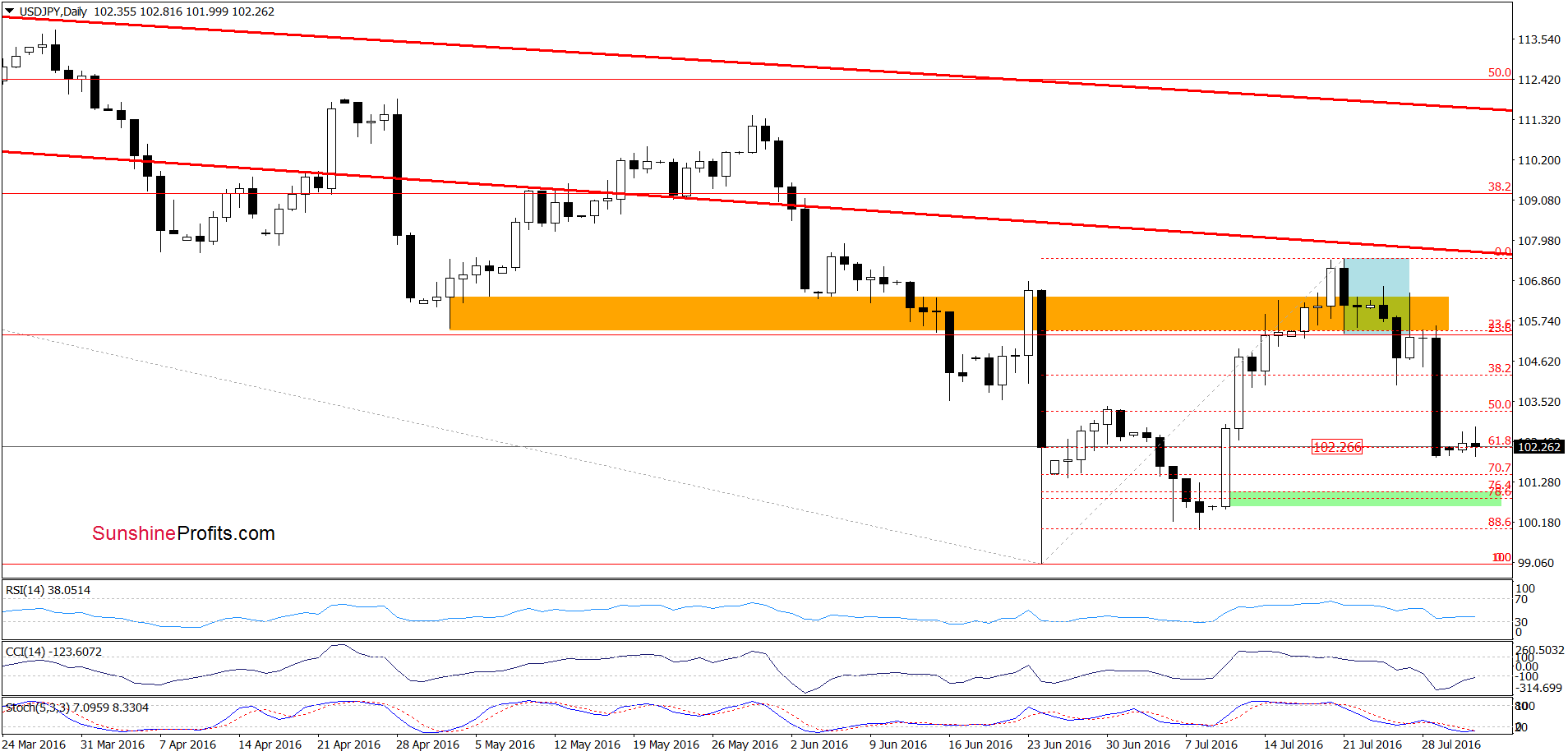

USD/JPY

On the daily chart, we see that USD/JPY is consolidating around the 61.8% Fibonacci retracement. However, a sell signal generated by the weekly Stochastic Oscillator suggests that our previous commentary on this currency pair is still valid:

(…) What’s next? The current position of the daily indicators (which are oversold) suggests that reversal and higher values of the exchange rate are just around the corner. Nevertheless, as long as there won’t be buy signals another downswing is likely – especially when we factor in a sell signal generated by the weekly Stochastic Oscillator. If this is the case, and we’ll see such price action, the next downside target would be the green support area created by the 76.8% and 78.6% Fibonacci retracement levels (around 100.84-101.02).

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/CHF

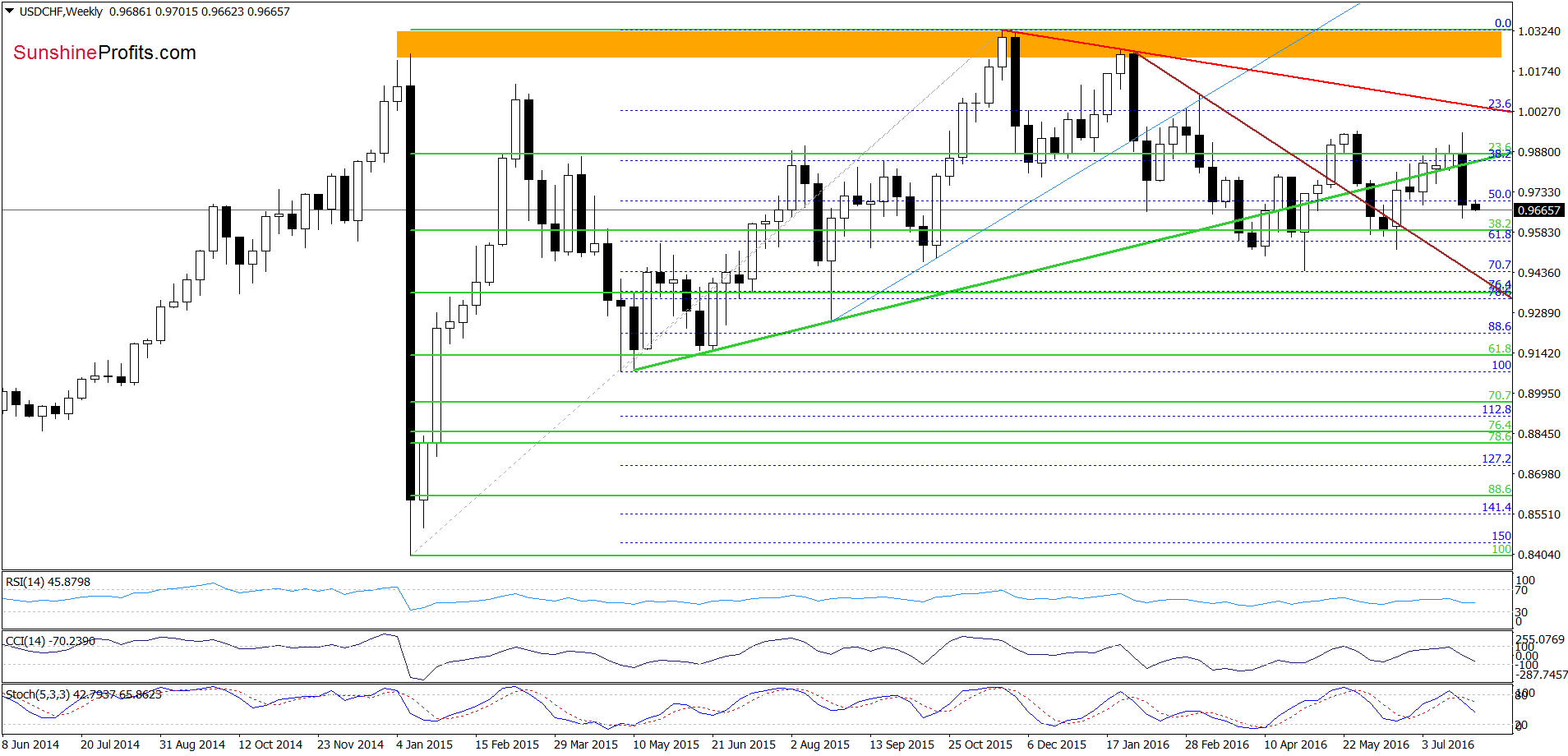

From the medium-term perspective, we see that invalidation of the breakout above the previously-broken rising green line and its negative impact on the exchange rate is still in effect. Additionally, sell signals generated by the indicators support further deterioration in the coming week.

Having said the above, let’s check what we can infer from the daily chart.

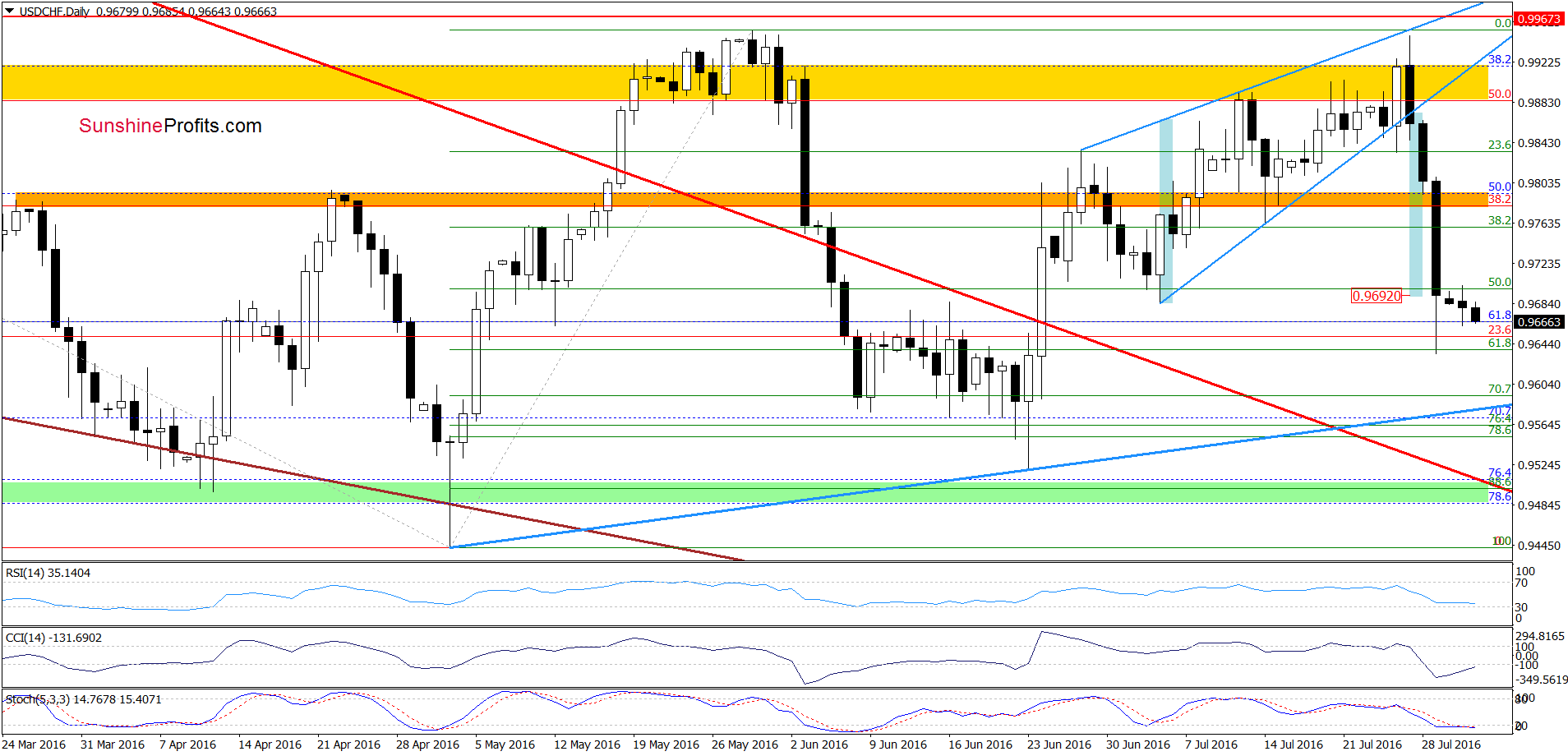

Looking at the daily chart, we see that USD/CHF moved slightly lower once again. Additionally, there are no buy signals, which could encourage currency bulls to act, which means that yesterday’s assumptions are up-to-date:

(…) as long as there won’t be buy signals generated by the indicators, another attempt to move lower is likely – especially when we factor in the medium-term picture. If this is the case and the pair moves lower once again, the next downside target would be around 0.9580, where the blue rising support line (based on the May and Jun lows) currently is.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: bearish

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop loss order at 0.9967 and next downside target at 0.9590) are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.