Welcome to my "Ranking, Rating and Score" article for the coming week. The article "Strength and Comparison" has also been published.

When looking at the Top 10 in the Weekly Ranking and Rating list, we can see that for the coming week the following stronger currencies are well represented for going long: AUD (4X) followed by the JPY (3X). The weaker currencies are the GBP (5X) followed by the CAD (2X) and the EUR (2X).

A nice combination for coming week may be e.g:

Some of the pairs in the top 10 comply for a longer term trade, based on the Technical Analysis (TA) of the daily and weekly chart. For the coming week these seem to be:

GBP/AUD, GBP/NZD and AUD/CAD.

These are just a few examples and many other combinations are possible. The mentioned pair combinations can be traded at the same time, according to the rules of the FxTaTrader strategy because these are all different currencies. Generally speaking, by not trading the same currency in the same direction more than once in the same time frame, you may have better chances with lower risk. In any case, it always seems better to spread risk and this can be done in many different ways.

When trading with more than 2 micro lots, it is a good idea to have a diversification and depending on your bias it may offer opportunities by going long or short on a specific currency trading it against other currencies.

______________________________________

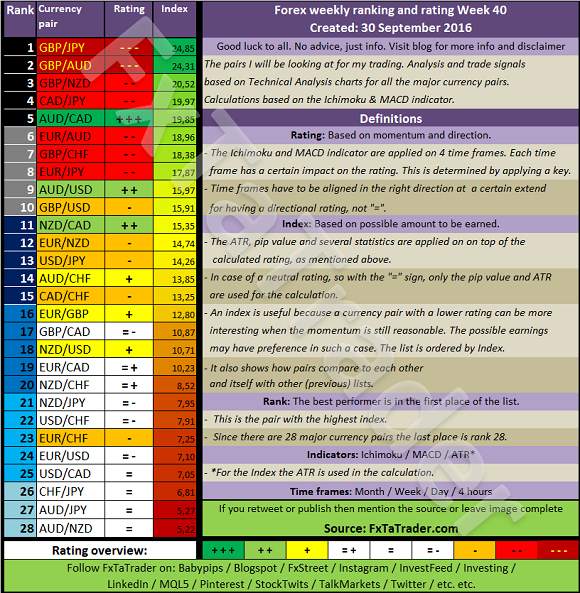

Ranking and Rating list

Analysis based on TA charts for all the major currency pairs. Good luck to all. No advice, just info. Every week the Forex ranking rating list will be prepared in the weekend. All the relevant time frames will be analyzed and the ATR and pip value will be set.

______________________________________

For analyzing the best pairs to trade looking from a longer term perspective, the last 13 weeks currency classification can be used in support.

This was updated on 25 September 2016 and is provided here for reference purposes:

Strong: USD, JPY, NZD. The preferred range is from 6 to 8.

Average: CHF, AUD. The preferred range is from 4 to 5.

Weak: EUR, GBP, CAD. The preferred range is from 1 to 3.

When comparing the 13 weeks currency classification with the pairs mentioned in the ranking list above, some would then become less interesting. On the other hand, these pairs are at the top of the list partly because of their volatility. It seems best to take positions for a short period then, and take advantage of the high price movements.

With the FxTaTrader strategy, these pairs are not traded because these would be trades in the 4 Hour chart or in a lower time frame. Nevertheless they may offer good chances for the short term trader.

______________________________________

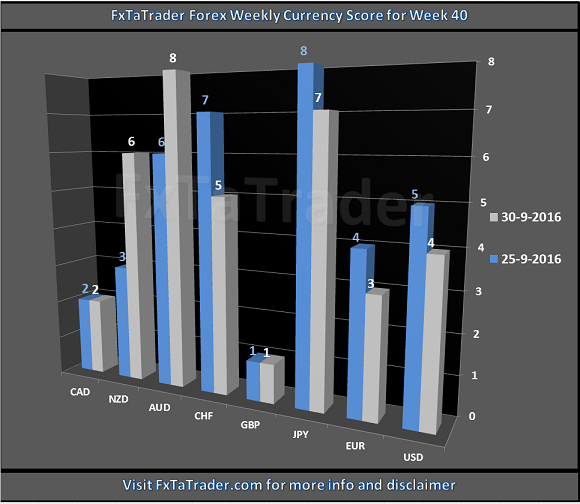

Currency Score Chart

The currency score analysis is one of the parameters used for the ranking and rating list, which is published also in this article. The currency score is my analysis on the 8 major currencies based on the technical analysis charts using the MACD and ichimoku indicator on 4 time frames: the monthly, weekly, daily and 4 hours. The result of the technical analysis is the screenshot here below.

When comparing the 13 weeks currency classification with the recent currency score, as provided in the image above, we can determine the deviations. In the article "Forex Strength and Comparison" this is analyzed in more detail. Currencies with a high deviation seem less interesting to trade because they are less predictable. A good example at the moment is e.g. the AUD and USD. Unless these currencies show a clear opportunity based on the longer term it seems best to avoid them.

______________________________________

DISCLAIMER: The articles are my personal opinion, not recommendations, FX trading is risky and not suitable for everyone.The content is for educational purposes only and is aimed solely for the use by ‘experienced’ traders in the FOREX market as the contents are intended to be understood by professional users who are fully aware of the inherent risks in forex trading. The content is for 'Forex Trading Journal' purpose only. Nothing should be construed as recommendation to purchase any financial instruments. The choice and risk is always yours. Thank you.