Last week in my FX market commentary, I opined how the Euro was in a short term bull trend being well underpinned, and that a daily close above the 20ema would reverse my medium term bearish bias. The bullish uptrend continued from the bullish engulfing bar, and the pair broke above the 20ema on the daily chart, following that up the next day with over 100 pip gain, bouncing right off the 20ema and launching higher.

Short term, the momentum is up, but I still hold a medium term bearish bias as I think this rally will hit a wall and will find more sellers waiting above. The first two key levels I’ll look to rejoin the medium term downtrend would be 1.3107 and 1.3260. Intraday bulls can look towards the daily 20ema for potential longs, targeting those resistance levels above.

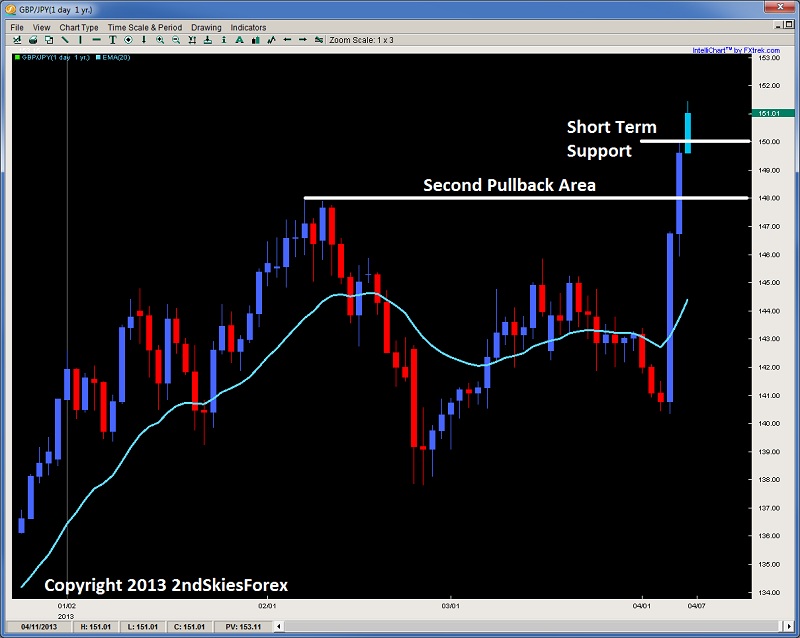

GBP/JPY

Now that the BOJ has pulled out the bond/QE bazooka (making Bernanke look like a miser in this area), the JPY has gotten hammered and I don’t think this will stop soon. In the last three days, the pair has lost over 1000 pips vs. the GBP and if we did this across the G-8, it would be several thousands of pips. I think this will go much further than people expect.

I’m looking to get bullish at the 150 (big figure) and 148 pullback / role reversal levels, with the latter being the yearly high that got annihilated last week. Upside targets will be the 2009 Oct. highs at 153, and a much longer target of 162.30 which is the 2009 double top highs for the same year.

WTI Crude Oil

The impressive March rally which saw the commodity gain over $9, hit a wall in April, selling off over $5 in the last 4 days. The pair ended last week forming a pin bar at a key support level around $92. This is worth taking a crack at a long on an intraday corrective pullback into the level with tight stops below. Should this level hold, then upside targets would be $94, $95 and a potential return to $97.30. A failure at this level will likely see a full return back to $89.33 where the March bull run started, so plays on both sides here.

Gold

After looking set to test the 2012 lows, Gold staged a nice reversal following the dismal NFP report. The PM found some buyers late last week, first with the pin bar off the $1540 June/July 2012 lows, and then the follow up buying on Friday, gaining almost $30 on the day. This breaking back into the range does help the bullish case, and often times a breakout failure later in the trends life, often marks a reversal, or change of hands. But the precious metal still remains fragile.

Either a corrective pullback towards the $1650/53 area and holding there, or a break above $1620 will fully eradicate the bearish bias the PM has been under since Oct. last year. If it can do so then $1645 is up next, while a failure back below $1540 will setup a test of $1527 and the nerves of many gold bulls out there. Bears can also look to sell corrective rallies into $1620 targeting $1600 and $1554.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Forex Price Action: Bearish Bias For EUR/USD

Published 04/08/2013, 12:56 AM

Updated 05/14/2017, 06:45 AM

Forex Price Action: Bearish Bias For EUR/USD

EUR/USD

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.