The U.S. dollar dipped against the yen and traded steady against the euro, however, on Monday morning the greenback rebounded against the Japanese currency while the euro slipped due to the possibility that the european Central Bank could implement new easing measures should prices remain low, although policy makers don’t believe that deflation is a problem at present. Meanwhile, the G-20 has concluded its meeting which was attended by Janet Yellen for the first time as head of the Federal Reserve, who won the praise of her peers for her efforts in helping ease concerns over the turmoil in the emerging markets. The greenback benefitted from risk aversion as speculators traded cautiously ahead of the release of this week’s U.S. economic reports, and as investors worried over news out of China which revealed that House Prices fell. The recent metrics out of the world’s second largest economy reignited concerns that its economy may have slowed down. Traders also watched the situation in the Ukraine, where Parliament voted to oust President Viktor Yanukovich and provide the country with an interim government which stated that it would move towards integrating with the euro-zone. Gold was supported by a hike in risk aversion. The shiny commodity jumped to the highest price in over four months on the Comex, as market traders believe that the U.S. economy could show further weakness, and as the political crisis in the Ukraine seemed to ease somewhat. Recent metrics denoting a drop in Existing U.S. Home Sales weighed on sentiment, causing Futures for April delivery to rise 0.7 percent to $1,333.00 a troy ounce in the morning hours of Monday.

The euro climbed against the U.S. dollar after Germany issued stellar economic reports denoting that the IFO Business Climate Index reached the highest level in almost three years. The release suggested that Germany’s firms have benefitted from a surge in exports; however, the ongoing crisis in the emerging economies dampened prospects for growth. The shared currency erased its advance against the greenback as the E.U. posted the annual rate of inflation which denoted no changes since December, while Consumer Prices slipped 1.1 percent. With the drop in prices, speculators anticipate that the central bank could move ahead with an expansion in monetary easing, a factor that Bank President Mario Draghi confirmed when he spoke after the G-20 summit. In his statement, Mr. Draghi pointed out that while deflation is not yet a concern, the Governing Board will stay on top of economic data in an effort to make a proper decision on how best to handle the situation. The British pound rallied against the U.S. dollar as economists anticipate positive growth figures for the fourth quarter, and as Bank of England Governor Mark Carney said that the central bank would continue to support the U.K.’s economy, even if it raises the key cash rate.

The yen had advanced versus the U.S. dollar but slipped slightly even though lackluster Chinese economic releases dampened risk appetite. The yen received support upon announcements confirming that House Prices in China declined for the first time in close to one-and-a-half years, suggesting that the economy has cooled off. However, the Governor of the People’s Bank of China, Zhou Xiaochuan, intimated that the country could still expand economically by perhaps 7 or 8 percent.

Lastly, in the South Pacific, the Australian dollar was affected by the drop in risk appetite, as well as by the fall of iron ore and disappointing macroeconomics issued by its main trade partner, China. The New Zealand dollar was more or less unchanged against the greenback as investors wait for key economic reports out of the U.S. and the markets watch the developments in the Ukraine.

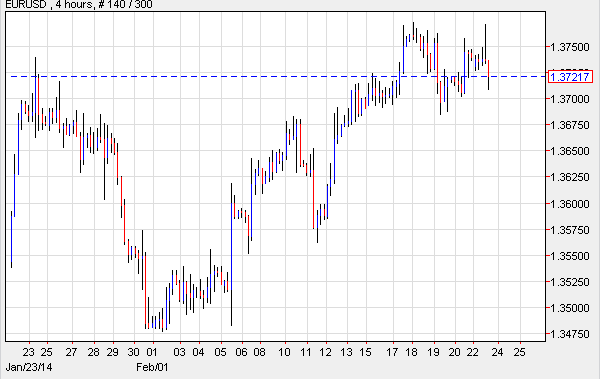

EUR/USD: Draghi Says Deflation Not A Concern

The EUR/USD traded like a see-saw as it gained upon news that Germany’s IFO Business Climate Index advanced to 111.3 this month, which was the highest in three years, after coming in at 110.6 in January. But the pair fell as the euro region indicated that its yearly rate of inflation did not change from 0.8 percent, a positive factor since economists predicted it would drop to 0.7 percent. But still, Consumer Prices sustained a drop of 1.1 percent. Speculation that the deteriorating outlook for prices could prompt the european Central Bank to take action pushed the EUR/USD further to the downside. Peter Praet, an Executive Board member from the ECB, said that policy members have enough tools they can utilize in order to obtain price stability.

EUR/USD Hourly Chart" title="EUR/USD Hourly Chart" width="474" height="242" />

EUR/USD Hourly Chart" title="EUR/USD Hourly Chart" width="474" height="242" />

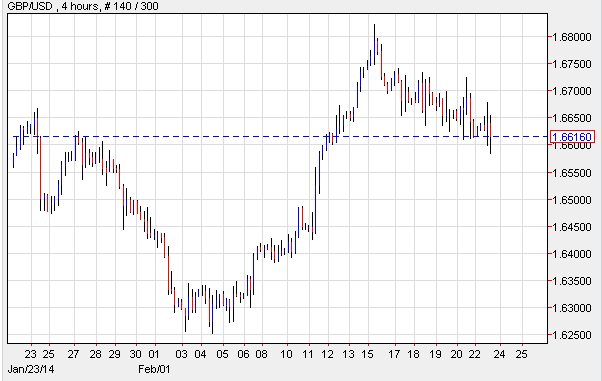

GBP/USD: U.K. Could See Q4 Growth

The GBP/USD rallied as investors anticipate that this week’s announcements could confirm that the U.K. sustained economic expansion in the last quarter of 2013. Meanwhile, the pair remained strong as Governor Mark Carney stated that the Bank of England will remain focused on ensuring that jobs, wages and consumer spending remain to the upside while policy makers move closer to increasing the benchmark interest rate. Mr. Carney added that even though the British economy is showing signs of recovery, the central bank will not take chances. On February 20, policy committee member Martin Weale suggested that a hike in the key cash rate may take place in the early part of 2015.

GBP/USD Hourly Chart" title="GBP/USD Hourly Chart" width="474" height="242" />

GBP/USD Hourly Chart" title="GBP/USD Hourly Chart" width="474" height="242" />

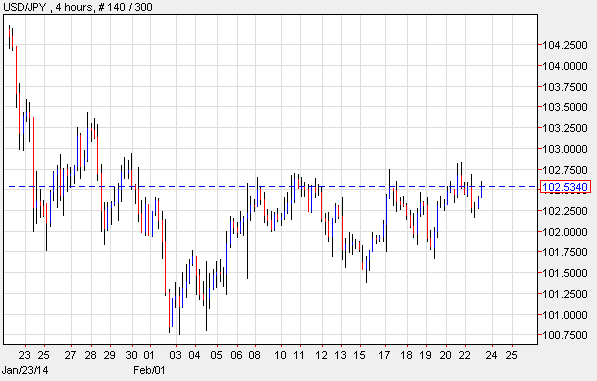

USD/JPY: Greenback Supported By Demand

The USD/JPY slumped during the early part of Monday following less than stellar economic reports out of China, but then retreated from session lows despite the fact that demand for safe havens was high. In Japan, the government continues to worry about its high debt and is looking for ways to create additional tax revenues in order to avert another financial crisis. According to official metrics, consumption taxes accounted for close to 24 percent of the 2012 tax income, while corporate taxes only accounted for 21 percent. Economists anticipate that Shinzo Abe’s administration may end up delaying the increase of sales taxes, and may instead push for the Bank of Japan to expand stimulus.

USD/JPY Hourly Chart" title="USD/JPY Hourly Chart" width="474" height="242" />

USD/JPY Hourly Chart" title="USD/JPY Hourly Chart" width="474" height="242" />

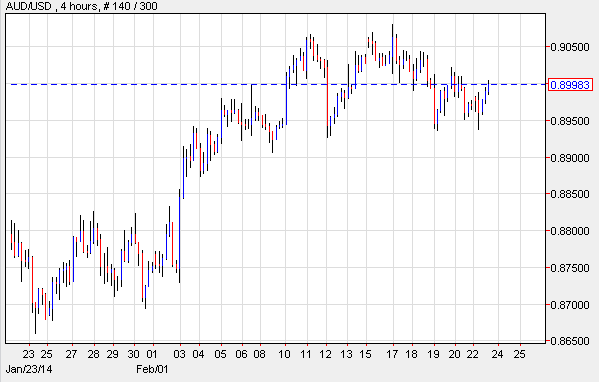

AUD/USD: Iron Ore Drops

The AUD/USD relinquished some of its gains as the G-20 summit came to an end in Sydney, with the nations advocating for 2 percent global growth. The Finance Ministers and central bankers who attended represent 85 percent of the global economies. The Aussie was impacted by lackluster economic releases out of China denoting a slump in House Prices, and by concerns over the growth outlook for the Asian nation. The South Pacific currency was also affected by a drop in iron ore and by the possibility that the hike in stockpiles in China could bring the prices of iron ore even further down. Iron ore is a steelmaking product, and according to Steel Index Ltd. the inventory of iron ore at the Chinese ports rose 100.9 million tons in the past week, which was the most since 2010.

AUD/USD Hourly Chart" title="AUD/USD Hourly Chart" width="474" height="242" />

AUD/USD Hourly Chart" title="AUD/USD Hourly Chart" width="474" height="242" />

Daily Outlook: Today’s economic calendar shows that the euro region will report on German GDP. The U.K. will issue data on BBA Mortgage Approvals. The U.S. will release the CB Consumer Confidence. And Australia will publish metrics on Construction Work Done.