Earlier today, the USD Index extended losses, which pushed USD/CHF to the lower border of the consolidation. Will it withstand the selling pressure in the coming days?

In our opinion the following forex trading positions are justified - summary:

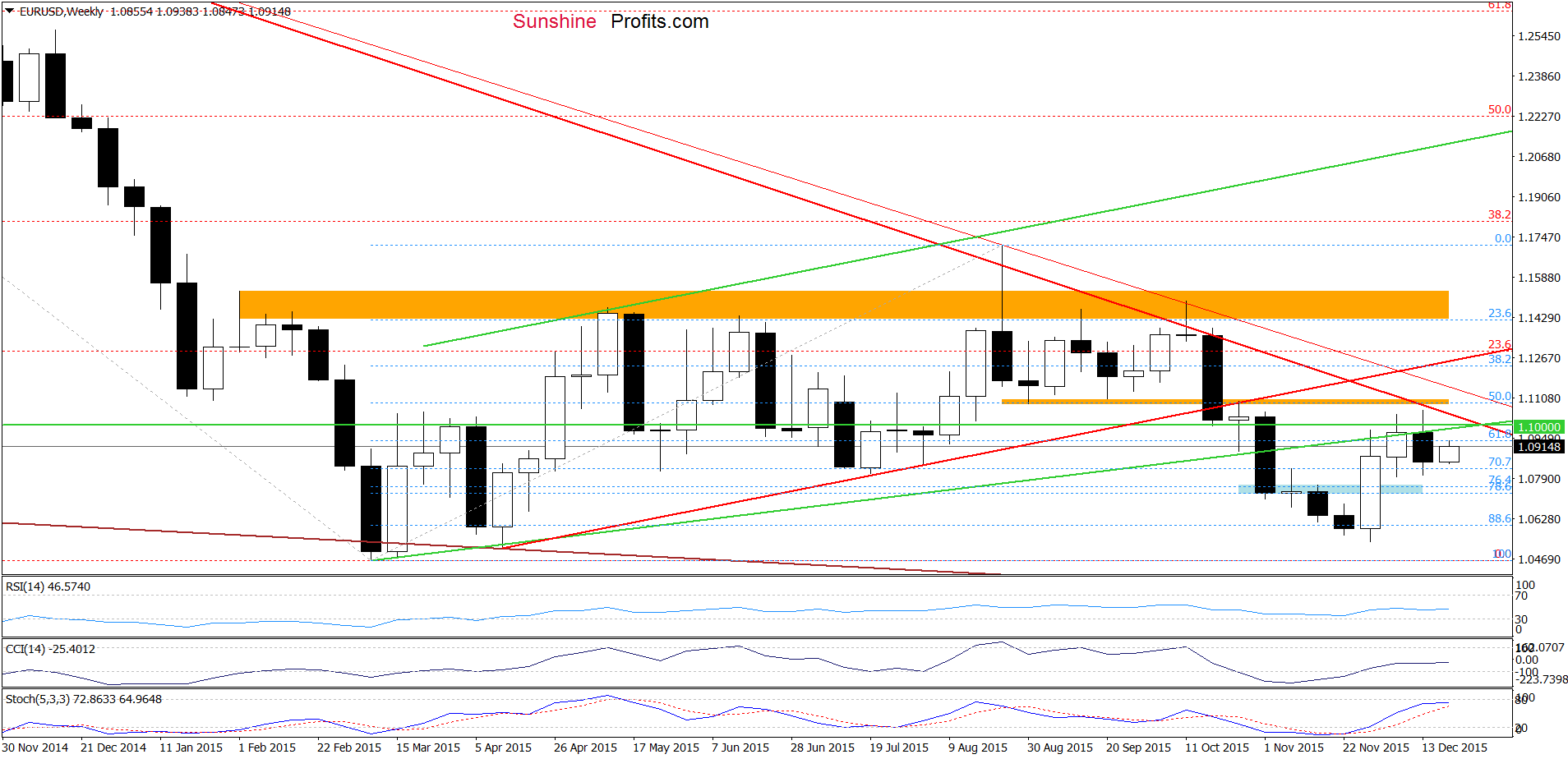

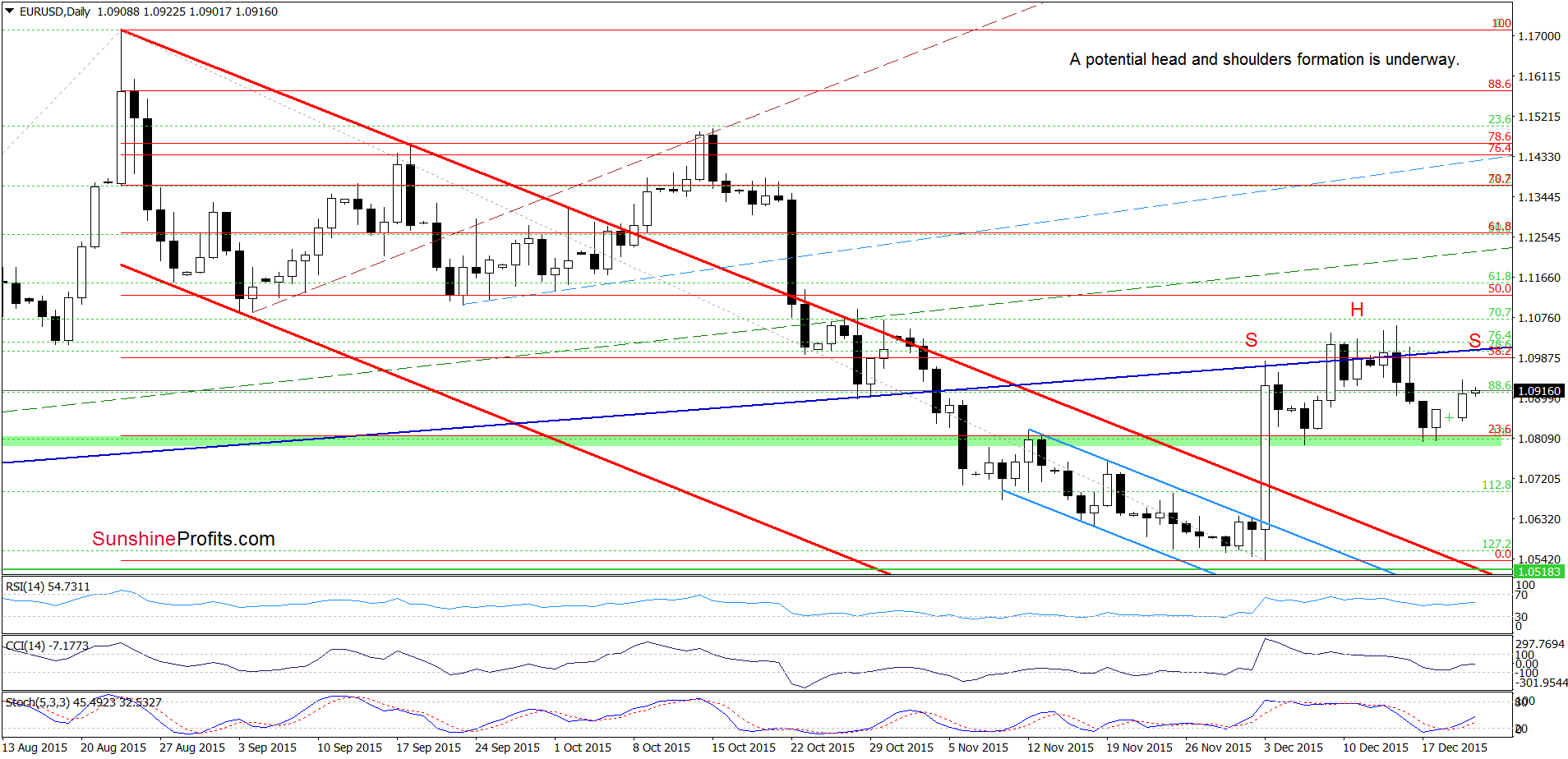

EUR/USD

Looking at the charts, we see that EUR/USD extended gains, which means that what we wrote yesterday is up-to-date:

(…) Taking into account the fact that the green area continues to keep gains in check and combining it with the current position of the indicators (the CCI and Stochastic Oscillator are very close to generating buy signals), we think that further improvement is just around the corner. If we see such price action, the initial upside target would be around 1.1000, where the 38.2% Fibonacci retracement and the navy blue resistance line are. Please note that in this case, we may see a head and shoulders formation in the coming days (an upward move from current levels would be a potential right shoulder of the pattern).

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. However, if the pair drops under the green support zone we’ll consider re-opening short positions. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

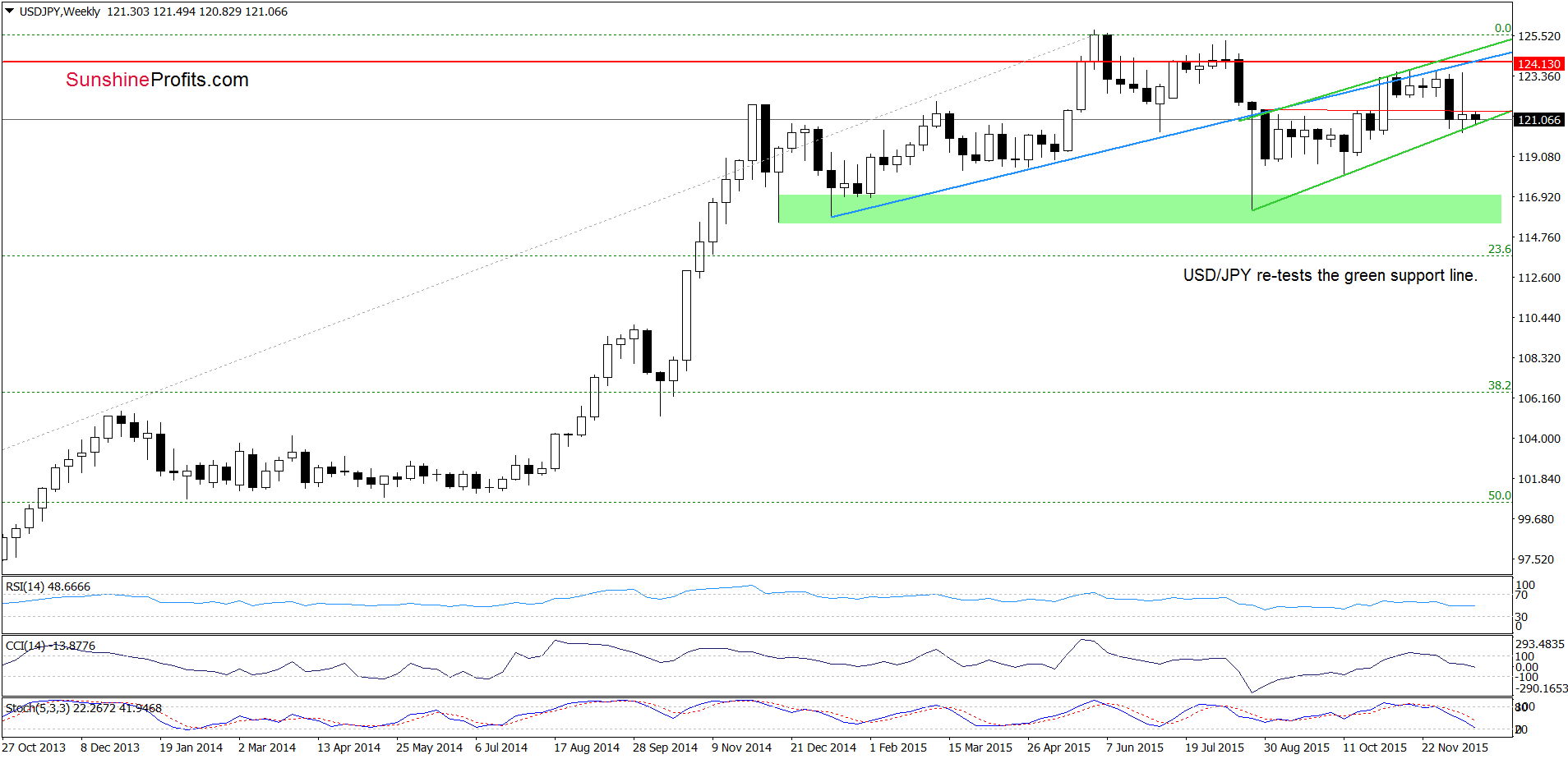

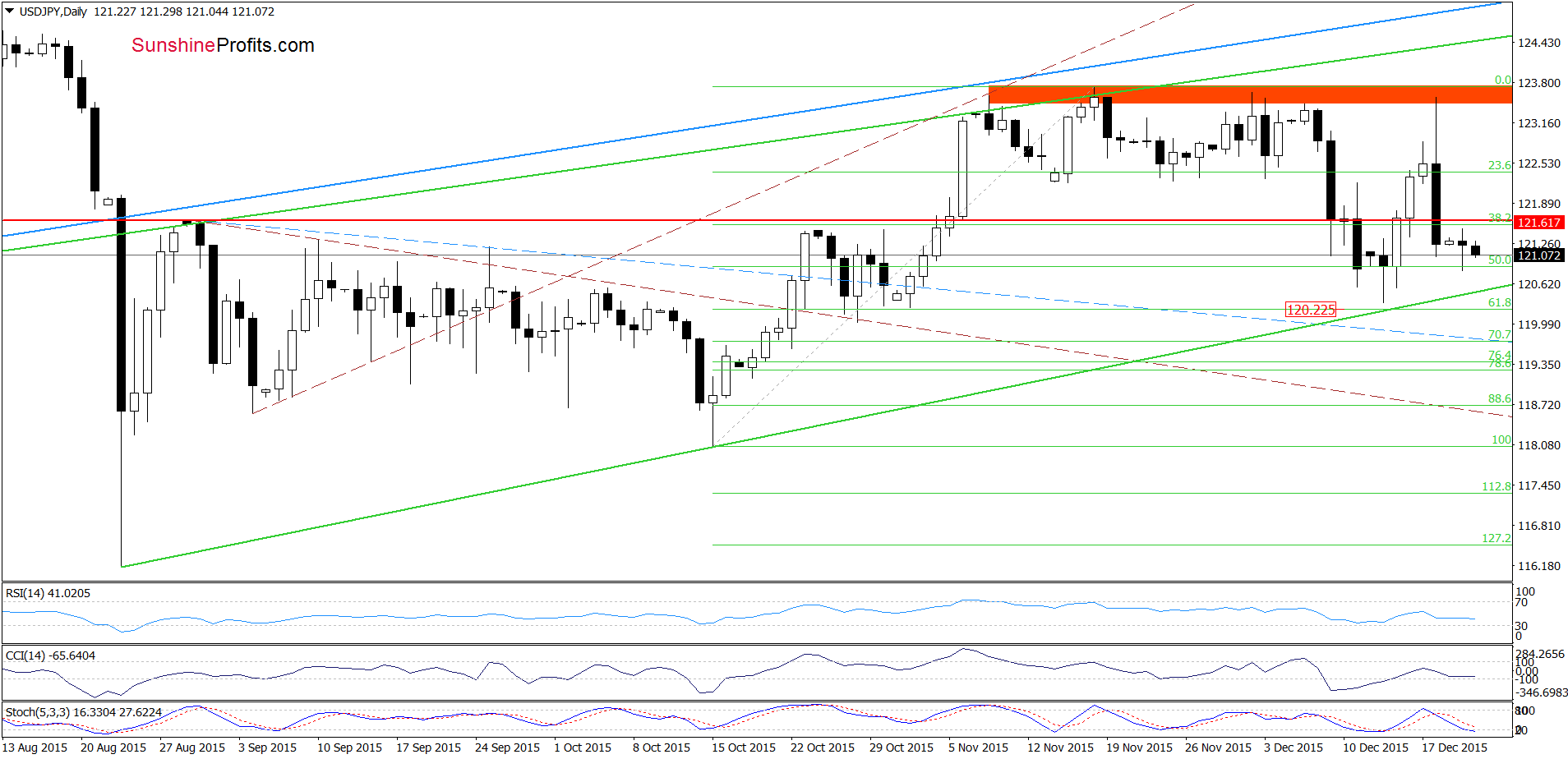

USD/JPY

From today’s point of view, we see that USD/JPY moved lower earlier this week, which suggests that currency bears will try to push the pair to our downside target posted in Friday’s alert:

(…) the exchange rate invalidated earlier breakout above (…) the red horizontal line, which suggests a test of the medium-term support line in the coming day(s). At this point, it is worth noting that the current position of the indicators suggests further deterioration (…)

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/CHF

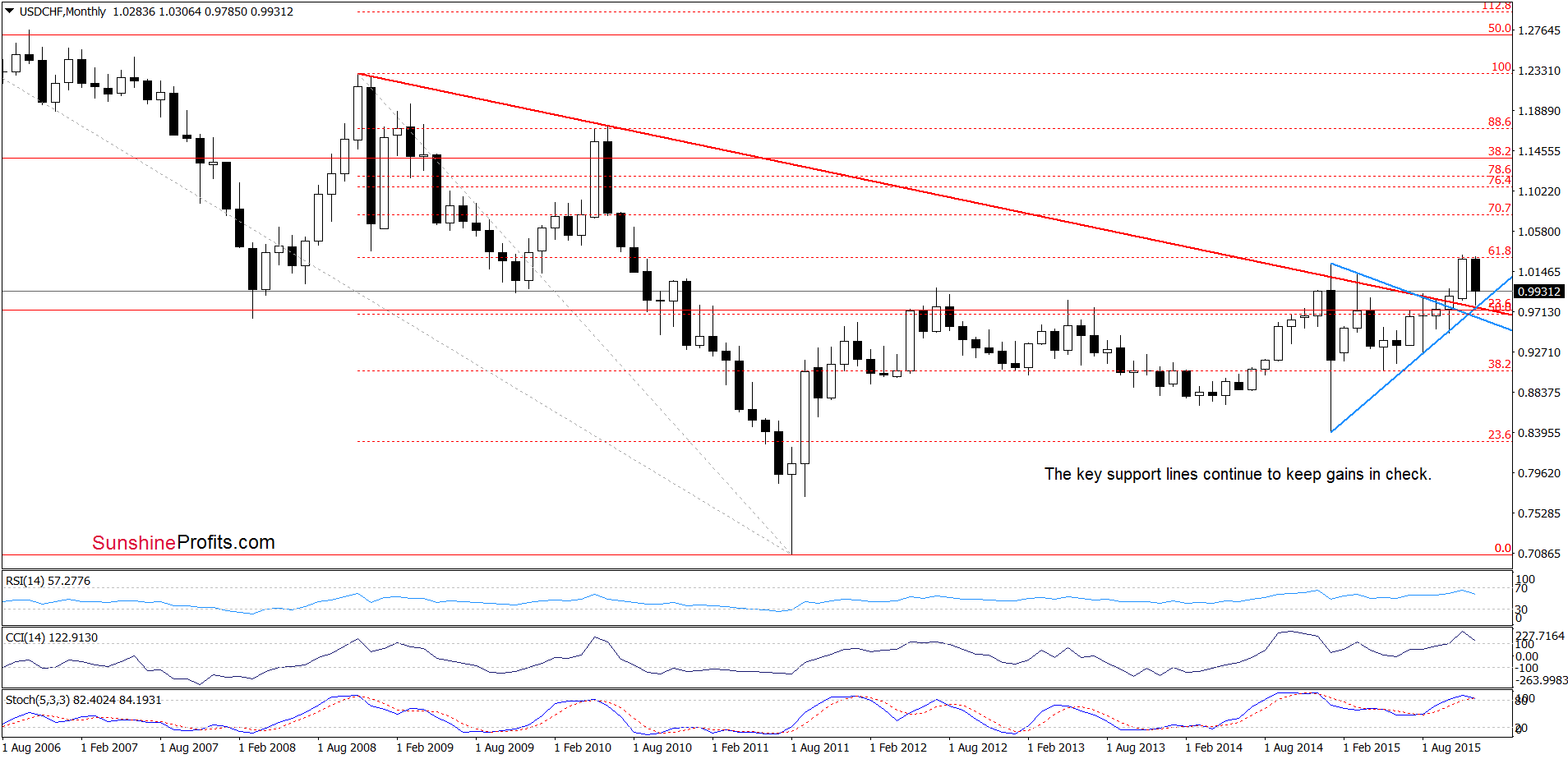

On the above chart, we see that the proximity to the previously-broken long-term red declining line and the blue support line based on the previous lows triggered a rebound.

What impact did it have on the daily chart? Let’s check.

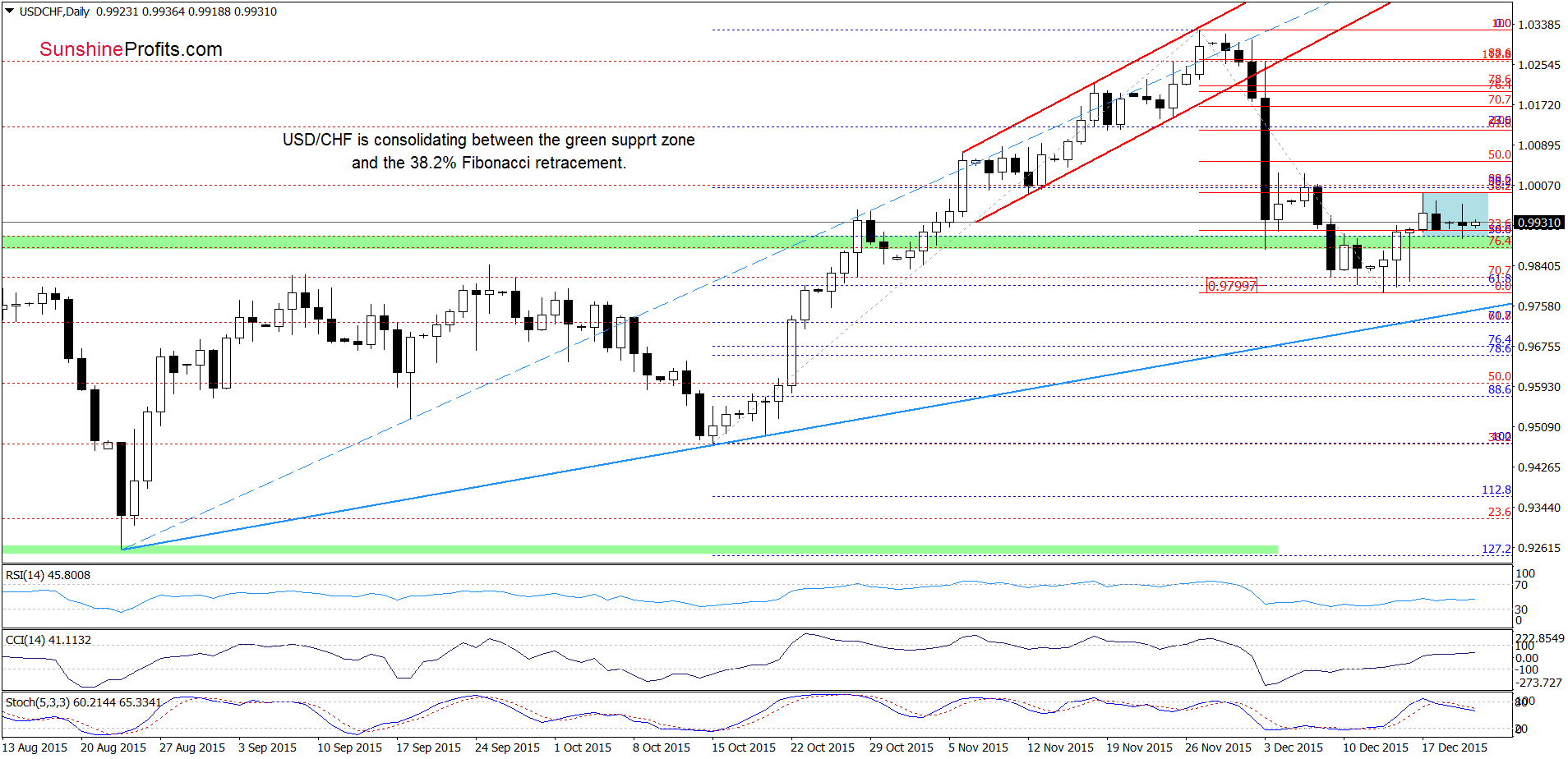

As you see on the daily chart, USD/CHF is consolidating between the green support zone and the 38.2% Fibonacci retracement. Taking this fact into account, and combining it with a sell signal generated by the Stochastic Oscillator, we believe that what we wrote on Friday is still valid:

(…) currency bulls pushed the pair higher (in line with our forecast), which resulted in an increase to the 38.2% Fibonacci retracement based on the entire Nov-Dec decline. At this point, it is worth noting that we saw similar price action in the previous week. Back then, unsuccessful attempt to move higher resulted in a drop to fresh Dec low. Therefore, if currency bulls do not manage to break higher, we’ll likely see another downswing in the coming week – especially if the Stochastic Oscillator generates a sell signal.

Finishing today’s commentary on this currency pair, please note that if currency bears push the pair under the green zone, the initial downside target would be around 0.9800, where the recent lows are.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.