Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

Whiff – Data Misses On All Fronts

Stocks fell globally starting with the first whiff of the day – the Spanish Bond Auction failed to meet its target while the 10yr yields climbed continuing the mantra the Pain in Spain isn’t going away.

Italian, Spanish and French yields all widened across the board today which sours the picture in the eurozone as more relief will be needed, meaning CTRL+P is coming to a sovereign near you. Number two on the Whiff list was Initial Jobless Claims printing 386K instead of 370K projected basically reminding people of reality the recovery in the US labor market is weak at best.

The third Whiff of the day existing home sales were expected to come in at .7% and came in -2.6% adding to the negative picture this side of the pond. The trifecta for the US came in the weaker-than-expected Philly Fed landing at 8.5 with a 12 figure expected.

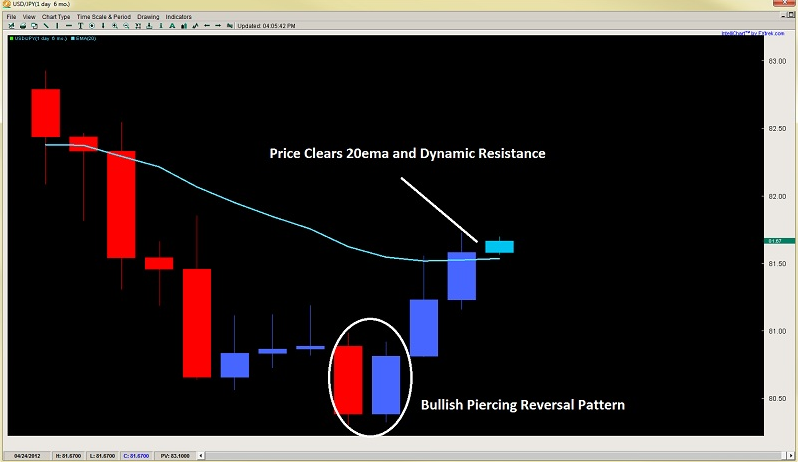

USD/JPY – Clears Dynamic Resistance

After spending most of April below the 20ema and dynamic resistance, the USD/JPY has climbed 3 days in a row from the bullish piercing pattern we discussed on Tuesday. Three days of solid climbs with no changes in the speed of buying which is interesting considering the rest of the majors have been range bound suggesting JPY pairs are the only gig in town.

Holding trades into the weekend is generally not my fancy, but intra-day players can look for price action pullbacks into the daily 20ema which is now dynamic support looking for a touch on 82.00 and potentially 82.50 before the weekend.

Stocks fell globally starting with the first whiff of the day – the Spanish Bond Auction failed to meet its target while the 10yr yields climbed continuing the mantra the Pain in Spain isn’t going away.

Italian, Spanish and French yields all widened across the board today which sours the picture in the eurozone as more relief will be needed, meaning CTRL+P is coming to a sovereign near you. Number two on the Whiff list was Initial Jobless Claims printing 386K instead of 370K projected basically reminding people of reality the recovery in the US labor market is weak at best.

The third Whiff of the day existing home sales were expected to come in at .7% and came in -2.6% adding to the negative picture this side of the pond. The trifecta for the US came in the weaker-than-expected Philly Fed landing at 8.5 with a 12 figure expected.

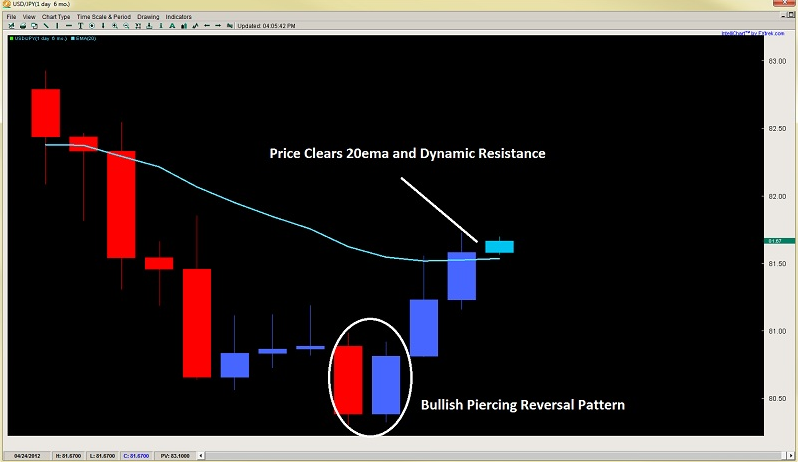

USD/JPY – Clears Dynamic Resistance

After spending most of April below the 20ema and dynamic resistance, the USD/JPY has climbed 3 days in a row from the bullish piercing pattern we discussed on Tuesday. Three days of solid climbs with no changes in the speed of buying which is interesting considering the rest of the majors have been range bound suggesting JPY pairs are the only gig in town.

Holding trades into the weekend is generally not my fancy, but intra-day players can look for price action pullbacks into the daily 20ema which is now dynamic support looking for a touch on 82.00 and potentially 82.50 before the weekend.