EUR/USD – Favorable Cross Precedes Kumo Break

A few weeks ago we talked about the EUR/USD and the Chikou Span making a favorable cross. Once the Chikou had cleared the price line and completed the favorable cross, the last remaining ingredient for a long signal was the Kumo Break which occurred three days ago. Many of our Ichimoku traders got in on this break well over 200pips ago and profited quite nicely from it. Now price has run into resistance just shy of 1.3500 forming an inside bar from yesterday’s selling. EUR/USD" title="EUR/USD" width="800" height="571" />

EUR/USD" title="EUR/USD" width="800" height="571" />With the tenkan flat at the moment, this is likely from the inside bar forming a two day trading range so intraday traders are probably parked on either side of the two bar range, thus watch for a break on either side for further clues, but with the Kijun about to break the Kumo, price could consolidate and rotate lower but the ichimoku is pointing to it being well supported around the 1.3200 levels. Price does not seem overextended at the moment but has its work cut out for it as the Chikou is still in the kumo but as long as price stays above 1.3200, we will expect the next major swing to be to the upside targeting just shy of 1.3800.

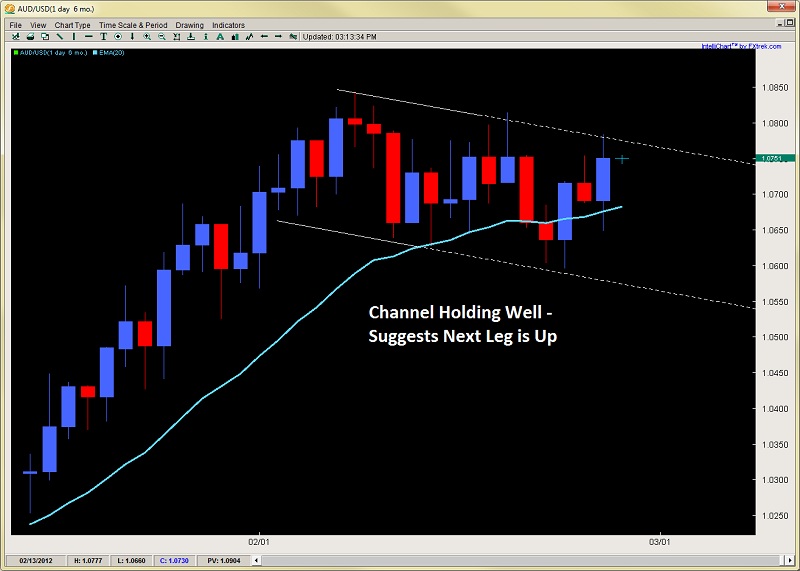

AUD/USD – Channel is Holding

For most of the month of February, the Aussie has been holding in the channel outlined below which has offered some good price action range plays on both sides of the channel but the overall structure suggests the next leg is up. AUD/USD - 1" title="AUD/USD " width="800" height="571" />Price is now sitting at the top of the channel which has formed a bearish pinbar on the 4hr chart so bears can look to take a short near the channel top with tight stops below while targeting the 20ema in the middle of the range for a first target and the 1.0600 level for a larger target offering a possible 2.5:1 reward to risk ratio.

AUD/USD - 1" title="AUD/USD " width="800" height="571" />Price is now sitting at the top of the channel which has formed a bearish pinbar on the 4hr chart so bears can look to take a short near the channel top with tight stops below while targeting the 20ema in the middle of the range for a first target and the 1.0600 level for a larger target offering a possible 2.5:1 reward to risk ratio. AUD/USD - 2" title="Chart - 3" width="800" height="571" />

AUD/USD - 2" title="Chart - 3" width="800" height="571" />Bulls on the other hand should wait for a breakout-retest of the channel high before taking any new longs, or else wait for a pullback in the lower end of the channel.