With China issuing rather bleak economic reports on its Manufacturing sector, investors around the globe grew concerned that growth in the second largest economy may be spiraling to the downside. This set off a number of events, the biggest one being a drop in risk appetite and higher demand for safe haven currencies such as the yen and the Swiss Franc, which both traded higher against the U.S. Dollar. The yen reached a seven-week high, while the Franc traded at the highest rate in three weeks. The greenback remained under pressure before the Federal Reserve’s policy makers convene to decide the future of monetary easing later this week. Most market traders anticipate that the central bank could announce another cut in the bond purchases, but it all remains to be seen, since last week’s data was somewhat disappointing and revealed a slowdown in Manufacturing activities. The U.S. Housing sector, on the other hand, showed a jump in re-sales, denoting that the real estate market is recovering. Gold prices finished on a high note, reaching a nine-week high following major losses for U.S. equities. Gold Contracts for February delivery traded at $1,273.20 on the New York Mercantile Exchange, which was the highest rate since November of 2013, and they settled at $1,264.30 by end of day Friday, denoting a hike of 0.16 percent. Furthermore, following the announcement of Chinese data, and as the Dow sustained the worst trading week in close to three years, many speculators moved their capital into gold.

In the euro region, the shared currency rallied after stellar economic releases indicating a surge in the manufacturing and services industries, not only in the region as a whole, but in most of the zone’s largest economies. However, China’s news weighed on risk appetite, and this caused Germany to experience a major drop in the yields of 10-year bonds, as well as in Spanish and Italian securities. The British pound rose to a 2 ½-year high against its U.S. counterpart as the announcement on Unemployment prompted the Bank of England’s Governor, Mark Carney, to suggest that policy makers will keep the interest rate at the current low so that the U.K. remains on the path to recovery.

The yen benefitted from the enormous sell-off of currencies from emerging markets, brought on by worries over the future of China’s economy. Among the currencies most impacted by the release of weak Chinese data were the South African Rand, the Argentinian Peso, the Turkish Lira and the Russian Ruble. These currencies began to drop since the Federal Reserve announced its first reduction of the $85 billion monthly asset purchases. The Bank of Japan’s Governor, Haruhiko Kuroda, stated that the Japanese economy has shown signs of progress. The yen advanced versus the euro and the U.S. Dollar.

Lastly, in the South Pacific, the Australian Dollar extended losses and dipped below 0.87 cents versus the U.S. currency in the early european session on Friday. The already weakened Aussie was also hit by the news out of China, which is its main trade partner. The New Zealand Dollar declined versus its U.S. peer subsequent to a drop in U.S. stocks as well as the turmoil throughout the emerging markets.

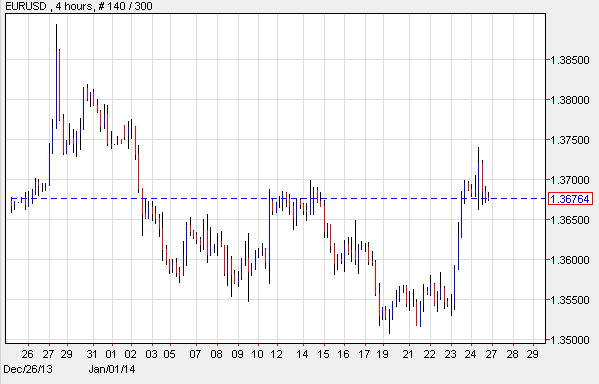

EUR/USD: Growth For Euro Region Services And Manufacturing

The EUR/USD was up after the euro region revealed growth for its Services and Manufacturing industries, though it slipped slightly on Friday. Today, the E.U. is to issue data on German Business Confidence, and if positive, analysts expect that the shared currency will rebound, erasing some of Friday’s losses. The euro is said to be overvalued at this time, and it may remain high while the markets await the Federal Reserve to announce what it will do in regards to stimulus for the coming months. Meanwhile, the euro region also indicated that the Gross Debt went down, signaling that it’s rebounding from the debt crisis. This was the first drop in six years as it went from 93.4 percent in the second quarter to 92.7 percent in the three months of July to September.

EUR/USD 4 Hour Chart" title="EUR/USD 4 Hour Chart" width="474" height="242">

EUR/USD 4 Hour Chart" title="EUR/USD 4 Hour Chart" width="474" height="242">

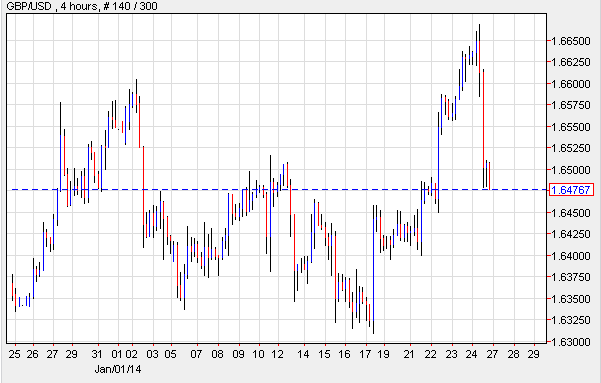

GBP/USD: Mortgage Approvals Post Below Forecasts

The GBP/USD managed to hover close to a 2½ year high after posting a drop in the rate of unemployment, and as central bank governor Mark Carney pledged to maintain the status quo in regards to the key cash rate so as not to upset economic growth. However, Mortgage Loan approvals came in below forecasts. Mr. Carney suggested that even with the good news showing that the jobless rate fell close to the bank’s goal, the economy has not yet reached what he called “escape velocity” and therefore stimulus is still necessary.

GBP/USD 4 Hour Chart" title="GBP/USD 4 Hour Chart" width="474" height="242">

GBP/USD 4 Hour Chart" title="GBP/USD 4 Hour Chart" width="474" height="242">

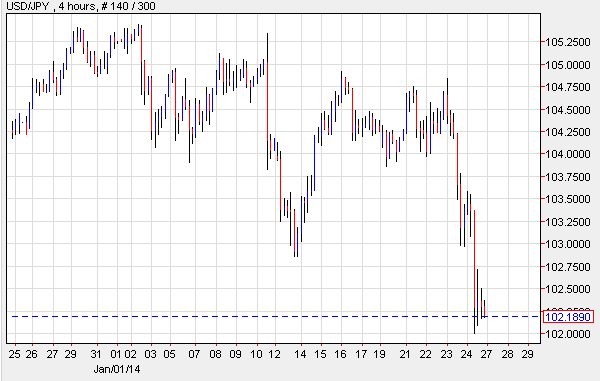

USD/JPY: Traders Opt For Safety

The JPY/USD advanced to a seven-week high as traders moved their capital to safe havens. Many of Japan’s speculators have purchased gold while the yen depreciated in the past weeks due to Prime Minister Shinzo Abe’s insistence on measures that debase the currency and prompt surges in inflation. The Nikkei plunged into the negative territory as China issued disappointing Manufacturing macroeconomics denoting that activities fell to 49.6 a number that denotes contraction. The International Monetary Fund stated that the Japanese Prime Minister’s economic plan is probably going to balance out the negative effects of the sales tax hike, and it expects the nation’s economy to expand 1.7 percent in 2014.

USD/JPY 4 Hour Chart" title="USD/JPY 4 Hour Chart" width="474" height="242">

USD/JPY 4 Hour Chart" title="USD/JPY 4 Hour Chart" width="474" height="242">

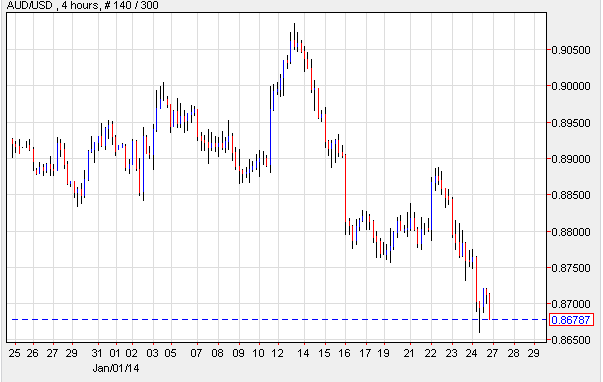

AUD/USD: Aussie At Lowest In Almost Four Years

The AUD/USD continued to spiral to the downside as the markets were surprised to hear that China’s Manufacturing sector contracted, reaching a six-month low in January. China is the world’s second biggest economy and a major export partner of the South Pacific nation. The Aussie remained weak as one of the Reserve Bank’s board members suggested that the currency ought to dip further. These comments prompted market traders to increase their short positions on the Aussie.

AUD/USD 4 Hour Chart" title="AUD/USD 4 Hour Chart" width="474" height="242">

AUD/USD 4 Hour Chart" title="AUD/USD 4 Hour Chart" width="474" height="242">

Daily Chart: Today’s economic calendar shows that the euro region will report on German Current Assessment. The U.S. will report on New Home Sales. Australia will publish the CB Leading Index and NAB Business Confidence.