EUR/USD

After starting the week under pressure from the Spanish regions requesting aid, the euro found short-term support – perhaps from the short sales ban in Italy and Spain. Although this tool is meant to curb short speculation on those economies, I’d like to point out two facts about short sale bans:

1) When have they ever worked?

2) Speculators will just move their short speculation to other economies which then bear the risk (i.e. Germany and France) which then puts pressure on them, and considering German taxpayers Germany is the bank for Europe, this will be a failed idea

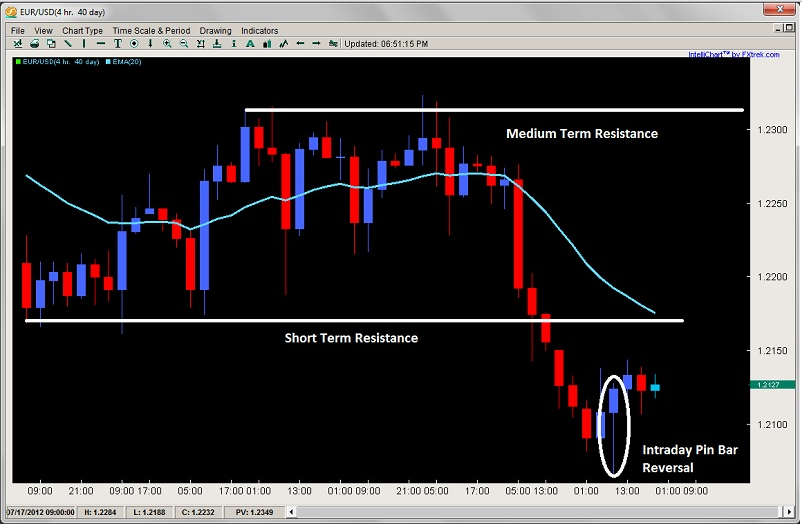

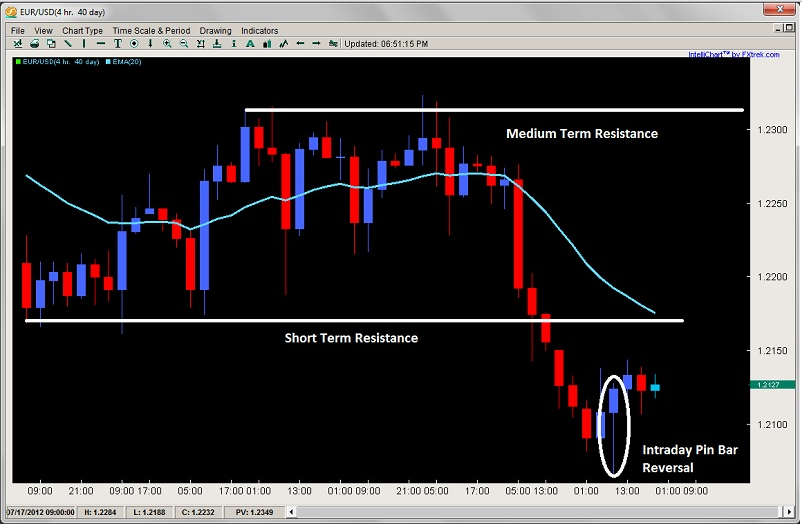

Nevertheless, the EUR/USD formed an intraday pin bar on the 4hr time frame at 1.2066, currently sitting at 1.2129. Does this trader think it will hold? Unlikely, this is why I prefer selling rallies either at the short-term resistance at 1.2169 area (and 20ema), or should this break, wait for a pullback to 1.2312 targeting 1.2175 and 1.2075.

Global Market Commentary:

Surges in Spanish and Italian yields, along with a recent Moody’s downgrade of Germany and Holland have been all the news and pressure on global investors as they look for the exits on any risk assets. Global markets sold off from Asia to Europe to the US anywhere from 1-3% per index. Spain and Italy have re-initiated a short sale ban (good luck with that) which has failed at every attempt, but this is simply a communication of how desperate and worried they are that things will get worse.

Spain will likely need a full-fledged bailout as all its regions are going bankrupt and will need assistance, meaning the money Spain got from the ESM will not be enough. Once we see how bad it really is in Spain, expect more fear and risk assets to sell off further. And don’t forget about Greece as it meets with its Troika creditors to see if they can meet their budget cuts (unlikely).

Expect the themes which started the week off with a bang to dominate till Friday’s close.

After starting the week under pressure from the Spanish regions requesting aid, the euro found short-term support – perhaps from the short sales ban in Italy and Spain. Although this tool is meant to curb short speculation on those economies, I’d like to point out two facts about short sale bans:

1) When have they ever worked?

2) Speculators will just move their short speculation to other economies which then bear the risk (i.e. Germany and France) which then puts pressure on them, and considering German taxpayers Germany is the bank for Europe, this will be a failed idea

Nevertheless, the EUR/USD formed an intraday pin bar on the 4hr time frame at 1.2066, currently sitting at 1.2129. Does this trader think it will hold? Unlikely, this is why I prefer selling rallies either at the short-term resistance at 1.2169 area (and 20ema), or should this break, wait for a pullback to 1.2312 targeting 1.2175 and 1.2075.

Global Market Commentary:

Surges in Spanish and Italian yields, along with a recent Moody’s downgrade of Germany and Holland have been all the news and pressure on global investors as they look for the exits on any risk assets. Global markets sold off from Asia to Europe to the US anywhere from 1-3% per index. Spain and Italy have re-initiated a short sale ban (good luck with that) which has failed at every attempt, but this is simply a communication of how desperate and worried they are that things will get worse.

Spain will likely need a full-fledged bailout as all its regions are going bankrupt and will need assistance, meaning the money Spain got from the ESM will not be enough. Once we see how bad it really is in Spain, expect more fear and risk assets to sell off further. And don’t forget about Greece as it meets with its Troika creditors to see if they can meet their budget cuts (unlikely).

Expect the themes which started the week off with a bang to dominate till Friday’s close.