Welcome to my "Strength and Comparison" article for the coming week. The article "Ranking, Rating and Score" has also been published. When looking at the currency strength in the table here below we can see that the USD is the strongest currency. The GBP is clearly the weakest and the CAD lost a lot of strength in the last 5 weeks. The USD and EUR became stronger in the last week and the NZD lost direction in the last 3 weeks by going from 3 to 6 and back to 3. For more details, read both of my articles where the relevant charts and tables are provided.

______________________________________

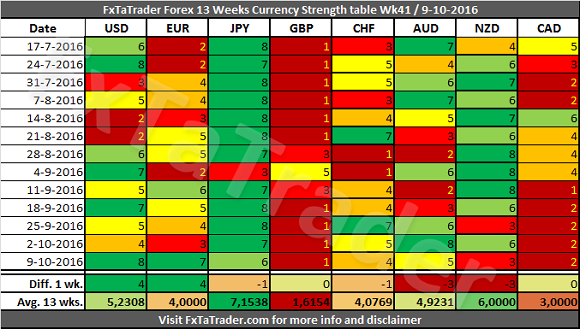

13 Weeks Currency Score Strength

The 13 weeks currency strength and the 13 weeks average are provided here below. This data and the "13 weeks Currency Classification" are considered for deciding on the preferred range. Because it is not ideal nor desired to change the range for a currency every single week, we perform several checks to avoid this.

- First of all the strength over a period of 13 weeks. See each row for more information.

- Then the 13 weeks average, see the last row called "Avg. 13 wks."

- The number of weeks that a currency is stronger than another currency can also be evaluated.

- The TA Charts for each time frame can also be consulted.

For analyzing the best pairs to trade looking from a longer term perspective the last 13 weeks currency classification can be used in support.

This was updated on 25 September 2016 and is provided here for reference purposes:

Strong: USD, JPY, NZD. The preferred range is from 6 to 8.

Average: CHF, AUD. The preferred range is from 4 to 5.

Weak: EUR, GBP, CAD. The preferred range is from 1 to 3.

The USD (strong) has an average score higher but close to the AUD (average) and it had only 6 times a higher score in the last 13 weeks. For these reasons, the USD is close to becoming an average currency and this was avoided last week because of the high score of 8.

The EUR (weak) has an average score lower but close to the CHF (average) and it had only 6 times a higher score in the last 13 weeks. However, the score of the EUR is more in the range of the average currencies than the weak currencies. This currency will be monitored closely in the coming week and may become an average currency.

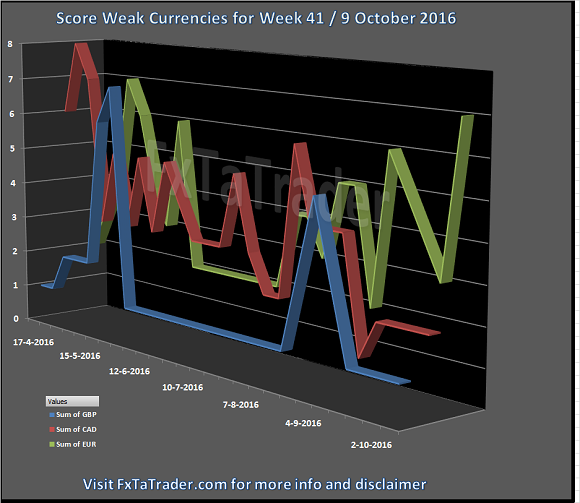

Here below you can see the weekly currency score chart with 6 months data as a reference.

_____________________________________

The Weak Currencies

As can be seen, the EUR is moving away from the other weak currencies and getting more in the range of the average and strong currencies.

_____________________________________

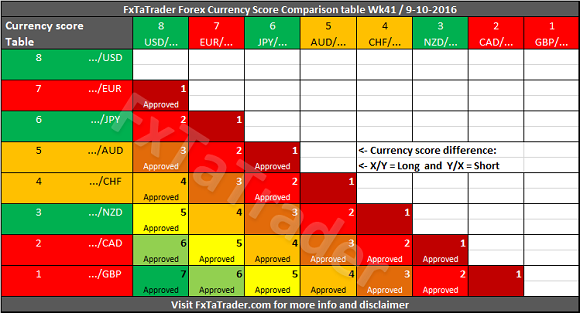

Currency Score Comparison

"Comparison table" and the "Ranking and Rating list"

The Forex currency comparison table compares each currency with its counterpart based on the currency ccore. For more information about the currency score of this week you can read the article "Forex Ranking, Rating and Score" which is published every week together with this article.

By using the comparison table directly below, you can get a view without the volatility and statistics as opposed to the "Ranking and Rating list". Only the strength of each currency against the counterparts is analyzed by using the technical analysis charts of the 4 time frames that are also used for the "Ranking and Rating List".

The information from the comparison table is the source for calculating the "Ranking and Rating List" where this list additionally uses the volatility and statistics for creating the best and worst performer in the list from number 1 to 28.

"Comparison table" and the "Currency Score Chart"

The additional value of this table, compared to the currency score table, is that the comparison table compares the strength between the currencies of each pair. By subtracting the strength of the weaker currency from the stronger currency, we have a way to compare each pair combination.

The comparison table provides a way to compare currencies from a longer term perspective of 13 weeks and also simultaneously taking the current trend into account. By coloring the currencies in the X and Y axis according to their classification, we can show what the best combinations are. In doing this, we apply 2 rules to make it clearer.

- First of all, only better classified currencies in combination with weaker classified currencies are "approved" when there is a currency score difference of at least 1 in the current week.

- The only exception is when 2 currencies are similarly classified but the currency score difference is equal to or more than 4.

- It means that each currency should be as far apart from each other as possible in the range from 1 to 8. The classification of the currencies in question may change in the longer term. By using the difference of 4 which is exact at the half of the range it seems a safe approach for trading 2 currencies which are similarly classified.

- Even though currencies may be in the same classification, a currency may be in a weaker/stronger period and may even change its classification in the future. See the current classification for the coming period at the beginning of this article.

______________________________________

Putting the pieces together

Based on the last "13 Weeks currency classification" and the "Currency Comparison Table" the most interesting currencies for going long seem to be the:

USD, JPY and AUD.

These are strong or average currencies from a longer term perspective when looking at the last "13 Weeks currency classification".

For going short the same analysis can be done and the following currencies seem to fit best:

GBP, CAD.

These are weak or average currencies from a longer term perspective.

Currencies with a high deviation seem less interesting to trade because they are less predictable. These currencies seem to be at the moment e.g. the:

EUR and NZD.

Unless these currencies offer a clear opportunity based on the longer term it seems best to be avoided. However, these currencies may offer opportunities for the short term trader.

Some of the pairs in the "Currency Comparison Table" comply for a longer term trade based on the technical analysis (TA) of the daily and weekly chart. For the coming week these seem to be: GBP/USD, GBP/JPY, EUR/GBP, GBP/AUD, GBP/CHF, AUD/CAD, CAD/CHF.

______________________________________

DISCLAIMER: The articles are my personal opinion, not recommendations, FX trading is risky and not suitable for everyone.The content is for educational purposes only and is aimed solely for the use by ‘experienced’ traders in the FOREX market as the contents are intended to be understood by professional users who are fully aware of the inherent risks in forex trading. The content is for 'Forex Trading Journal' purpose only. Nothing should be construed as recommendation to purchase any financial instruments. The choice and risk is always yours. Thank you.