A third round of quantitative easing is not off the table! In a speech delivered last Monday to the Business Economists, Mr. Bernanke mentioned that the current employment data are still far from optimal, and he reiterated his accommodative position, saying that the Federal Reserve was ready to do more to help the U.S. employment market (quantitative easing). This may well be a volatile week, with a meeting of the G7 on Tuesday and the release of Canadian and U.S. employment data on Thursday and Friday, respectively.

Canada

The week begins with Mark Carney giving a speech in Ontario. He will probably talk about the relatively austere federal budget tabled on Thursday by Jim Flaherty, the Minister of Finance. The budget forecasts a balanced budget by 2015-2016, which is sure to affect Mr. Carney’s fiscal policies. All the important news expected in Canada this week will be released on Thursday. The day begins with Building Permits. Analysts are expecting the figure to have improved dramatically, from -12.3% to 1.5%. We will then have unemployment figures for March. The abbreviated week will end with the release of the Ivey Purchasing Managers’ Index.

United States

An array of indicators is expected this week in the U.S. On Monday we will have the ISM Manufacturing Index as well as Construction Spending for March. On Tuesday, the Fed will reveal the minutes of its last meeting. On Wednesday, we will be given the very important ADP Nonfarm Employment Change, which measures private employment.

The traditional monthly employment data will be released on Friday. This figure is now even more important, given Mr. Bernanke’s speech last Monday, and it will certainly set the stage for the Fed’s next meeting on April 25. It is worth noting that Friday is a legal holiday in Canada and the U.S., so we suggest that you place your orders on Wednesday to take advantage of any market movements caused by this news.

International

Monday will be International Purchasing Managers’ day, with the release of indices for Italy, France, Germany and the eurozone. It should be recalled that markets reacted strongly the last time these data were released, given that each was lower than expected.

On Wednesday Retail Sales for the eurozone and the ECB’s interest rate decision will be released. The LTRO certainly helped lower interest rates on new sovereign debt issues by eurozone countries, but it did nothing to stimulate economic growth. We are wondering which countries will be generating growth, as more and more of them are being forced to tighten their belts to avoid bankruptcy. Last week Spain introduced its most austere budget since 1978. On Thursday, Sir Mervyn King and the Bank of England will reveal their interest rate decision and the level of quantitative easing.

The Loonie

“It’s all about the balance.” Mireille Guiliano

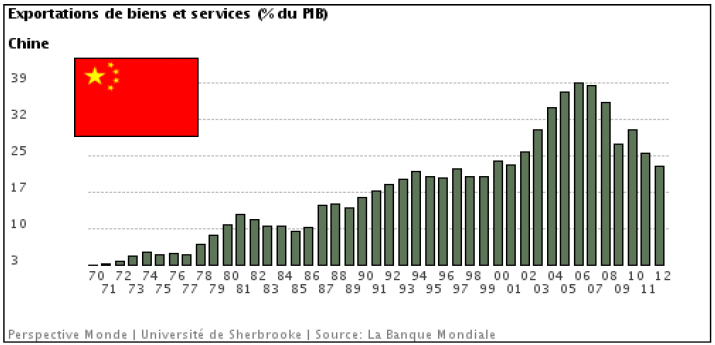

China, a vast manufacturing plant with low labour costs that has become the world’s second largest economy, has seen its growth slow. The Chinese giant, whose economy has been booming since 2004 and carrying the global economy since the debt crisis, is entering into a period of structural reform. Until now, the boom has depended on massive exports and phenomenal investments abroad, particularly in U.S. government debt instruments.

The Chinese government quickly realized that this heavy dependence on the outside world at the expense of internal expansion through domestic consumption would require a major readjustment if it was to re-establish the balance it would need for healthy growth. In 2011, the central bank was concerned about inflation and undertook a series of preventive initiatives. This surely helped slow growth.

Then in December and February, it eased off the brakes and lowered the banks’ reserve requirements again in order to encourage sales and stimulate more economic growth. The Chinese trade balance nevertheless went into deficit—for the first time in 10 years—due to lower exports. A modest recovery in the U.S. and the recession in Europe cause a reduction of the weight of exports in China’sGDP.

It is worth remembering that the modernization of China caused its people to migrate into the large cities, at the expense of Chinese agriculture. The agrifood industry faces the considerable challenge of feeding 1.3 billion people who will depend on cereal imports. As a response to a drop in the real estate market and the budget deficit, and with an eye to transforming its export-based economy into one based on domestic consumption, in March the Chinese government began easing controls on foreign capital inflows.

This could alleviate some of the recent weakness in the Chinese currency, the renminbi, without compromising the competitive position of Chinese manufacturers. Should the renminbi come under attack, China has over $3 trillion of reserves that can be used to intervene in the market. (Is the renminbi destined to become an international reserve currency anytime soon?) We believe that they will opt for maintaining social stability and competitiveness and gradually reform their monetary system, and this will take some time.

In the meanwhile, the Australian dollar is being buffeted by Asia’s every whim, fluctuating close to 500 basis points in one week. Conversely, the Canadian loonie has not strayed out of a narrow range, benefiting from better indicators of a recovery in the U.S., and returning to the fold with the first stirrings of spring, stronger than ever.

Technical Analysis

USD/CADLast week looked much like the week before: the 200-day moving average could not break through 1.0007, and a shooting star formed when it was touched. The only difference was that the USD/CAD spent almost the entire week close to the top of the 0.9850-1.0050 range, and indicators like the MACD are showing that a certain momentum had been in place. Once again, as long as neither 1.0050 nor 0.9850 is broken through, the balance between bearish and bullish movements will be maintained.

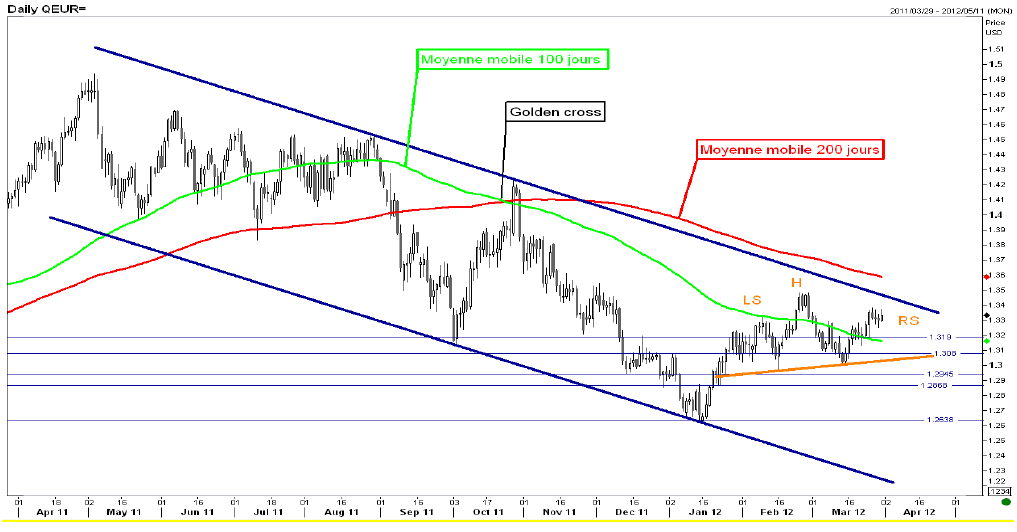

EUR/USD

See the graph below. The main trend has clearly been bearish since May 2011. We continue to see higher highs and lower lows. The 100-day and 200-day moving averages are falling, with the former crossing over the latter (golden cross). By approaching the top of the bearish channel, the rate may be about to produce a head and shoulders pattern with an objective of 1.2575, but it is still too early to say for sure. We will need to see movement below the neckline (in orange). Breaking through the top of the bearish channel (1.3475) and movement above the 200-day moving average (currently at 1.3585) would be reason to doubt a bearish scenario.

Fixed Income

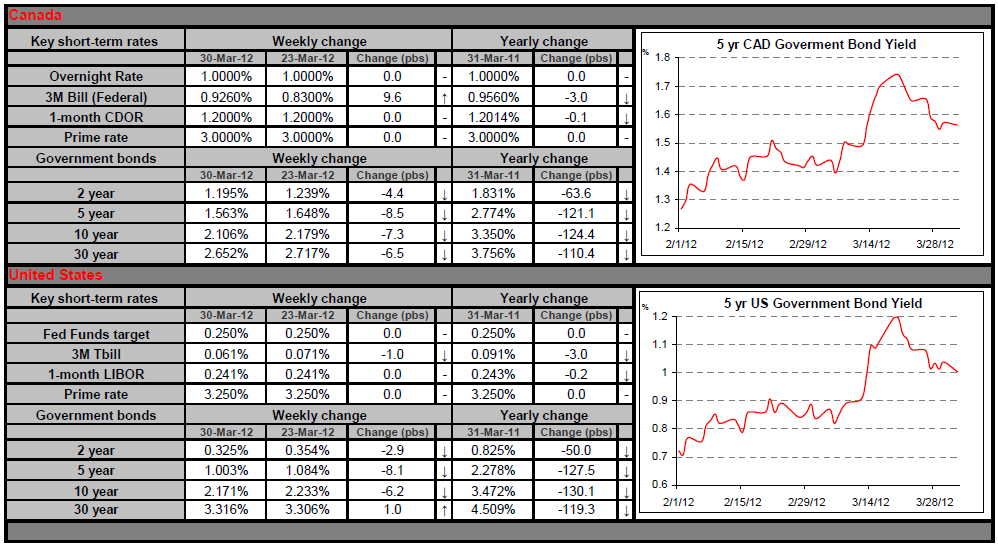

Canadian bond and swap rates were pushed slightly lower last week, following various comments from Fed officials as well as economic releases that continue to support a slow but steady recovery in the US.

Yields retreated after Fed Chairman Ben Bernanke said he’s still worried about some aspects of the US economy, notably the housing market, but acknowledged that job growth has been better recently. He also reiterated that an accommodative policy is still needed to secure the recovery. Market prices showed chances of a rate hike dropped on the speech, as traders prudently stepped back to avoid a confrontation with the Fed by pricing an increase too soon.

The good reaction to the release of the federal budget on Thursday, combined with some quarter-end buying support from institutional investors might have also contributed to last week’s pull back in yields.

Next week, the Fed releases the minutes of its March rate decision on Wednesday, while job numbers are expected in Canada and the US, respectively on Thursday and Friday. Both economies are expected to have created jobs last month, but performances significantly different from expectations could trigger sharp swings in yields.

Commodities

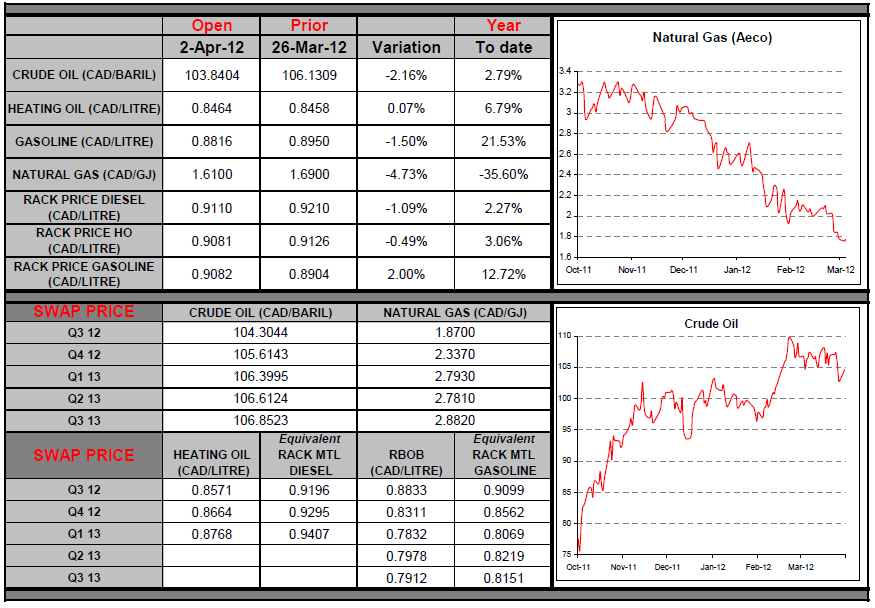

The price of oil was down slightly last week, in response to rumours that a decision had been made to tap into strategic reserves, as well as fears that the Chinese economy was slowing down more than expected. The prices of WTI and Brent crude were down 3.6% and 1.6% for the week. In addition, the Saudi Arabian oil Minister mentioned that high prices were bad news for economic growth in Europe, the United States and emerging countries. Price increases contribute to trade deficits and feed fears of inflation.

Based on his comments, Saudi Arabia is producing 10 million barrels per day, and the market has sufficient supply. Over the next few months, we will monitor the evolution regarding the embargo against Iran. Oil represents 80% of the country’s revenue, and these sanctions already had a devastating impact on the Iranian economy.

Last Week At A Glance

CanadaIn January, GDP grew in line with expectations at the lowly rate of 0.1%, while December’s growth figure was revised up a tick to 0.5%. The goods sector expanded 0.1% on higher output from mining, manufacturing (surprising given the weak shipments report) and utilities (a first increase in four months as winter made a belated appearance), which offset declines in construction and oil and gas.

The services sector advanced 0.2%, driven by finance, real estate and insurance (+0.2%) and accommodation and food services. Retailing was sluggishly flat in the month and wholesaling was up 0.3%, both surprising in light of their earlier monthly individual reports. The Canadian economy did not get off to a great start of the year. January output growth was lacklustre to say the least and February could see some softness, as well, owing to an unscheduled shutdown in production in the energy sector.

That said, the excellent handoff from December means that Q1 growth is tracking near the Bank of Canada’s estimate of 1.8% annualized. Canada's Survey of Employment, Payrolls and Hours, which surveys establishments (as opposed to the Labour Force Survey, which surveys households), indicated Canada lost 1,740 jobs in January (versus a gain of 39,200 paid jobs reported in January's LFS).

According to the SEPH, average weekly earnings rose 0.6% in the first month of 2012, bringing year-on-year gains to 2%. Average weekly hours worked inched up to 32.9 from 32.8 in December, although they remained below the 33 hours reached a year ago. This was the first time in six months that the SEPH showed weaker employment than the LFS paid component. Still, over a six-month period (August- January), the SEPH has painted a much rosier employment picture than the LFS has, with the former averaging 11,600 jobs/month, more than double the meagre 4,930 jobs/month reported by the latter (paid employment).

The SEPH also suggests that Canadian wages continue to grow at a healthy pace consistent with the vigour observed in consumption spending over the same period. The federal government presented its budget for 2012-13 where it charted a course back to a surplus situation in 2015-16. A departmental spending review will result in savings of $5.2 billion on an ongoing basis and a downsized civil service (19,200 jobs eliminated over three years). The federal debt-to GDP ratio is forecast to peak in 2012-13 at 34.4% on the back of a budget deficit of $21.1 billion. By 2016-17, however, the debt-to-GDP ratio is projected to recede to 28.5%.

United States

In February, personal income grew 0.2%. In real terms, disposable income fell 0.1% for a second consecutive drop. Personal spending shot up 0.8%, topping the 0.6% that consensus was looking for. In addition, the prior month’s figure was revised up. In real terms, spending rose 0.5%. With spending growing faster than income, the savings rate slipped six ticks to 3.7%.

The core PCE deflator rose 0.1% in the month, keeping the year-on-year rate steady at 1.9%. In March, consumer confidence sagged slightly according to the Conference Board. The confidence index dropped to a near-consensus 70.2 from an upwardly revised 71.6. Though consumers were more upbeat about the current situation (up 4.6 points to 51), they were less so about the outlook (down 5.4 points to 83). When asked about employment prospects, respondents were a bit more optimistic, though the "hard to get" employment index rose in the month (up 2.4 points to 41).

There was greater eagerness (and probably more means) to buy autos, homes and major appliances. Though small, the drop in confidence is not good news. That said, the February and March readings were nevertheless the highest in thirteen months. In February, durable goods orders rose 2.2%, short of the 3% increase expected by consensus. However, the prior month’s figure was revised up four ticks to -3.6%.

Transportation orders rose 3.9% thanks to Boeing's strong order book and to improved orders for vehicles and parts. Ex-transportation orders jumped 1.6% in line with consensus expectations. Non-defence capital goods orders excluding aircraft climbed 1.2%. Total shipments of durable goods sank 0.4% overall. While shipments of non-defence capital goods ex-aircraft (an indicator of business investment) swelled 1.4%, the increase did not completely erase the previous month’s sharp decline.

February's report showed a decent rebound after January's weak numbers. However, despite February's gains, Q1 growth in shipments of non-defence capital goods ex-aircraft is still tracking at -2.4% (assuming no change in March). This suggests a softening of business investment in the first quarter consistent with our view that the U.S. economy moderated slightly after growing a solid 3% in 2011Q4. Separately, there was no surprise in the third estimate of Q4 GDP growth, with the rate left unchanged at 3% annualized.