USD/CHF – Head Fake Above .9600?

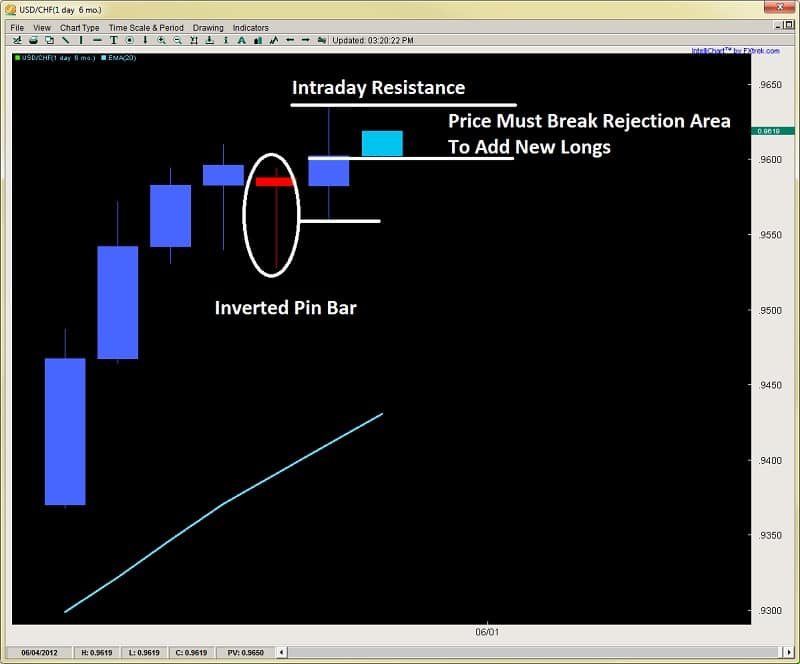

The swissie today formed its first daily close above the .9600 level which is the first time in over 14 months it has done this. The question is, is this a false break or head fake? Although it closed above the key level by 3pips, it has formed a rejection of the lows and the highs forming a trading range. As you can see from the chart below, price has thus opened inside the wick or rejection area of the prior candle.

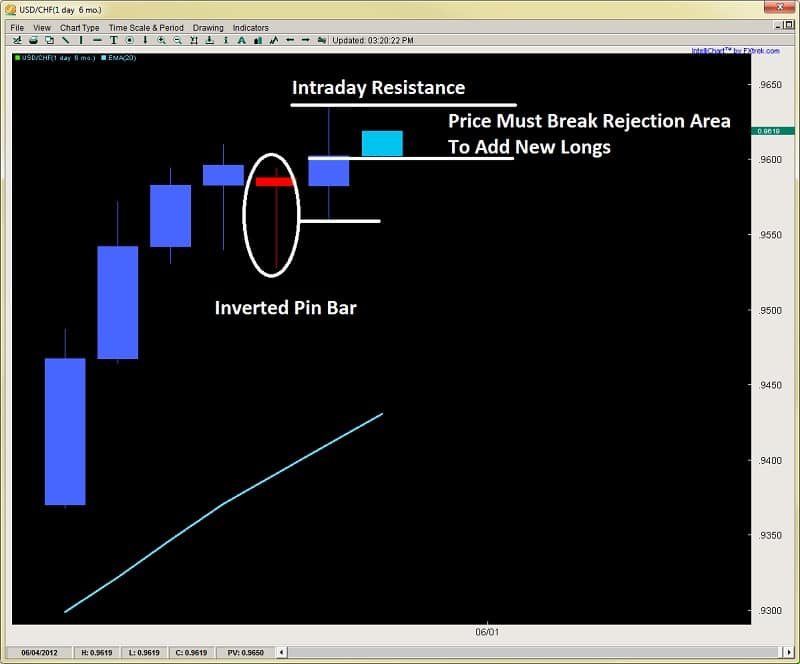

This means price will have to clear yesterday’s high before we will likely see new intra-day traders come in or any strong bullish momentum. Although the 1hr and 4hr charts are showing pin bar rejections at the intra-day highs, the lows continue to step higher, thus we are thinking a breakout continuation is more likely. Bears can wait for a daily price action trigger while bulls can add longs at .9600 or on a break above .9642.

Daily Chart

1hr Chart With Pin Bar Setup

Global Market Commentary:

While the Spanish yields continue to rise, putting pressure on their borrowing costs, the euro broke the 1.2500 barrier when Egan-Jones cut Spain’s credit rating as their sovereign debt issues are not going away. Oh yeah, did we mention Miguel Ordonez (Gov. of the Bank of Spain) just resigned with two weeks notice? Can we say jumping ship before it hits the Iceberg?

In other markets, the Dow gained 1% or 125pts, gold gained $5.40 while FacePlant just broke below $29 losign 9.6% or over 21% from the IPO debut.

The swissie today formed its first daily close above the .9600 level which is the first time in over 14 months it has done this. The question is, is this a false break or head fake? Although it closed above the key level by 3pips, it has formed a rejection of the lows and the highs forming a trading range. As you can see from the chart below, price has thus opened inside the wick or rejection area of the prior candle.

This means price will have to clear yesterday’s high before we will likely see new intra-day traders come in or any strong bullish momentum. Although the 1hr and 4hr charts are showing pin bar rejections at the intra-day highs, the lows continue to step higher, thus we are thinking a breakout continuation is more likely. Bears can wait for a daily price action trigger while bulls can add longs at .9600 or on a break above .9642.

Daily Chart

1hr Chart With Pin Bar Setup

Global Market Commentary:

While the Spanish yields continue to rise, putting pressure on their borrowing costs, the euro broke the 1.2500 barrier when Egan-Jones cut Spain’s credit rating as their sovereign debt issues are not going away. Oh yeah, did we mention Miguel Ordonez (Gov. of the Bank of Spain) just resigned with two weeks notice? Can we say jumping ship before it hits the Iceberg?

In other markets, the Dow gained 1% or 125pts, gold gained $5.40 while FacePlant just broke below $29 losign 9.6% or over 21% from the IPO debut.