The U.S. dollar advanced after Monday’s economic releases revealed that the Manufacturing Index gained more than anticipated in February, while Personal Consumption rose in January, signaling that the economy may be back on the right track. The Institute for Supply Management took the markets by surprise announcing that Manufacturing improved from 51.3 to 53.2 in February, suggesting that this could be a turning point for the world’s biggest economy. The greenback slumped against several of the majors like the euro and the pound as sentiment turned toward risk appetite following Russia’s move to pull back its troops from the Ukraine. Russian President Vladimir Putin stated that he would only use military force as a “last resort.” However, President Barack Obama and european leaders have indicated they will maintain economic pressure on Russia given the occurrence of the past weekend, when Mr. Putin sent troops to the region of Crimea. And as safe havens lost their appeal, so did the shiny metal. Gold Futures for April delivery slipped 0.8 percent and traded at $1,339.20 a troy ounce on the New York Mercantile Exchange. Bullion for immediate delivery plunged 0.8 percent as well, and settled at $1,339.25 an ounce during morning trading hours in London. The precious commodity jumped 2.1 percent on Monday when Russia was said to have ordered Ukrainian war ships to surrender.

The euro rebounded as tensions around the globe eased when Russia’s President Putin indicated that there was no need to utilize military might on the Ukraine. The shared currency remained strong days after the region reported that Inflation metrics came in higher than anticipated, reducing pressure on the european Central Bank to implement new policy measures. Investors are looking forward to Thursday at which time the central bank will reveal whether it will tighten policy any time soon. The Swiss Franc dropped as risk appetite improved in the foreign exchange. And the British pound was bolstered by a return to risk appetite, though its advance was limited by disappointing reports showing that the U.K.’s Construction sector didn’t fare as well as expected.

The yen dropped against its most traded Forex counterparts, and fell by the most in two weeks against the U.S. dollar, as the tensions between Russia and the Ukraine appeared to ease once Russian troops were ordered back to their barracks. The yen remained under pressure as the Bank of Japan’s governor, Haruhiko Kuroda, spoke to Parliament and suggested this could be a good time for the carry trade, a strategy where investors borrow in low -interest rate markets in an effort to fund buys of high-yield assets.

Lastly, in the South Pacific, the Australian dollar declined against its peers after the Reserve Bank announced it will leave the costs of borrowing money at the current level. The Aussie remained to the downside as the bank’s governor, Glenn Stevens suggested that the currency’s decline has aided the economy, but its value is still too high. The Aussie shrugged off economic releases denoting a surge in Building Approvals. The New Zealand dollar traded steady versus its U.S. counterpart as the markets seemed to embrace risk once again.

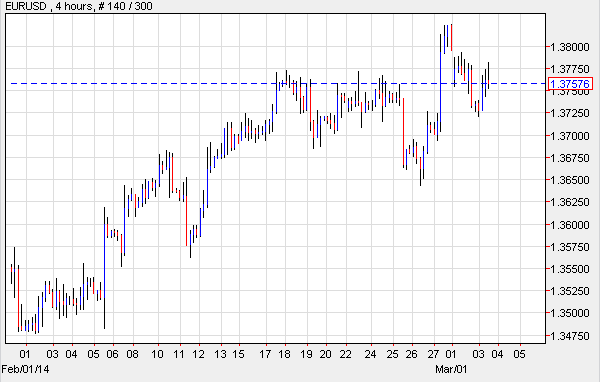

EUR/USD: Investors Await Thursday’s News

The EUR/USD rallied after PPI posted somewhat better than predicted. However, the pair’s gains were due to relief felt throughout the markets as Russia’s President ordered the military to return to barracks, indicating that the “exercises”" were successful. At this time, investors look forward to Thursday, when the european Central Bank will meet to discuss monetary policy. Economists say that deflation is still in the back of their minds, as it could pose a threat to the stability of the euro-zone; and unemployment ranks second in terms of concerns, as it’s still at 12 percent.

EUR/USD 4 Hour Chart" title="EUR/USD 4 Hour Chart" width="474" height="242">

EUR/USD 4 Hour Chart" title="EUR/USD 4 Hour Chart" width="474" height="242">

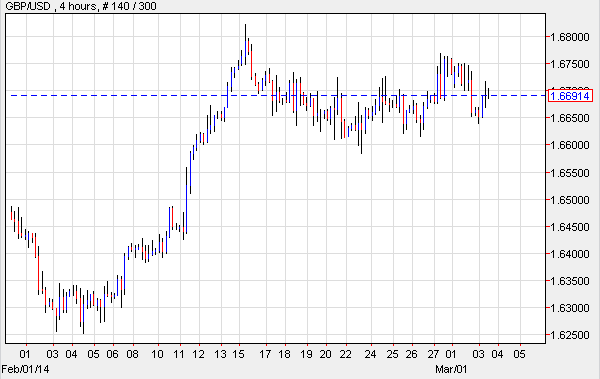

GBP/USD: Construction Disappoints

The GBP/USD benefitted from a reduction in risk aversion prompted by news that Russia desisted from taking over the Crimea region, but remained under pressure after domestic reports indicated that the Construction Purchasing Manager’s Index dropped from 64.6 to 62.6 last month. The announcement revealed that the bad weather in a number of regions of the U.K. dampened growth, since it prevented construction activities. However, the sector did manage to create payrolls, causing employment to reach a three-month high. The GBP/USD remained to the upside after a release confirmed that Russia’s President, Vladimir Putin ordered the troops to return, adding that these were only military exercises. Mr. Putin said that force would only be implemented “if needed.”

GBP/USD 4 Hour Chart" title="GBP/USD 4 Hour Chart" width="474" height="242">

GBP/USD 4 Hour Chart" title="GBP/USD 4 Hour Chart" width="474" height="242">

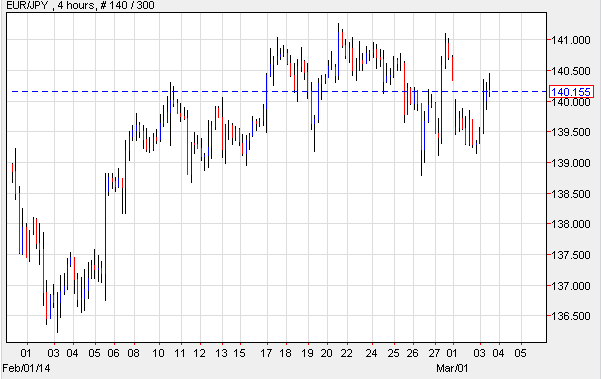

EUR/JPY: Havens Lose Momentum

The EUR/JPY edged higher as demand for harbor currencies ebbed following news that Russia sent its troops back to barracks, thereby easing geopolitical tensions. In Japan, domestic releases revealed that tax revenues rose 21.5 percent in January in comparison with the year before. Furthermore, revenues from income tax surged 40.8 percent as investors sold off their equities. The EUR/JPY gained further as the yen slipped due to higher demand for risk assets.

EUR/JPY 4 Hour Chart" title="EUR/JPY 4 Hour Chart" width="474" height="242">

EUR/JPY 4 Hour Chart" title="EUR/JPY 4 Hour Chart" width="474" height="242">

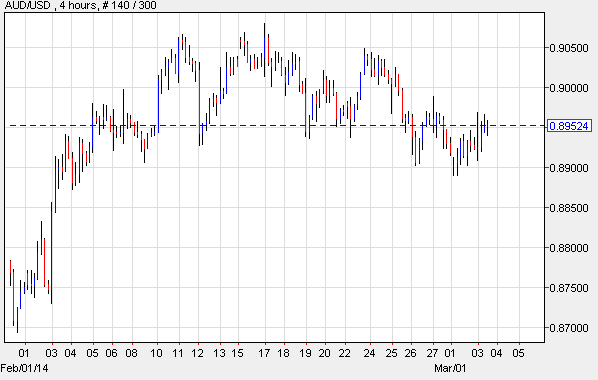

AUD/USD: RBA Made No Changes

The AUD/USD rebounded after falling on Monday, but the gains were capped by comments issued by the RBA’s governor, Glenn Stevens, who suggested that the exchange rate is still too high to support the economy. The AUD/USD slipped after the Reserve Bank stated that the benchmark interest rate will stay at 2.5 percent as forecast by most economists. Other releases confirmed that the Current Account Deficit contracted to AUD$10.1 billion in the three last months of 2013, after posting at AUD$12.5 billion in the third quarter. Furthermore, Building approvals climbed 6.8 percent in January, beating predictions for a hike of 2 percent.

AUD/USD 4 Hour Chart" title="AUD/USD 4 Hour Chart" width="474" height="242">

AUD/USD 4 Hour Chart" title="AUD/USD 4 Hour Chart" width="474" height="242">

Daily Outlook: Today’s economic calendar shows that the euro region will report on Services PMI, GDP, Retail Sales, and Services PMI from a number of E.U. nations. The U.S. will publish data on MBA Mortgage Applications, ISM Non-Manufacturing Employment, ISM Non-Manufacturing PMI, the Beige Book and ADP Non-Farm Payroll Employment Change. And Australia will release Retail Sales and Trade Balance.