Greetings everyone and happy Easter, let’s take a look at some fx pairs that are in interesting formations and very important junctions.

Holding inside the bullish channel. Price is bouncing. As long as price is above 81.65 we could see another new higher high towards 83.25. However a break below 81.65 will open the way for a move below 80.

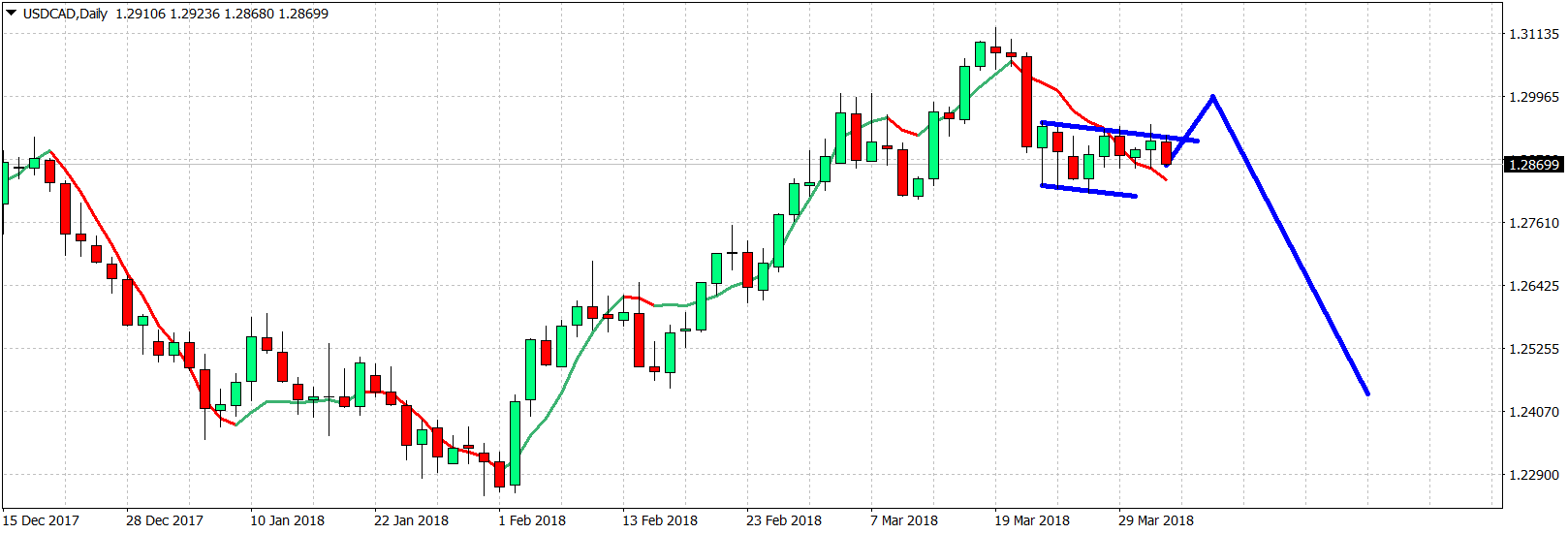

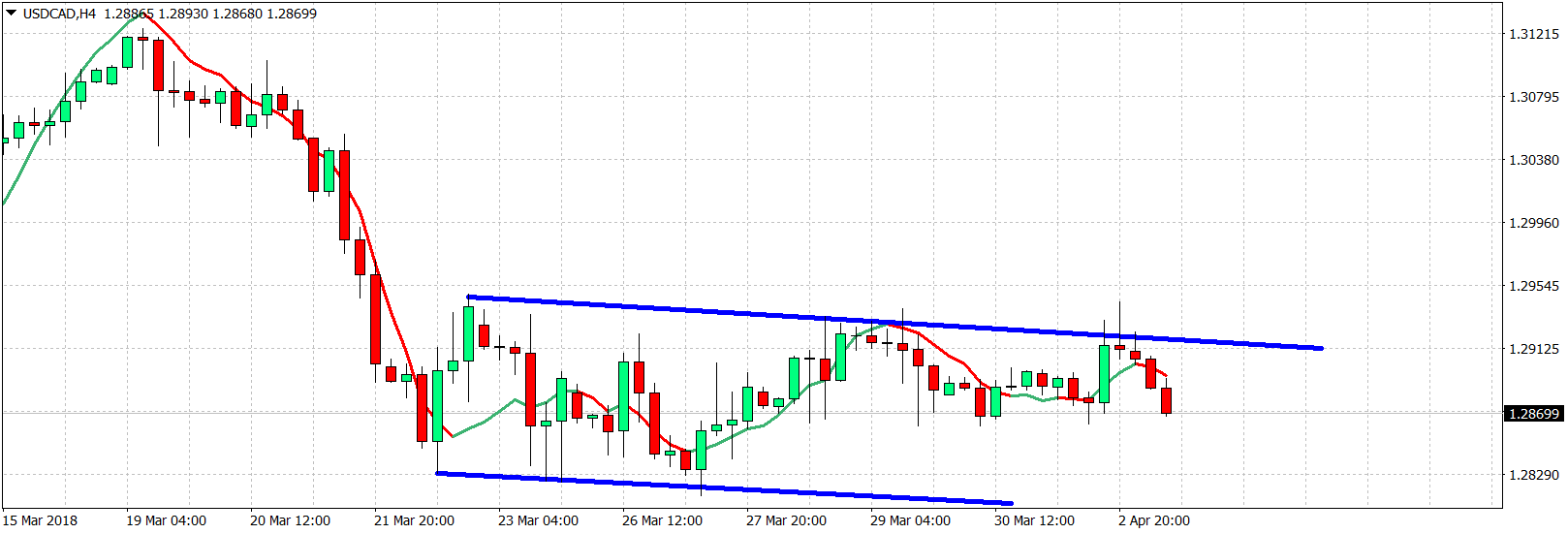

Still trapped inside the trading range. Made a try yesterday to break short-term resistance at 1.2930 but price got rejected. I still expect 1.30 to be seen before selling the hell out of it for a move towards 1.24 and lower.

This pair has broken out of a long-term wedge pattern and yesterday might have completed a back test pull back of the broken wedge boundary. Bulls now need to break above 107 and this open the way for a move towards 108 and why not 109.30. 105.60 yesterday’s lows are important short-term support now. Bulls do not want to see new lower lows.

Still inside long-term bullish channel and respecting short-term trend line support. Bears need to break back below 1.40 in order to regain short-term trend control.

Is this a selling opportunity? Maybe as long as price is below the blue TL resistance. Support is at 130.30 while resistance at 131.30. I’m bearish as long as price is below the blue TL.

Concluding, waiting for USD/CAD to reach 1.30 to get bearish, I’m bearish now EUR/JPY, CAD/JPY and USD/JPY…

Disclosure: None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that June be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions.