GROWTHACES.COM Forex Trading Strategies

Taken Positions:

EUR/USD: long at 1.0705, target 1.0900, stop-loss 1.0610, risk factor **

GBP/USD: long at 1.5265, target 1.5390, stop-loss 1.5180, risk factor **

USD/CAD: short at 1.3270, target 1.3050, stop-loss 1.3370, risk factor *

AUD/USD: long at 0.7170, target 0.7280, stop-loss 0.7090, risk factor *

NZD/USD: long at 0.6520, target 0.6700, stop-loss 0.6445, risk factor **

EUR/CAD: short at 1.4320, target 1.3950, profit locked in at 1.4260, risk factor **

CHF/JPY: short at 122.05, target 120.50, profit locked in at 121.30, risk factor **

Positions Opened At Current Market Price:

EUR/USD, GBP/USD, USD/CAD, AUD/USD, NZD/USD

Positions Closed Before The Target Level:

EUR/GBP: profit taken at 0.7015 (short opened at 0.7075)

Pending Orders:

EUR/CHF: buy at 1.0830, target 1.0990, stop-loss 1.0740, risk factor *

AUD/NZD: buy at 1.0850, target 1.1100, stop-loss 1.0720, risk factor **

AUD/JPY: buy at 88.00, target 91.00, stop-loss 87.00, risk factor **

More Strategies - GrowthAces.com

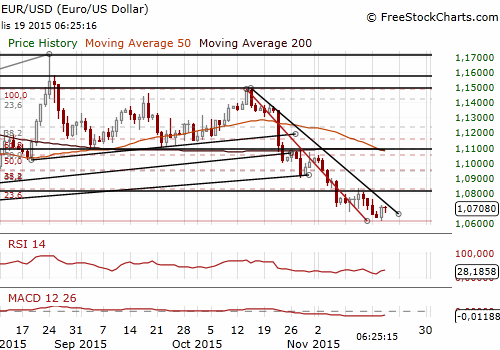

EUR/USD: FOMC Minutes Failed To Drive USD Higher

(long at 1.0705, target 1.0900)

- Atlanta Fed President Dennis Lockhart said global financial markets have settled since the August turmoil that caused the US Federal Reserve to delay raising rates, so that it will soon be appropriate to make the policy change.

- New York Fed President William Dudley said he does not expect a "huge surprise" or major market reaction to a hike in part because it has been so loudly telegraphed.

- The new president of the Dallas Federal Reserve Bank, Rob Kaplan, said that the US central bank faces a tricky situation with a global slowdown even as the US approaches full employment, but stressed that keeping interest rates at zero has costs. He said the Fed will raise rates gradually, adding that gradual to him means reassessing conditions after each rate hike and pausing before the next one if needed. In his opinion accommodative policy does not necessarily mean a zero fed funds rate.

- Minutes of the October discussions revealed Fed officials' view that the job market would improve further and that inflation would begin to move toward their 2% annual target. Federal Reserve officials believed last month that the economic conditions needed to trigger the first interest rate hike in nearly a decade could "well be met" by their next meeting in December.

- The USD surprisingly fell against other major currencies after FOMC minutes. This situation suggests that the outcome of the December meeting is increasingly discounted, particularly in the wake of recent, very heavy USD buying. It may mean that some signal on the trajectory of rates beyond the first hike may be needed to drive the USD higher. That is why we expect some stronger recovery in the EUR/USD. We have got EUR/USD long at 1.0705.

Significant technical analysis' levels:

Resistance: 1.0746 (10-day ema), 1.0778 (high Nov 16), 1.0816 (high Nov 13)

Support: 1.0617 (low Nov 18), 1.0571 (low Apr 15), 1.0532 (low Apr 14)

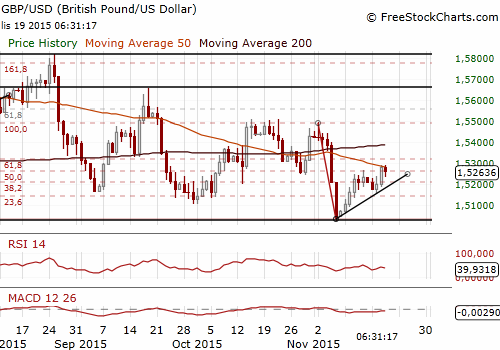

GBP/USD Rising Despite Weaker British Retail Sales

(long at 1.5265)

- The Office for National Statistics said British retail sales volumes fell 0.6% in the month of October after a 1.7% upturn in September, which was boosted by the Rugby World Cup. The reading was below market expectations for a fall by 0.5% mom. The Office said food stores, department stores and clothing were the biggest drags on retail sales growth in October.

- While the decline was a little steeper than expected, British consumers remain upbeat, boosted by a pick-up in wages, falling prices for goods in stores and record-low interest rates that markets do not expect to rise until late next year, or even 2017.

- In the three months to October, retail sales volumes rose 0.9%, holding steady from September's pace of growth that was the strongest since February.

- The GBP/USD rallied to 1.5294 today and our short GBP/USD position hit the stop-loss at 1.5270. The GBP weakened slightly after British retail sales data, but this was not a big surprise, as our forecast was below the market consensus.

- We expect some profit taking on USD-buying positions in the coming days after yesterday’s FOMC minutes failed to launch the USD higher. Medium-term outlook on the GBP/USD is also slightly bullish. Given hawkish comments from BoE policymaker Ben Broadbent yesterday current market expectations for a BoE hike are too dovish. We expect a shift in these expectations soon. We have got GBP/USD long at 1.5265.

- We have taken profit on our EUR/GBP short at 0.7015.

Significant technical analysis levels:

Resistance: 1.5294 (session high Nov 19), 1.5318 (61.8% of 1.5498-1.5027), 1.5401 (high Nov 5)

Support: 1.5229 (low Nov 19), 1.5188 (low Nov 18), 1.5155 (low Nov 17)

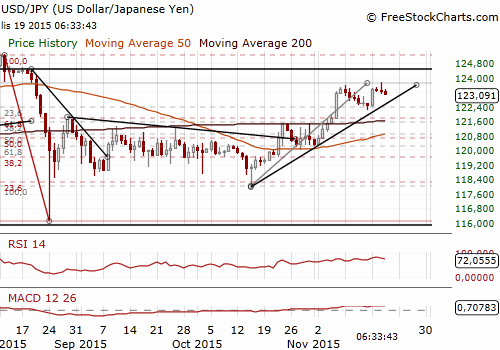

USD/JPY: BoJ Kept Policy Unchanged Despite Recession

(stay sideways)

- The Ministry of Finance data showed that exports fell 2.1% yoy in October. A slowdown in China was the main reason for weak exports in Japan. The data showed China-bound exports fell 3.6% yoy in October, down for a third straight month on falling shipments of items such as steel and car parts. Exports to the United States rose 6.3% yoy in October.

- Imports fell 13.4% in October versus a year ago, swinging the trade balance to a surplus of JPY 111.5 bn, the first trade surplus in seven months.

- The soft figures follow just days after third-quarter data showed Japan slipped into its fourth recession in five years. The run of weak data add to doubts the Bank of Japan will be able to accelerate inflation to its ambitious 2% target in the latter half of next fiscal year to March 2017.

- As widely expected, the Bank of Japan maintained its current pace of monetary stimulus, clinging to hopes that an economic recovery is in sight despite soft domestic capital expenditure and challenging global business conditions. The central bank also kept intact its assessment that while exports and output were feeling the pain from weak emerging market demand, Japan's economy has continued to recover moderately.

- But the central bank offered a slightly more cautious view than last month on inflation expectations, underscoring its concern over a lack of success in nudging companies into boosting wages and investment.

- Many central bank policymakers are reluctant to expand their already massive stimulus programme too soon, preferring to save their diminishing policy options for as long as possible.

- Bank of Japan Governor Haruhiko Kuroda said: “Emerging economies will likely emerge from the doldrums helped by solid growth in advanced economies. Exports will move sideways for the time being, but will likely recover moderately. GDP contracted for two straight quarters but that was largely due to declines in inventory, which shows inventory adjustment is proceeding. Final demand is pretty strong. (…) I do not think we need to conclude at this stage that the timing for achieving our price target will be delayed because of short-term fluctuations in oil moves. (…) As we said when we introduced QQE in April 2013, we will maintain this programme until we hit 2% inflation and we are sure inflation will stay there stably. We never said we will only maintain this programme for two years.”

- The JPY strengthened after BoJ had kept its policy unchanged. The USD/JPY fell to 123.09 in Asia. We have withdrawn our USD/JPY buy order, as we can see profit taking on USD pairs today. A deeper fall in the USD/JPY is possible in the coming days.

- JPY crosses also went up slightly and we made a small loss on our EUR/JPY short. We keep our CHF/JPY short position (opened at 122.05) with the target of 120.50. But we have locked in profit on this position at 121.30.

Significant technical analysis levels:

Resistance: 123.65 (session high Nov 19), 123.77 (high Nov 18), 124.00 (psychological level)

Support: 123.00 (psychological level), 122.23 (low Nov 16), 122.00 (psychological level)

Source: Growth Aces Forex Trading Strategies