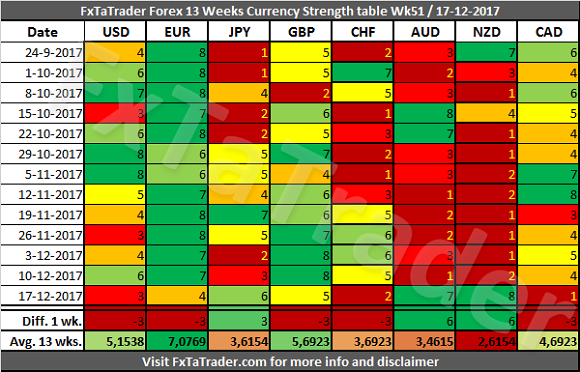

In the Currency Strength table, the NZD was the strongest currency while the CAD was the weakest. There were some significant changes last week with the NZD and AUD gaining 6 points, the JPY 3 points while the USD, EUR, GBP, CHF, and CAD lost 3 points.

The NZD, AUD and to a lesser extent the JPY showed a good performance last week.

The AUD and JPY are Neutral currencies and may offer some good opportunities against the Weak currencies.

The NZD is a Weak currency and was especially strong against the AUD and CAD. The strength in the NZD seems more like a temporary pullback.

The CAD, and to a lesser extent the CHF and USD, showed a weak performance last week while the EUR and GBP showed a lot of weakness at the end of last week.

The CHF is a Neutral currency and it may offer some good opportunities against the Strong currencies.

The CAD was very Weak last week and more in the range of the Neutral currencies in the 4 weeks before while it is a Strong currency.

Based on:

- the Classification of each currency as described in this article

- and the development in the "Currency Strength table" as described above

- and the "Currency Score Comparison table" which is supplied at the bottom of this article

it seems that going long with the AUD and JPY may offer the best opportunities while going for going short this may be the CHF

13 Weeks Currency Score Strength

The 13 Weeks Currency Strength and the 13 Weeks Average are provided here below. For more information check the page Explanation Articles on my blog.

Average 13 wks. Score

When looking at the Average 13 wks. Score we can see the currencies grouped together according to their classification.

There may be some doubt and in that case it could be a currency that will change its classification in the coming weeks. There are no such currencies at the moment.

- Strong - We can see that the EUR, USD, GBP and CAD are clearly grouped together as Strong currencies around an Average 13 wks. Score of 5 to 7.

- Neutral - The JPY, AUD and CHF are grouped together around an Average 13 wks. Score of 3 to 4.

- Weak -The NZDis the only Weak currency with a Score around anAverage 13 wks. Score of 2 to 3.

Classification review

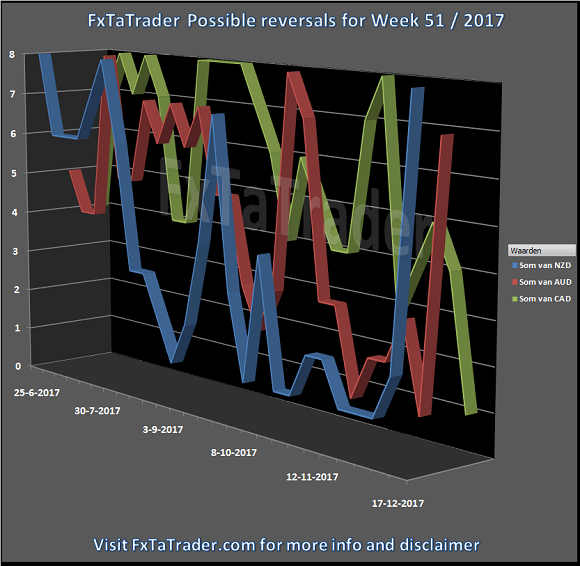

This week we take a look at the Possible reversals. For this we look at the Price in relation to the Ichimoku cloud and the MACD in relation to the zero line in the Daily chart.

- The NZD showed a lot of Strength last week becoming the strongest currency that week. This was especially the case against the AUD and CAD where it reversed. The strength does not seem to be structural for the moment.

- The AUD showed a lot of Strength last week too and this was especially against the CAD where it reversed. Also here, the strength does not seem to be structural for the moment.

- The CAD showed a lot of weakness last week. This is a Strong currency and it reversed against all the major currencies. The Score in the last 5 weeks has not been in the range of Strong currencies. This currency is still a Strong currency based on the Average 13 wks. Score but is now the Weakest currency of the Strong currencies. It may become a Neutral currency within a few weeks if the performance does not improve.

Below you can see the Weekly Currency Score Chart with the 6 months' data as a reference.

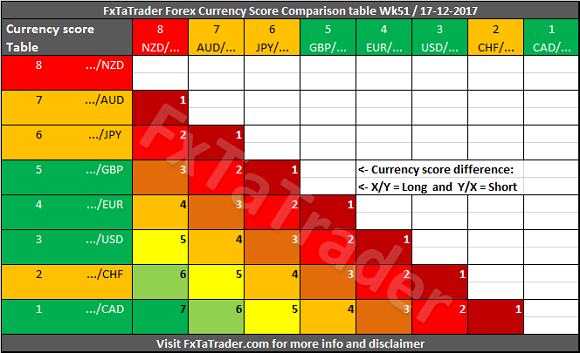

For analyzing the best pairs to trade looking from a longer-term perspective the last 13 weeks Currency Classification can be used in support.

This was updated on 10 December 2017 and is provided here for reference purposes:

Strong: EUR, USD, GBP and CAD. The preferred range is from 5 to 8.

Neutral: JPY, AUD and CHF. The preferred range is 2 to 4.

Weak: NZD. The preferred range is from 1 to 1.

Currency Score Comparison

The Forex Currency Comparison Table compares each currency with its counterpart based on the Currency Score. For more information check the page Explanation Articles on my blog. For more information about the currency Score of this week, you can read the article "Forex Ranking, Rating and Score" which is published every week together with this article.

Besides this article, I also use the Forex "Ranking, Rating and Score" which is also available once a week on my blog. In the article "Ranking, Rating and Score" we look in more detail at the absolute position of the currencies and pairs.

It is recommended to read the page "Currency score explained", "Introduction to the FxTaTrader Forex Models" and "Statistics and Probabilities" for a better understanding of the article. If you would like to use this article then mention the source by providing the URL FxTaTrader.com or the direct link to this article. Good luck in the coming week.

Disclaimer: The article is my personal opinion, not recommendations, FX trading is risky and not suitable for everyone.The content is for educational purposes only and is aimed solely for the use by ‘experienced’ traders in the FOREX market as the contents are intended to be understood by professional users who are fully aware of the inherent risks in forex trading. The content is for 'Forex Trading Journal' purpose only. Nothing should be construed as recommendation to purchase any financial instruments. The choice and risk is always yours.