Following a day of thin trading, the U.S. dollar climbed the most against the yen and rallied versus the majority of its Forex peers as investors increased speculation that the Federal Reserve may decide to scale back on the monthly bond purchases. The greenback sustained a major advance as investors awaited this week’s Manufacturing releases, which could show an increase in activities, while Existing Home Sales may also show improvement. The U.S. dollar rallied the most since 2009 versus its Canadian counterpart, and surged versus the euro as the region remained concerned over the possibility of a further slowdown in inflation. Gold Prices neared a five-week high but dipped on the possibility the U.S. central bank could implement further cuts to stimulus when it meets at the end of the month. Futures for February delivery traded at $1,247.00 a troy ounce during european market hours. However, demand for the precious metal remains high as China continues its celebration of the Lunar New Year.

The euro erased prior gains as German Investor Confidence dropped following five continuous months of increases. According to the reports, the index which gauges business sentiment reached a 20-month high in December, reflecting economic recovery in the euro-zone. But Tuesday’s release put investors on notice about the progress of the region. european Central Bank officials have voiced their concerns regarding inflation, but they still anticipate that Germany, which is the E.U.’s biggest economy, will grow in 2014. The British Pound fell versus the U.S. dollar following news indicating a drop in the U.K.’s Factory Output; the currency’s decline was capped by positive metrics out of the Manufacturing sector, which revealed that Orders surged the most since 2011.

In Japan, the central bank began a two-day policy meeting and it’s expected to implement new measures for avert the possibility of deflation. The yen dipped versus the U.S. dollar on speculation that the Federal Reserve may opt for further stimulus cuts; and it remained under pressure as Industrial Production, a key indicator that provides insight into the health of the Japanese economy, posted a drop for the month of November.

Lastly, in the South Pacific, New Zealand’s dollar remained unchanged versus the greenback after announcing that Consumer Price Inflation went up in the final three months of 2013. The Kiwi rose dramatically subsequent to the release. And the Australian dollar rose versus its U.S. counterpart during the Tokyo market hours as speculators look ahead to the release of CPI out of the South Pacific nation.

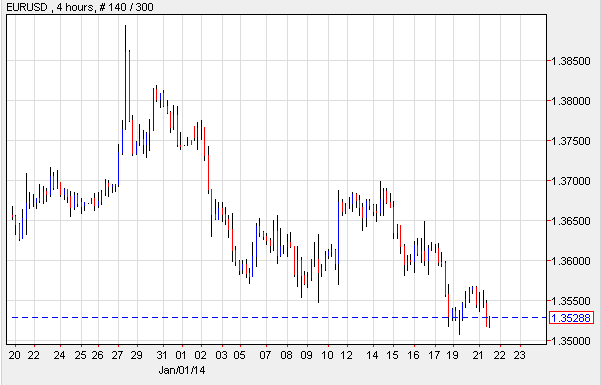

EUR/USD: ZEW Reports Decline

The EUR/USD dipped on Tuesday as the ZEW Centre for Economic Research reported that the German Economic Sentiment Index fell to 61.7 in the initial month of 2014, following December’s 62.0 reading. But this did not stop the experts at the Bundesbank from announcing that that the German economy will grow 1.7 percent this year, rather than the previously anticipated 1.5 percent. The release suggested that Germany is counting on domestic consumption to grow while the region grapples with high unemployment and lower bank lending. Analysts are also expecting Germany to report advances in the Manufacturing sector. Some market traders remain positive that the euro-zone’s economy will expand this year.

EUR/USD 4 Hour Chart" title="EUR/USD 4 Hour Chart" width="474" height="242">

EUR/USD 4 Hour Chart" title="EUR/USD 4 Hour Chart" width="474" height="242">

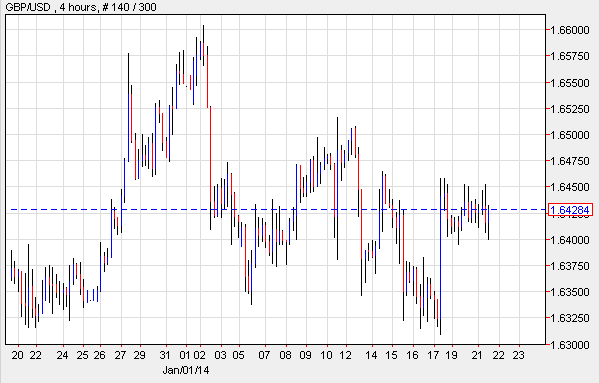

GBP/USD: Sterling Down On CBI

The GBP/USD declined as demand for the latter remained high on speculation that the Federal Reserve could cut stimulus when it meets at the end of January. The Sterling was also weighed down by lackluster reports showing that Industrial Order Expectations dropped to -2 subsequent to a posting of 12 in the last month of 2013. The numbers came in below predictions. On a more positive side, the Confederation of British Industry indicated that Orders for the next quarter were at the highest since 2012.

GBP/USD 4 Hour Chart" title="GBP/USD 4 Hour Chart" width="474" height="242">

GBP/USD 4 Hour Chart" title="GBP/USD 4 Hour Chart" width="474" height="242">

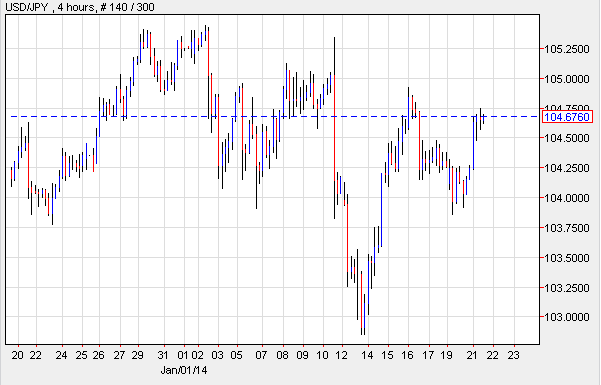

USD/JPY-: Yen Dips On Production

While the latest string of economic releases has denoted growth, the Ministry of Economy announced that Industrial Production dropped 0.1 percent in November, and did not gain 0.1 percent as analysts predicted. The decline was rather steep, especially as Production posted a 1 percent advance in October. Furthermore, Capacity Utilization dropped 0.5 percent on a month over month basis, and in comparison with the previous year, it declined 2.8 percent. Despite the lackluster metrics, Japan still ranked as a strong exporter along with Germany and the U.S. The government’s austerity measures have helped bolster investor sentiment and economists predict Japan’s economy will expand this year.

USD/JPY 4 Hour Chart" title="USD/JPY 4 Hour Chart" width="474" height="242">

USD/JPY 4 Hour Chart" title="USD/JPY 4 Hour Chart" width="474" height="242">

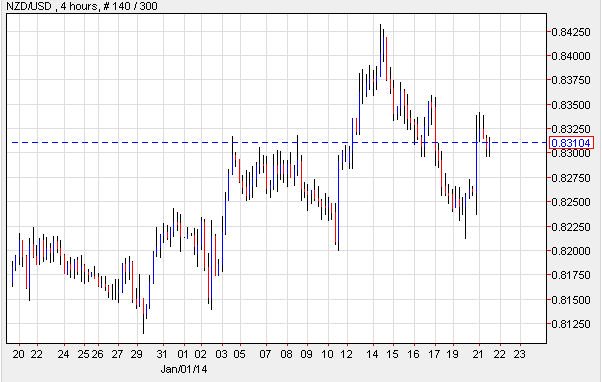

NZD/USD: Kiwi Surges

In the small South Pacific country of New Zealand, the CBI posted higher than predicted for the fourth quarter of 2013. According to the official data, CPI advanced 0.1 percent. Some economists anticipated the numbers would post higher, but with the decline in food prices, the final metrics don’t come as a surprise. Given this release, the Reserve Bank of New Zealand is now forecast to raise the benchmark interest rate by spring.

NZD/USD 4 Hour Report" title="NZD/USD 4 Hour Report" width="474" height="242">

NZD/USD 4 Hour Report" title="NZD/USD 4 Hour Report" width="474" height="242">

Daily Outlook: Today’s economic calendar shows that the Bank of Japan may hold a Press Conference. The E.U. will issue Spain’s Trade Balance. The U.K. will report on Claimant Count Change, the Unemployment Rate, the MPC Meeting Minutes, Average Earnings + Bonuses, and Public Sector Net Borrowing. Lastly, China will publish the HSBC Manufacturing PMI.