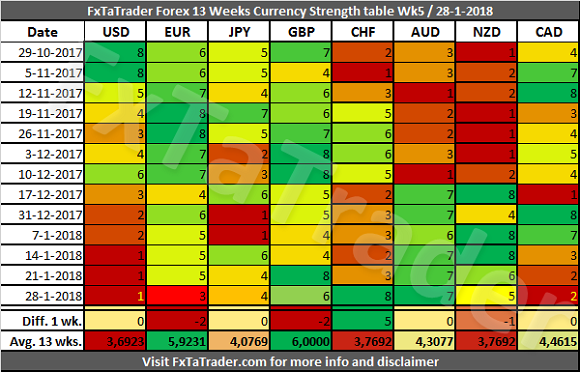

In the Currency Strength table, the CHF was the strongest currency while the USD was the weakest. There were some significant changes last week with the CHF gaining 5 points while the EUR and GBP lost 2 points.

On a week-to-week basis, the CHF and AUD showed a very good performance and to a lesser extent the GBP and NZD.

The USD and CAD showed a very weak performance and to a lesser extent the EUR and JPY.

When looking at the development at the end of last week, the CHF and GBP performed very well and to a lesser extent the AUD. On the other hand, the USD and CAD kept performing weak and to a lesser extent the NZD.

Although some good performing currencies may have lost points they remain interesting when looking at all the currencies in the table as a whole. Same for the weak currencies that may have gained points. That is why the Classification of Currencies and the Currency Score comparison are important also. We will look at this in more detail.

13 Weeks Currency Score Strength

The 13 Weeks Currency Strength and the 13 Weeks Average are provided here below. For more information check the page Explanation Articles on my blog.

Average 13 wks. Score

When looking at the Average 13 weeks Score we can see the currencies grouped together according to their classification.

There may be some doubt and in that case it could be a currency that will change its classification in the coming weeks. Such currencies are the USD and CAD, these changed classification last week.

- Strong - We can see that the EUR and GBP are clearly grouped together as Strong currencies around an Average 13 wks. Score of 5,9 to 6.

- Neutral - The AUD and CAD are grouped together around an Average 13 wks. Score of 4,3 to 4,6.

- Weak - The USD, JPY, NZD and CHF are grouped together around an Average 13 wks. Score of 3,6 to 4.

Classification review

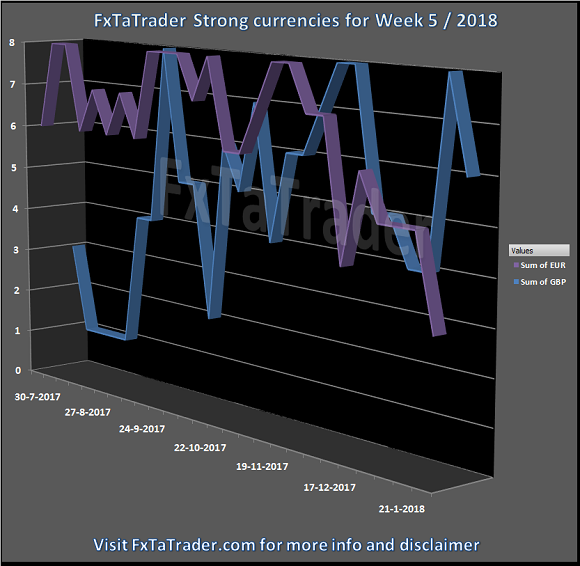

This week we take a look at the Strong currencies.

- The GBP remains strong with recently dips to a Score of 4.

- The EUR started to lose strength in the second week of December and continued to do so until now. With a Score of 3, it is now in the range of the Weak currencies. It remains a Strong currency for now because the Average 13 wks. is still very Strong and far from the Neutral currencies.

Below you can see the Weekly Currency Score Chart with the 6 months' data as a reference.

For analyzing the best pairs to trade looking from a longer-term perspective the last 13 weeks Currency Classification can be used in support.

This was updated on 21 January 2018 and is provided here for reference purposes:

Strong: EUR and GBP. The preferred range is from 7 to 8.

Neutral: AUD and CAD. The preferred range is 5 to 6.

Weak: USD, JPY, NZD and CHF. The preferred range is from 1 to 4.

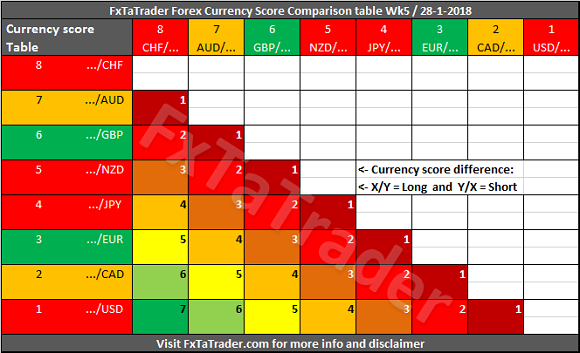

Currency Score Comparison

The Forex Currency Comparison Table compares each currency with its counterpart based on the Currency Score. For more information check the page Explanation Articles on my blog. For more information about the currency Score of this week, you can read the article "Forex Ranking, Rating and Score" which is published every week together with this article.

Putting the pieces together

Based on the analysis of this article it seems that going long with the AUD and GBP may offer the best opportunities.

For going short, the USD and CAD seem to offer good opportunities.

The CHF is a Weak currency and for that reason, it seems not the best one to go long with even though it showed a Strong or Neutral performance last week.

The EUR is a Strong currency and for that reason, it seems not the best one to go short with even though it showed a Weak or Neutral performance last week.

Besides this article, I also use the Forex "Ranking, Rating and Score" which is also available once a week on my blog. In the article "Ranking, Rating and Score" we look in more detail at the absolute position of the currencies and pairs.

It is recommended to read the page "Currency score explained," "Introduction to the FxTaTrader Forex Models" and "Statistics and Probabilities" for a better understanding of the article. If you would like to use this article then mention the source by providing the URL FxTaTrader.com or the direct link to this article. Good luck in the coming week.

DISCLAIMER: The articles are my personal opinion, not recommendations, FX trading is risky and not suitable for everyone. The content is for educational purposes only and is aimed solely for the use by ‘experienced’ traders in the FOREX market as the contents are intended to be understood by professional users who are fully aware of the inherent risks in forex trading. The content is for 'Forex Trading Journal' purpose only. Nothing should be construed as a recommendation to purchase any financial instruments.