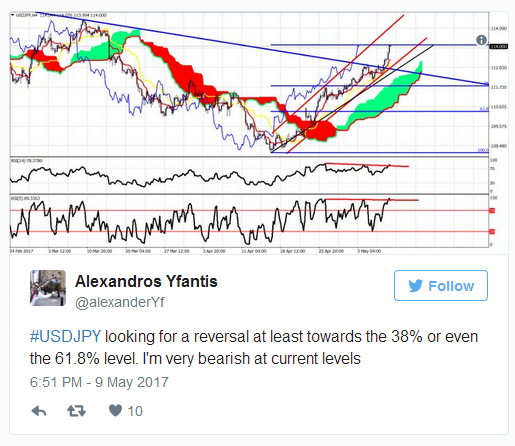

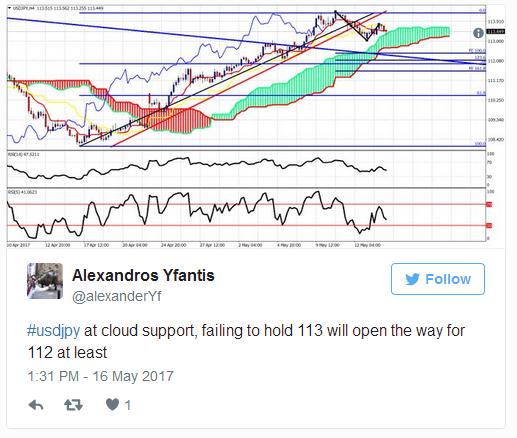

Good day to all, last week I called the turn in the USD/JPY was imminent as I was fully bearish above 114.

Also calling major support at 113 that if broken could push at least towards 112….

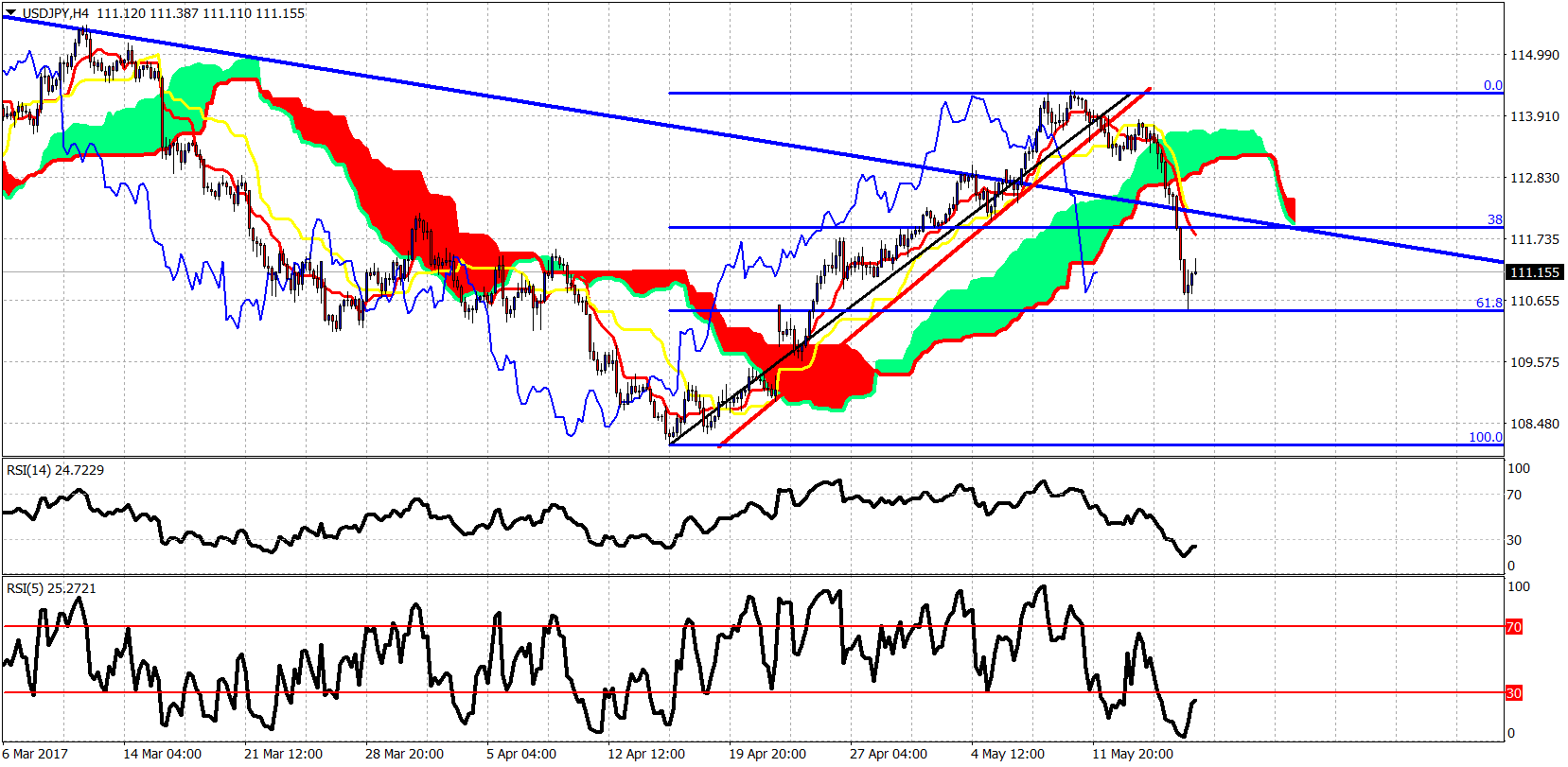

Price has reached the important 61.8% Fibonacci retracement of the entire rise from 108.

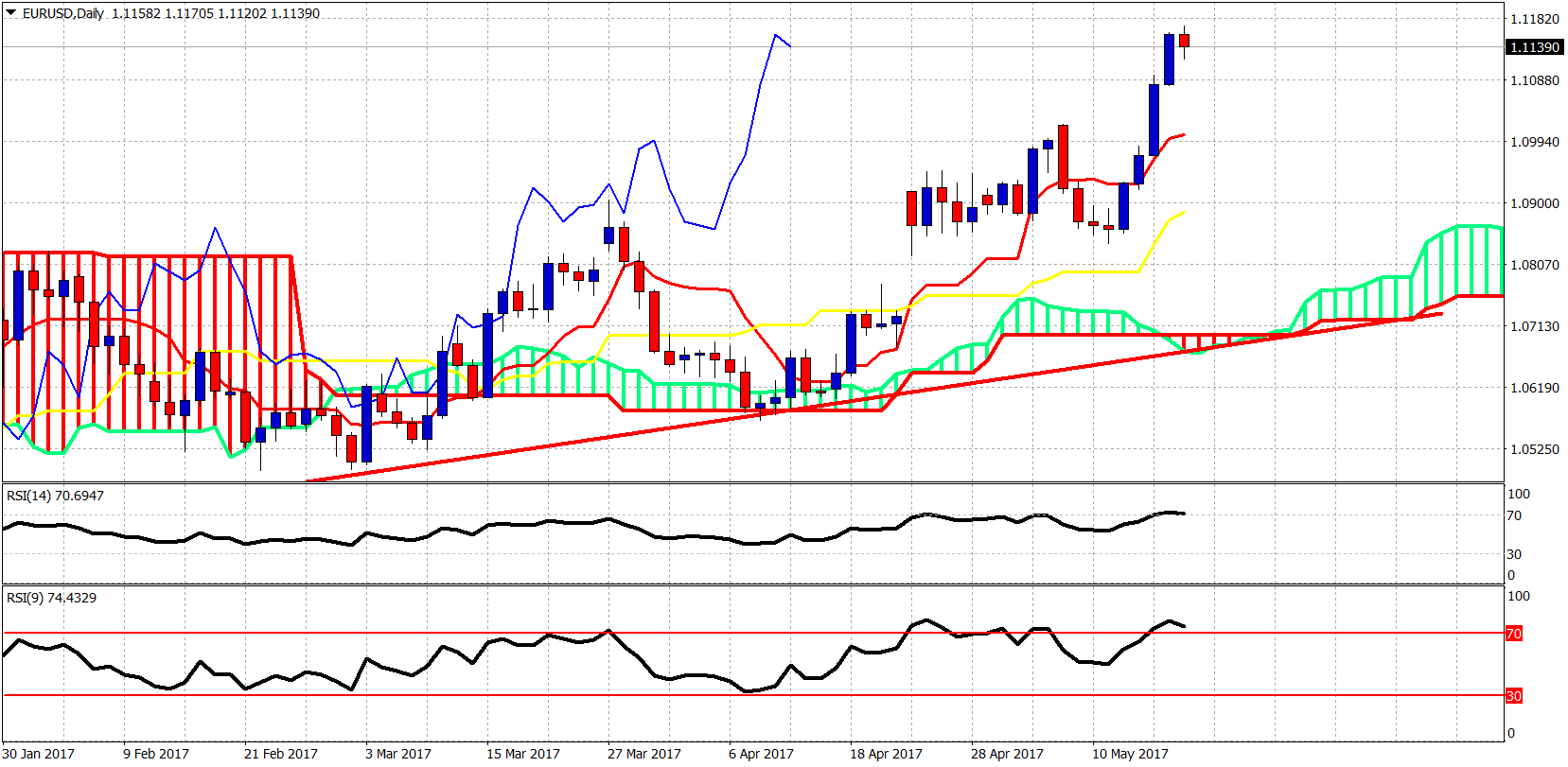

EUR/USD on the other hand has broken out of the bullish channel and this could be a blow-off top. However I would not be looking to sell it but rather look to buy it on dips back towards 1.08-1.07.

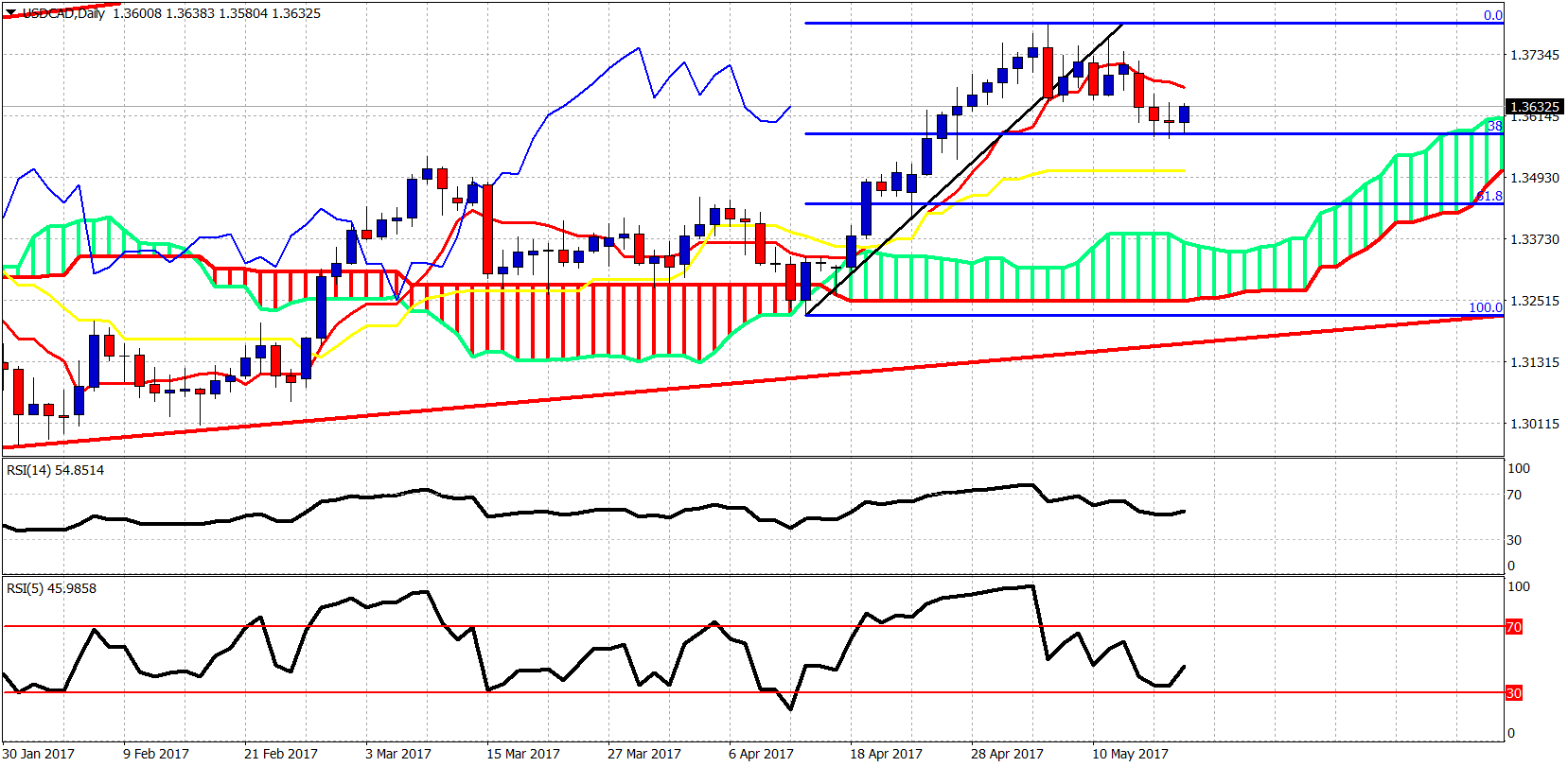

USD/CAD I’m bullish expecting a move towards 1.40 as I can see oil weakening. Confirmation of this view will come with oil breaking below $48 and USD/CAD breaking above 1.3720.

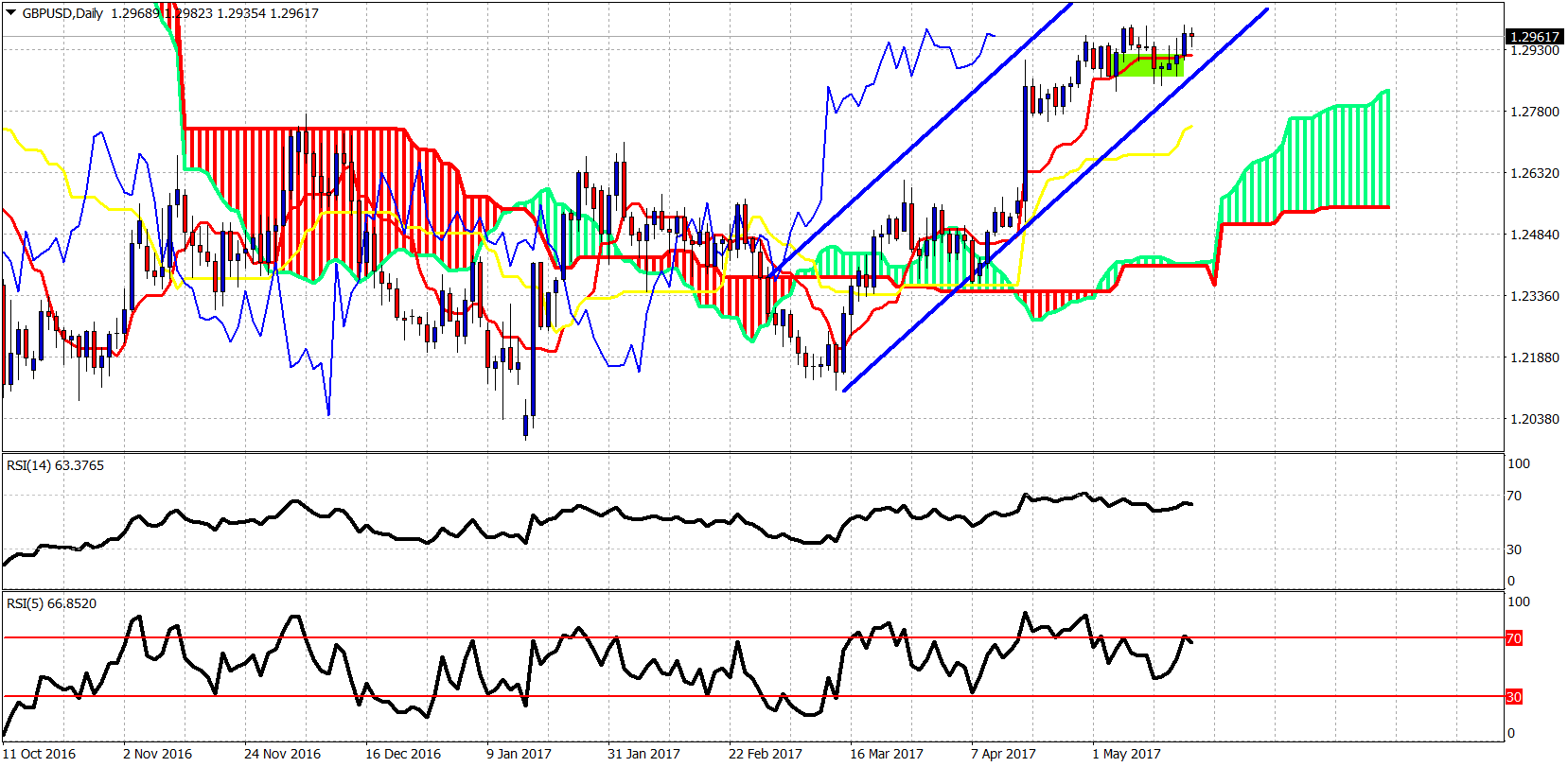

GBP/USD remains inside the bullish channel and although we could see a pull back towards 1.28 again, I believe that eventually 1.31-1.32 could be reached.

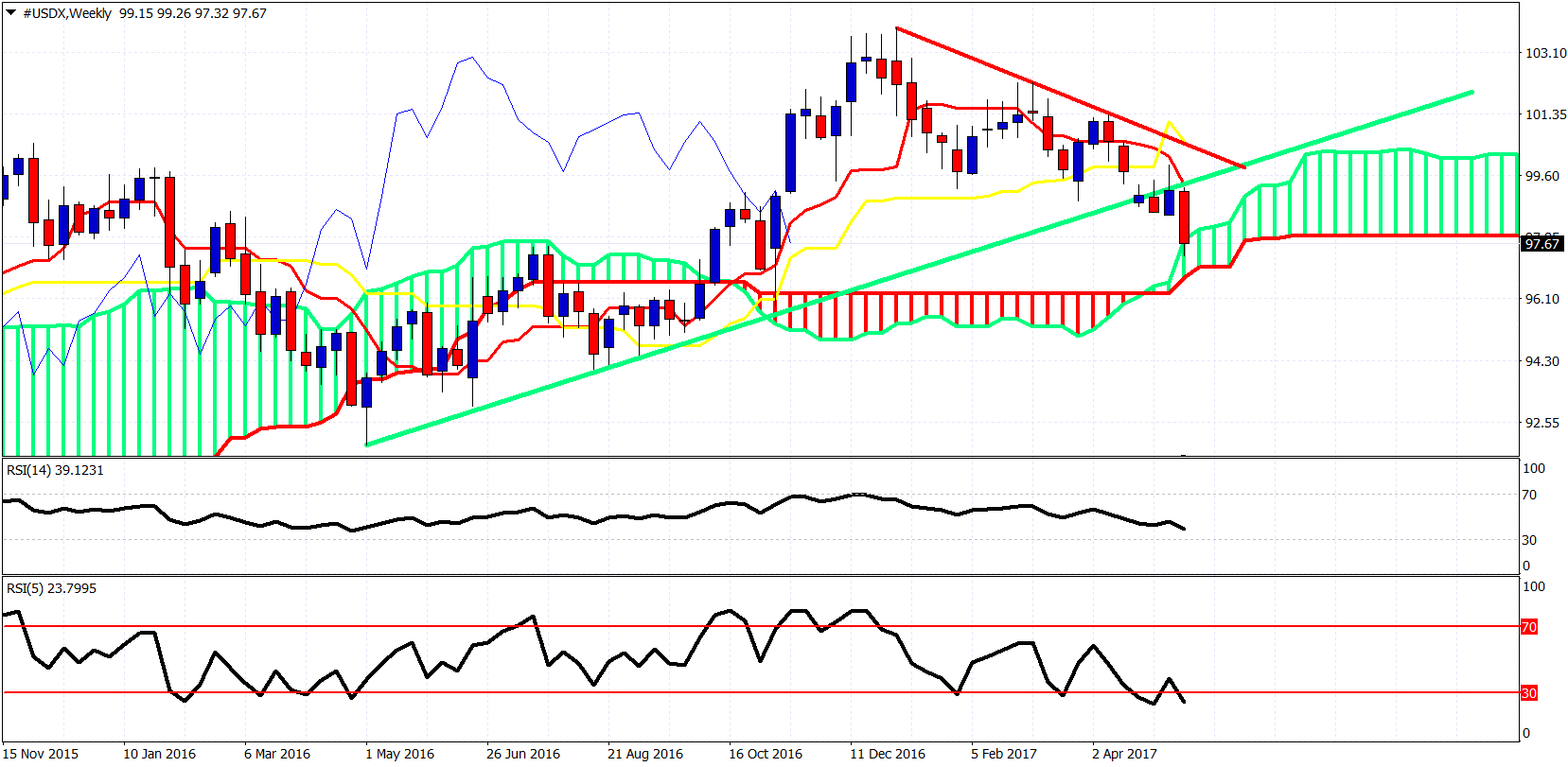

The Dollar Index has reached very important weekly support so at least a bounce for the short-term is expected.

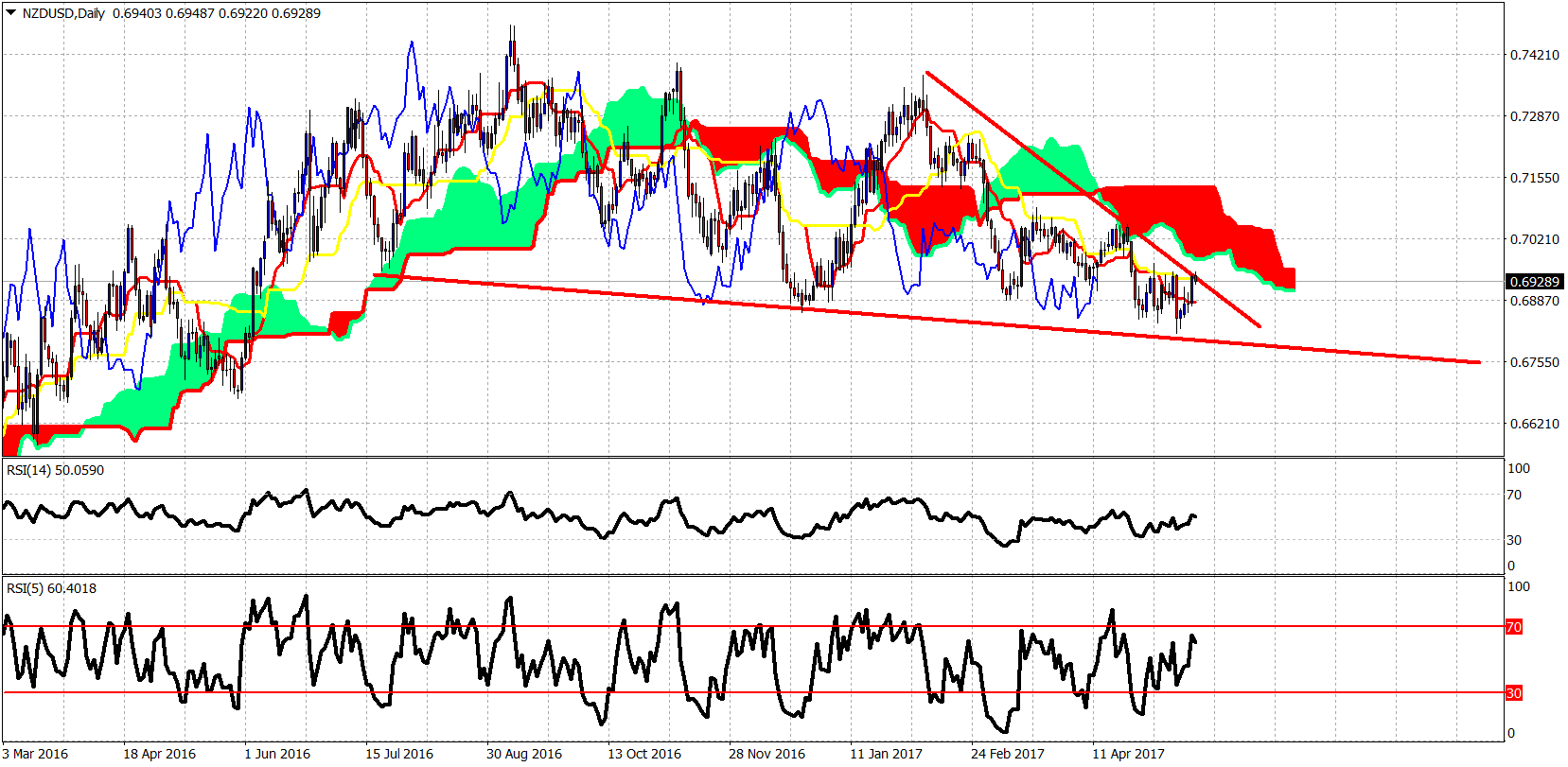

Is NZD/USD trying to break out of the triangle?

That is all from me today….have a nice trading day and keep safe.

Disclosure: None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that June be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions.